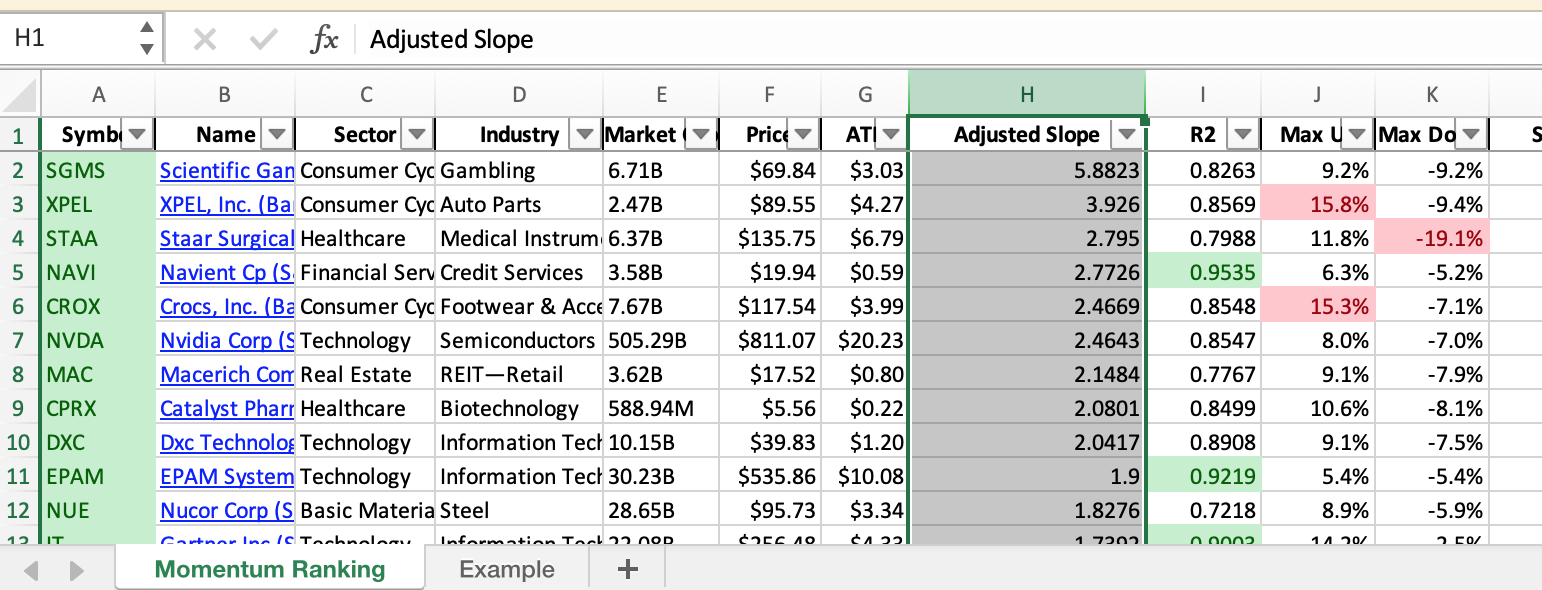

Click here for the Momentum Ranking of week 28.

This week’s transactions:

-

Sold:

- MTZ

- SNX

- CAR (no longer in top 20%)

-

Bought:

- IT (Gartner Inc (S&P 500))

- FTNT (Fortinet Inc (S&P 500))

Index Distribution:

The S&P 500 still has the highest weight in the portfolio:

Current portfolio allocation:

Now the Tech sector and Consumer Cyclicals make up about 50% of the portfolio:

Weekly sector distribution:

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| EFX | Equifax Inc. | S&P 500 | Industrials | 29.87B | -0.006 | 0.06 |

| EPAM | EPAM Systems, Inc. | Barrons 400 | Technology | 30.29B | -0.015 | 0.054 |

| NLOK | NortonLifeLock Inc. | S&P 500 | Technology | 15.79B | -0.056 | 0.05 |

| IRM | Iron Mountain Incorporated | S&P 500 | Industrials | 12.74B | -0.06 | 0.05 |

| IT | Gartner, Inc. | S&P 500 | Technology | 22.02B | -0.006 | 0.05 |

| FTNT | Fortinet, Inc. | S&P 500 | Technology | 41.94B | -0.014 | 0.045 |

| POOL | Pool Corporation | S&P 500 | Consumer Cyclical | 18.88B | -0.007 | 0.044 |

| TXT | Textron Inc. | S&P 500 | Industrials | 15.1B | -0.039 | 0.042 |

| SHLX | Shell Midstream Partners, L.P. | Barrons 400 | Energy | 5.81B | -0.098 | 0.037 |

| SFBS | ServisFirst Bancshares, Inc. | Barrons 400 | Financial Services | 3.61B | -0.059 | 0.036 |

| SLM | SLM Corporation | S&P 400 | Financial Services | 6.33B | -0.047 | 0.036 |

| MYRG | MYR Group Inc. | Barrons 400 | Industrials | 1.53B | -0.015 | 0.035 |

| NVDA | NVIDIA Corporation | S&P 500 | Technology | 503.56B | -0.017 | 0.034 |

| NAVI | Navient Corporation | S&P 400 | Financial Services | 3.59B | -0.007 | 0.034 |

| LB | L Brands, Inc. | S&P 500 | Consumer Cyclical | 20.62B | -0.017 | 0.03 |

| SEE | Sealed Air Corporation | S&P 500 | Consumer Cyclical | 8.62B | -0.029 | 0.029 |

| DXC | DXC Technology Company | S&P 500 | Technology | 10.13B | -0.035 | 0.028 |

| CROX | Crocs, Inc. | Barrons 400 | Consumer Cyclical | 7.66B | -0.009 | 0.028 |

| STLD | Steel Dynamics, Inc. | S&P 400 | Basic Materials | 12.91B | -0.06 | 0.027 |

| VVV | Valvoline Inc. | S&P 400 | Energy | 5.75B | -0.073 | 0.026 |

| KSU | Kansas City Southern | S&P 500 | Industrials | 24.44B | -0.143 | 0.025 |

| AEO | American Eagle Outfitters, Inc. | S&P 400 | Consumer Cyclical | 6.09B | -0.048 | 0.025 |

| HIBB | Hibbett, Inc. | Barrons 400 | Consumer Cyclical | 1.5B | -0.027 | 0.025 |

| CC | The Chemours Company | S&P 400 | Basic Materials | 5.61B | -0.103 | 0.022 |

| XPEL | XPEL, Inc. | Barrons 400 | Consumer Cyclical | 2.48B | -0.036 | 0.021 |

| DVN | Devon Energy Corporation | S&P 500 | Energy | 19.73B | -0.103 | 0.019 |

| MAC | The Macerich Company | S&P 400 | Real Estate | 3.6B | -0.301 | 0.018 |

| SGMS | Scientific Games Corporation | S&P 400 | Consumer Cyclical | 6.68B | -0.119 | 0.017 |

| AYI | Acuity Brands, Inc. | S&P 400 | Technology | 6.03B | -0.102 | 0.016 |

| OLN | Olin Corporation | S&P 400 | Basic Materials | 6.99B | -0.118 | 0.013 |

| NUE | Nucor Corporation | S&P 500 | Basic Materials | 28.55B | -0.119 | 0.013 |

| CPRX | Catalyst Pharmaceuticals, Inc. | Barrons 400 | Healthcare | 586.29M | -0.098 | 0.013 |

| cash | Cash | Cash | Cash | – | 0.0 | -0.001 |

As always, more trades next week!