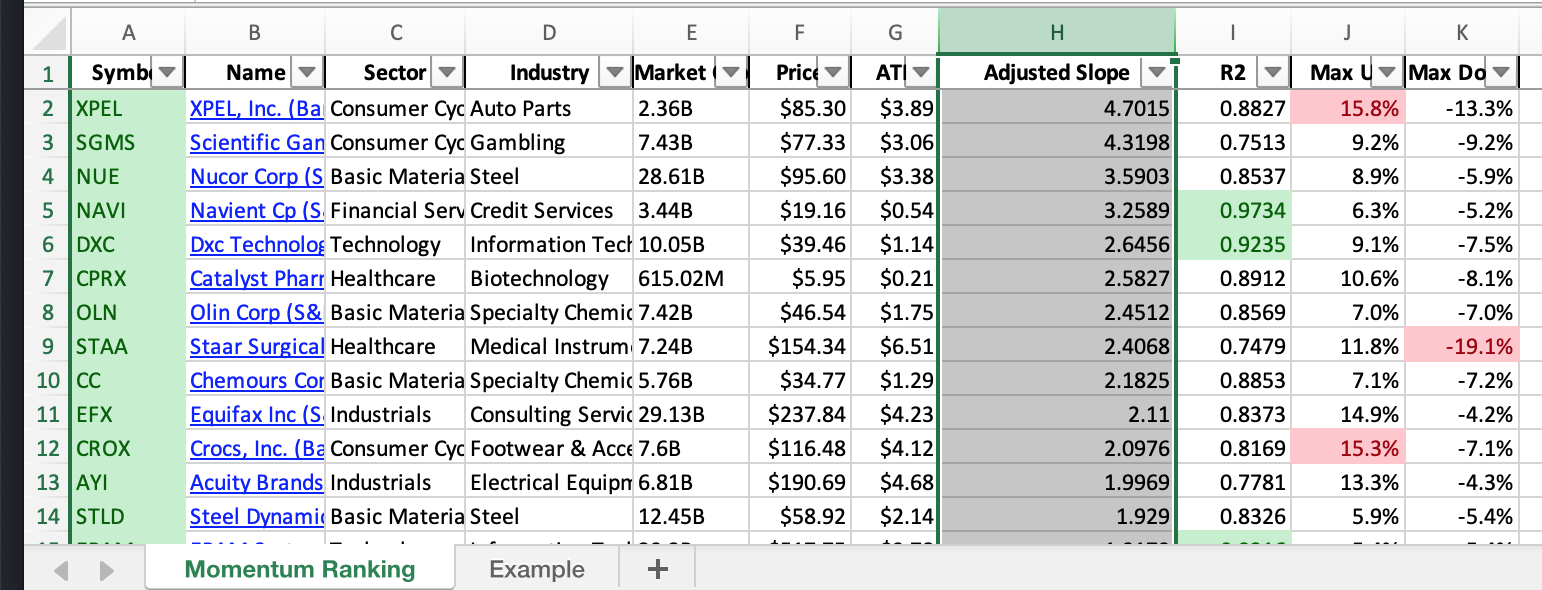

Click here for the Momentum Ranking of week 26.

This week’s transactions:

-

Sold:

- IVZ

- FIX

- GPS

- LPX (no longer in top 20%)

-

Bought:

- CROX (Crocs, Inc. (Barrons 400))

Index Distribution:

The S&Ps (400 + 500) now make up around 70% of the portfolio:

Current portfolio allocation: The Consumer Cyclical sector now has the largest share in the portfolio:

Weekly sector distribution:

