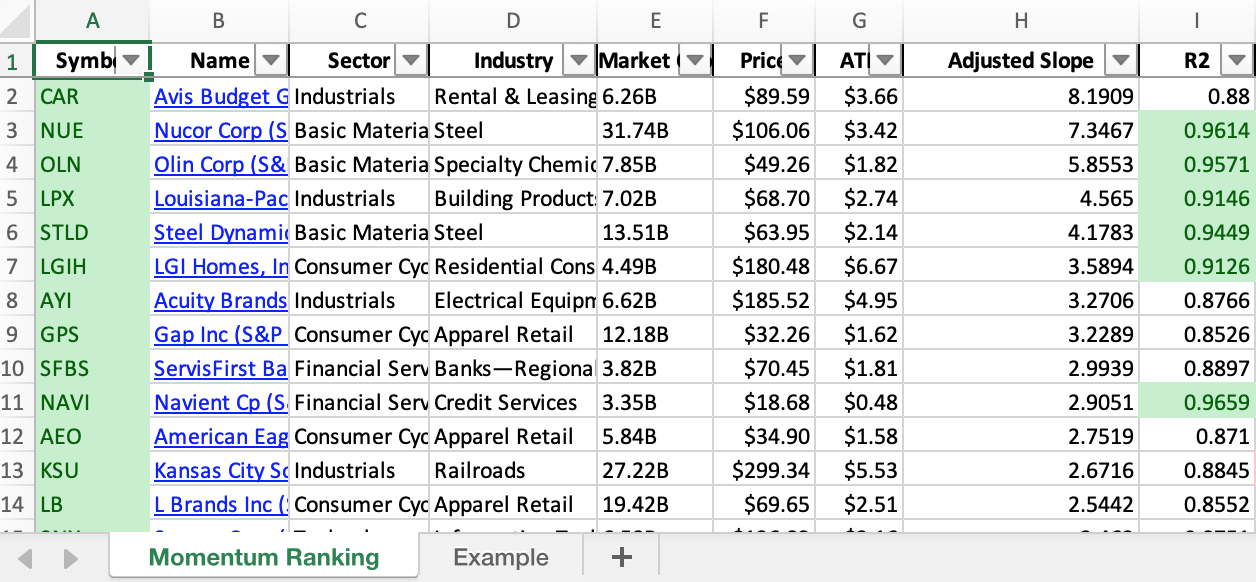

Click here for the Momentum Ranking of week 22.

This week’s transactions:

-

Sold:

- MRO

- TBBK

- TPR (no longer in top 20%)

-

Bought:

- DISH (Dish Network Corp (S&P 500))

-

Added to:

- KSU

- FIX

Index Distribution:

The S&P 400 now makes up almost half of the portfolio:

Current portfolio allocation: The Financial sector now has the largest share in the portfolio:

Weekly sector distribution:

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| KSU | Kansas City Southern | S&P 500 | Industrials | 27.35B | -0.056 | 0.054 |

| FIX | Comfort Systems USA, Inc. | Barrons 400 | Industrials | 3.07B | -0.064 | 0.042 |

| SNX | SYNNEX Corporation | S&P 400 | Technology | 6.56B | -0.023 | 0.041 |

| NAVI | Navient Corporation | S&P 400 | Financial Services | 3.35B | -0.024 | 0.038 |

| SFBS | ServisFirst Bancshares, Inc. | Barrons 400 | Financial Services | 3.79B | -0.015 | 0.037 |

| SLM | SLM Corporation | S&P 400 | Financial Services | 6.35B | -0.027 | 0.036 |

| AYI | Acuity Brands, Inc. | S&P 400 | Technology | 6.59B | -0.045 | 0.035 |

| NWSA | News Corporation | S&P 500 | Consumer Cyclical | 15.37B | -0.035 | 0.035 |

| IVZ | Invesco Ltd. | S&P 500 | Financial Services | 12.44B | -0.015 | 0.034 |

| AMG | Affiliated Managers Group, Inc. | S&P 400 | Financial Services | 6.84B | -0.073 | 0.033 |

| SHLX | Shell Midstream Partners, L.P. | Barrons 400 | Energy | 5.89B | -0.125 | 0.031 |

| MTZ | MasTec, Inc. | S&P 400 | Industrials | 8.73B | -0.039 | 0.03 |

| PACW | PacWest Bancorp | S&P 400 | Financial Services | 5.45B | -0.034 | 0.029 |

| WAL | Western Alliance Bancorporation | Barrons 400 | Financial Services | 10.53B | -0.089 | 0.029 |

| NUE | Nucor Corporation | S&P 500 | Basic Materials | 33.08B | -0.072 | 0.029 |

| STLD | Steel Dynamics, Inc. | S&P 400 | Basic Materials | 13.58B | -0.058 | 0.029 |

| LB | L Brands, Inc. | S&P 500 | Consumer Cyclical | 19.56B | -0.029 | 0.028 |

| CMC | Commercial Metals Company | S&P 400 | Basic Materials | 3.92B | -0.061 | 0.028 |

| TEX | Terex Corporation | S&P 400 | Industrials | 3.76B | -0.058 | 0.026 |

| DISH | DISH Network Corporation | S&P 500 | Communication Services | 23.22B | -0.075 | 0.026 |

| LGIH | LGI Homes, Inc. | Barrons 400 | Consumer Cyclical | 4.57B | -0.038 | 0.026 |

| SBNY | Signature Bank | S&P 400 | Financial Services | 14.38B | -0.041 | 0.026 |

| WSM | Williams-Sonoma, Inc. | S&P 400 | Consumer Cyclical | 12.79B | -0.129 | 0.026 |

| OLN | Olin Corporation | S&P 400 | Basic Materials | 8.04B | -0.031 | 0.025 |

| MOS | The Mosaic Company | S&P 500 | Basic Materials | 14.23B | -0.055 | 0.024 |

| CCS | Century Communities, Inc. | Barrons 400 | Consumer Cyclical | 2.76B | -0.022 | 0.024 |

| HIBB | Hibbett Sports, Inc. | Barrons 400 | Consumer Cyclical | 1.41B | -0.089 | 0.023 |

| AEO | American Eagle Outfitters, Inc. | S&P 400 | Consumer Cyclical | 5.77B | -0.074 | 0.022 |

| LPX | Louisiana-Pacific Corporation | S&P 400 | Basic Materials | 7B | -0.12 | 0.022 |

| ATKR | Atkore Inc. | Barrons 400 | Industrials | 3.72B | -0.143 | 0.018 |

| CAR | Avis Budget Group, Inc. | S&P 400 | Industrials | 6.25B | -0.034 | 0.017 |

| XEC | Cimarex Energy Co. | S&P 400 | Energy | 6.96B | -0.096 | 0.017 |

| ADS | Alliance Data Systems Corporation | S&P 400 | Financial Services | 6.24B | -0.054 | 0.016 |

| DVN | Devon Energy Corporation | S&P 500 | Energy | 20.06B | -0.125 | 0.016 |

| cash | Cash | Cash | Cash | – | 0.0 | 0.013 |

| GPS | The Gap, Inc. | S&P 500 | Consumer Cyclical | 12.32B | -0.111 | 0.011 |

As always, more trades next week!