Another Casino stock was added this week. As the saying goes, “Know when to hold ’em, know when to fold ’em, know when to walk away, know when to run!” ;-)

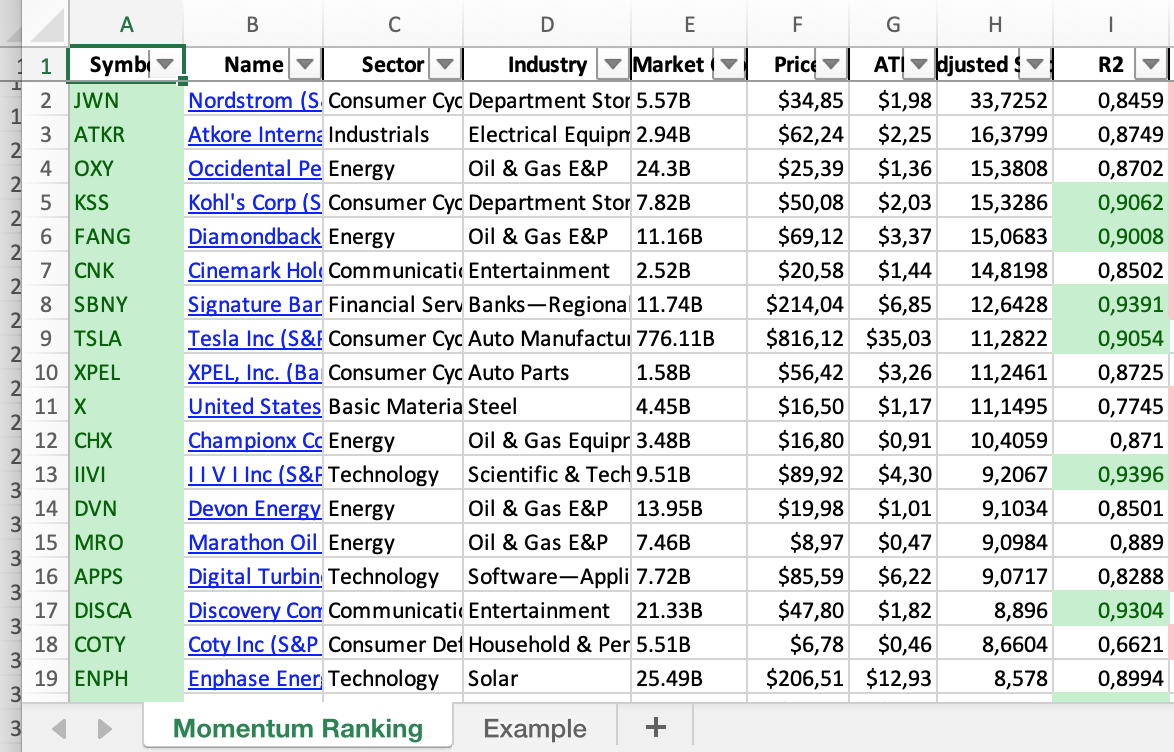

According to the latest ranking the following trades were due this week:

This week’s transactions:

-

Sold:

- MYRG (no longer in top 20%)

-

Reduced to 50% (below the 8/21 MA):

- NCR

- TSLA

-

New Buys:

- PENN (Penn Natl Gaming Inc (S&P 400)))

The S&P 400 still has the biggest share in the portfolio:

pie title Index Distribution

"S&P 400":40.57

"S&P 500":37.71

"Barrons 400":20.12

"Cash":1.59

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| ATKR | Atkore International Group Inc. | Barrons 400 | Industrials | 2.93B | -2.7% | 3.6% |

| UAA | Under Armour, Inc. | S&P 500 | Consumer Cyclical | 9.37B | -4.8% | 3.5% |

| IVZ | Invesco Ltd. | S&P 500 | Financial Services | 10.52B | -2.5% | 3.1% |

| EVR | Evercore Inc. | S&P 400 | Financial Services | 4.77B | -7.2% | 3.1% |

| TPR | Tapestry, Inc. | S&P 500 | Consumer Cyclical | 10.74B | -4.7% | 3.1% |

| PNFP | Pinnacle Financial Partners, Inc. | S&P 400 | Financial Services | 5.94B | -3.5% | 3.0% |

| TBBK | The Bancorp, Inc. | Barrons 400 | Financial Services | 1.17B | -3.8% | 3.0% |

| MAT | Mattel, Inc. | S&P 400 | Consumer Cyclical | 6.53B | -3.7% | 2.9% |

| SIVB | SVB Financial Group | S&P 500 | Financial Services | 27.14B | -3.4% | 2.8% |