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| SEE | Sealed Air Corporation | S&P 500 | Consumer Cyclical | 8.91B | -0.009 | 0.062 |

| VVV | Valvoline Inc. | S&P 400 | Energy | 5.91B | -0.063 | 0.053 |

| EPAM | EPAM Systems, Inc. | Barrons 400 | Technology | 29.19B | -0.011 | 0.053 |

| EFX | Equifax Inc. | S&P 500 | Industrials | 29.25B | -0.022 | 0.052 |

| POOL | Pool Corporation | S&P 500 | Consumer Cyclical | 18.82B | -0.029 | 0.042 |

| TXT | Textron Inc. | S&P 500 | Industrials | 15.59B | -0.049 | 0.041 |

| AYI | Acuity Brands, Inc. | S&P 400 | Technology | 6.85B | -0.025 | 0.04 |

| SNX | SYNNEX Corporation | S&P 400 | Technology | 6.35B | -0.066 | 0.039 |

| SFBS | ServisFirst Bancshares, Inc. | Barrons 400 | Financial Services | 3.71B | -0.047 | 0.038 |

| SLM | SLM Corporation | S&P 400 | Financial Services | 6.43B | -0.021 | 0.036 |

| KSU | Kansas City Southern | S&P 500 | Industrials | 25.78B | -0.098 | 0.034 |

| MYRG | MYR Group Inc. | Barrons 400 | Industrials | 1.5B | -0.047 | 0.033 |

| NAVI | Navient Corporation | S&P 400 | Financial Services | 3.43B | -0.05 | 0.033 |

| CPRX | Catalyst Pharmaceuticals, Inc. | Barrons 400 | Healthcare | 613.98M | -0.045 | 0.029 |

| LB | L Brands, Inc. | S&P 500 | Consumer Cyclical | 19.92B | -0.031 | 0.028 |

| CROX | Crocs, Inc. | Barrons 400 | Consumer Cyclical | 7.64B | -0.016 | 0.027 |

| DXC | DXC Technology Company | S&P 500 | Technology | 10.08B | -0.065 | 0.027 |

| OLN | Olin Corporation | S&P 400 | Basic Materials | 7.4B | -0.089 | 0.027 |

| DISH | DISH Network Corporation | S&P 500 | Communication Services | 22.07B | -0.113 | 0.026 |

| LGIH | LGI Homes, Inc. | Barrons 400 | Consumer Cyclical | 3.99B | -0.172 | 0.026 |

| IRM | Iron Mountain Incorporated | S&P 500 | Industrials | 12.25B | -0.093 | 0.026 |

| AEO | American Eagle Outfitters, Inc. | S&P 400 | Consumer Cyclical | 6.17B | -0.06 | 0.025 |

| XPEL | XPEL, Inc. | Barrons 400 | Consumer Cyclical | 2.35B | -0.084 | 0.023 |

| HIBB | Hibbett, Inc. | Barrons 400 | Consumer Cyclical | 1.39B | -0.097 | 0.022 |

| CC | The Chemours Company | S&P 400 | Basic Materials | 5.75B | -0.12 | 0.021 |

| SGMS | Scientific Games Corporation | S&P 400 | Consumer Cyclical | 7.55B | -0.05 | 0.019 |

| DVN | Devon Energy Corporation | S&P 500 | Energy | 19.35B | -0.112 | 0.018 |

| SHLX | Shell Midstream Partners, L.P. | Barrons 400 | Energy | 5.69B | -0.133 | 0.016 |

| cash | Cash | Cash | Cash | – | 0.0 | 0.016 |

| CAR | Avis Budget Group, Inc. | S&P 400 | Industrials | 5.45B | -0.178 | 0.016 |

| MTZ | MasTec, Inc. | S&P 400 | Industrials | 7.94B | -0.131 | 0.013 |

| STLD | Steel Dynamics, Inc. | S&P 400 | Basic Materials | 12.5B | -0.123 | 0.013 |

| NUE | Nucor Corporation | S&P 500 | Basic Materials | 28.64B | -0.143 | 0.013 |

| X | United States Steel Corporation | S&P 400 | Basic Materials | 6.38B | -0.226 | 0.012 |

As always, more trades next week!