Click here for the Momentum Ranking of week 15.

This week’s transactions:

-

Sold:

- JW-A

- FOXF

- PENN

- CPRI (no longer in top 20%)

-

Bought:

- MRO (Marathon Oil Corp (S&P 500)))

- LB (L Brands Inc (S&P 500))

- SFBS (ServisFirst Bancshares In (Barrons 400))

- LPX (Louisiana-Pacific Corp (S&P 400))

- ADS (Alliance Data Systems Corp (S&P 400))

- WSM (Williams-Sonoma (S&P 400))

Index Distribution:

The S&P 400 still has the highest weight in the portfolio:

Current portfolio allocation: The Financial sector now has the largest share in the portfolio:

Weekly sector distribution:

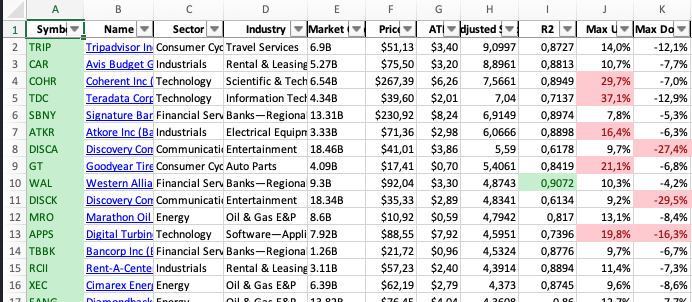

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| cash | Cash | Cash | Cash | – | 0.0 | 0.064 |

| AMG | Affiliated Managers Group, Inc. | S&P 400 | Financial Services | 6.63B | -0.003 | 0.038 |

| SLM | SLM Corporation | S&P 400 | Financial Services | 6.35B | -0.012 | 0.036 |

| NLSN | Nielsen Holdings plc | S&P 500 | Industrials | 9.08B | -0.043 | 0.035 |

| SFBS | ServisFirst Bancshares, Inc. | Barrons 400 | Financial Services | 3.27B | -0.045 | 0.035 |

| IVZ | Invesco Ltd. | S&P 500 | Financial Services | 12B | -0.005 | 0.034 |

| PNFP | Pinnacle Financial Partners, Inc. | S&P 400 | Financial Services | 6.8B | -0.052 | 0.034 |

| AEO | American Eagle Outfitters, Inc. | S&P 400 | Consumer Cyclical | 5.43B | -0.003 | 0.029 |

| UAA | Under Armour, Inc. | S&P 500 | Consumer Cyclical | 9.23B | -0.058 | 0.025 |

| MTZ | MasTec, Inc. | S&P 400 | Industrials | 7.27B | -0.007 | 0.025 |

| NBLX | Noble Midstream Partners LP | Barrons 400 | Energy | 1.28B | -0.097 | 0.024 |

| SYNA | Synaptics Incorporated | S&P 400 | Technology | 4.5B | -0.084 | 0.023 |

| TBBK | The Bancorp, Inc. | Barrons 400 | Financial Services | 1.26B | -0.099 | 0.023 |

| OLN | Olin Corporation | S&P 400 | Basic Materials | 6.28B | -0.029 | 0.023 |

| LPX | Louisiana-Pacific Corporation | S&P 400 | Basic Materials | 6.68B | -0.017 | 0.023 |

| AMAT | Applied Materials, Inc. | S&P 500 | Technology | 122.88B | -0.075 | 0.023 |

| DAR | Darling Ingredients Inc. | S&P 400 | Consumer Defensive | 11.39B | -0.122 | 0.022 |

| OMF | OneMain Holdings, Inc. | Barrons 400 | Financial Services | 7.42B | -0.051 | 0.022 |

| BKE | The Buckle, Inc. | Barrons 400 | Consumer Cyclical | 2.1B | -0.008 | 0.022 |

| EWBC | East West Bancorp, Inc. | S&P 400 | Financial Services | 10.3B | -0.079 | 0.021 |

| WAL | Western Alliance Bancorporation | Barrons 400 | Financial Services | 9.31B | -0.097 | 0.02 |

| EVR | Evercore Inc. | S&P 400 | Financial Services | 5.55B | -0.065 | 0.02 |

| LB | L Brands, Inc. | S&P 500 | Consumer Cyclical | 18.56B | -0.009 | 0.02 |

| OZK | Bank OZK | S&P 400 | Financial Services | 5.05B | -0.13 | 0.02 |

| PACW | PacWest Bancorp | S&P 400 | Financial Services | 4.56B | -0.056 | 0.019 |

| ATKR | Atkore Inc. | Barrons 400 | Industrials | 3.31B | -0.041 | 0.019 |

| TPR | Tapestry, Inc. | S&P 500 | Consumer Cyclical | 12.42B | -0.019 | 0.019 |

| SBNY | Signature Bank | S&P 400 | Financial Services | 13.28B | -0.074 | 0.017 |

| CAR | Avis Budget Group, Inc. | S&P 400 | Industrials | 5.28B | -0.009 | 0.017 |

| SIVB | SVB Financial Group | S&P 500 | Financial Services | 26.93B | -0.132 | 0.017 |

| TEX | Terex Corporation | S&P 400 | Industrials | 3.16B | -0.086 | 0.016 |

| RCII | Rent-A-Center, Inc. | Barrons 400 | Industrials | 3.07B | -0.107 | 0.016 |

| WSM | Williams-Sonoma, Inc. | S&P 400 | Consumer Cyclical | 13.27B | -0.06 | 0.016 |

| KSS | Kohl’s Corporation | S&P 400 | Consumer Cyclical | 9.51B | -0.025 | 0.016 |

| XEC | Cimarex Energy Co. | S&P 400 | Energy | 6.4B | -0.107 | 0.016 |

| BYD | Boyd Gaming Corporation | S&P 400 | Consumer Cyclical | 7.06B | -0.048 | 0.016 |

| ADS | Alliance Data Systems Corporation | S&P 400 | Financial Services | 5.42B | -0.079 | 0.016 |

| MOS | The Mosaic Company | S&P 500 | Basic Materials | 12.28B | -0.097 | 0.015 |

| DVN | Devon Energy Corporation | S&P 500 | Energy | 14.7B | -0.163 | 0.014 |

| TRIP | TripAdvisor, Inc. | S&P 400 | Consumer Cyclical | 6.93B | -0.213 | 0.014 |

| FCX | Freeport-McMoRan Inc. | S&P 500 | Basic Materials | 49.55B | -0.139 | 0.013 |

| MRO | Marathon Oil Corporation | S&P 500 | Energy | 8.58B | -0.19 | 0.013 |

| SFNC | Simmons First National Corporation | Barrons 400 | Financial Services | 3.14B | -0.11 | 0.013 |

| HIBB | Hibbett Sports, Inc. | Barrons 400 | Consumer Cyclical | 1.13B | -0.075 | 0.013 |

| FANG | Diamondback Energy, Inc. | S&P 500 | Energy | 13.73B | -0.168 | 0.012 |

| LGND | Ligand Pharmaceuticals Incorporated | S&P 400 | Healthcare | 2.55B | -0.341 | 0.011 |

As always, more trades next week!