| OMF | OneMain Holdings, Inc. | Barrons 400 | Financial Services | 7.19B | -10.6% | 2.8% |

| SLM | SLM Corporation | S&P 400 | Financial Services | 5.59B | -4.6% | 2.8% |

| BYD | Boyd Gaming Corporation | S&P 400 | Consumer Cyclical | 6.12B | -2.8% | 2.7% |

| MTZ | MasTec, Inc. | S&P 400 | Industrials | 6.47B | -1.1% | 2.7% |

| ALRM | Alarm.com Holdings, Inc. | Barrons 400 | Technology | 4.99B | -4.5% | 2.7% |

| AMAT | Applied Materials, Inc. | S&P 500 | Technology | 108.84B | -3.7% | 2.6% |

| OZK | Bank OZK | S&P 400 | Financial Services | 5.14B | -3.0% | 2.6% |

| GE | General Electric Company | S&P 500 | Industrials | 103.68B | -9.4% | 2.6% |

| MU | Micron Technology, Inc. | S&P 500 | Technology | 97.95B | -1.4% | 2.6% |

| AXON | Axon Enterprise, Inc. | S&P 400 | Industrials | 11.36B | -7.9% | 2.5% |

| GM | General Motors Company | S&P 500 | Consumer Cyclical | 77.67B | -6.0% | 2.4% |

| TEX | Terex Corporation | S&P 400 | Industrials | 2.81B | -4.1% | 2.3% |

| APPS | Digital Turbine, Inc. | Barrons 400 | Technology | 7.52B | -12.4% | 2.3% |

| BKR | Baker Hughes Company | S&P 500 | Energy | 24.16B | -5.6% | 2.3% |

| DAR | Darling Ingredients Inc. | S&P 400 | Consumer Defensive | 11.37B | -5.2% | 2.3% |

| AEO | American Eagle Outfitters, Inc. | S&P 400 | Consumer Cyclical | 4.16B | -4.4% | 2.3% |

| DISCA | Discovery, Inc. | S&P 500 | Consumer Cyclical | 21.08B | -4.3% | 2.3% |

| OLN | Olin Corporation | S&P 400 | Basic Materials | 4.62B | -3.0% | 2.3% |

| CROX | Crocs, Inc. | Barrons 400 | Consumer Cyclical | 5.42B | -1.8% | 2.2% |

| GTLS | Chart Industries, Inc. | Barrons 400 | Industrials | 5.62B | -3.4% | 2.1% |

| VIAC | ViacomCBS Inc. | S&P 500 | Communication Services | 36.36B | -4.0% | 2.1% |

| ADNT | Adient plc | S&P 400 | Consumer Cyclical | 3.49B | -3.3% | 2.1% |

| ARWR | Arrowhead Pharmaceuticals, Inc. | S&P 400 | Healthcare | 8.94B | -4.8% | 2.1% |

| CREE | Cree, Inc. | S&P 400 | Technology | 13.41B | -5.3% | 2.0% |

| FCX | Freeport-McMoRan Inc. | S&P 500 | Basic Materials | 47.37B | -8.1% | 1.9% |

| ENPH | Enphase Energy, Inc. | S&P 500 | Technology | 24.65B | -9.8% | 1.7% |

| cash | Cash | Cash | Cash | – | 0.0% | 1.6% |

| PENN | Penn National Gaming, Inc. | S&P 400 | Consumer Cyclical | 18.59B | -7.9% | 1.6% |

| DFS | Discover Financial Services | S&P 500 | Financial Services | 29.01B | -7.2% | 1.5% |

| APA | Apache Corporation | S&P 500 | Energy | 6.96B | -40.2% | 1.5% |

| XPEL | XPEL, Inc. | Barrons 400 | Consumer Cyclical | 1.53B | -7.2% | 1.5% |

| NCR | NCR Corporation | S&P 400 | Technology | 4.49B | -11.1% | 1.1% |

| ALB | Albemarle Corporation | S&P 500 | Basic Materials | 19.08B | -12.6% | 1.0% |

| TSLA | Tesla, Inc. | S&P 500 | Consumer Cyclical | 767.59B | -9.4% | 0.7% |

Current portfolio allocation:

pie title Sector Distribution

"Consumer Cyclical":27.31

"Financial Services":24.66

"Industrials":15.8

"Technology":15.09

"Basic Materials":5.25

"Energy":3.85

"Consumer Defensive":2.25

"Communication Services":2.11

"Healthcare":2.08

"Cash":1.59

As always, more trades next week!