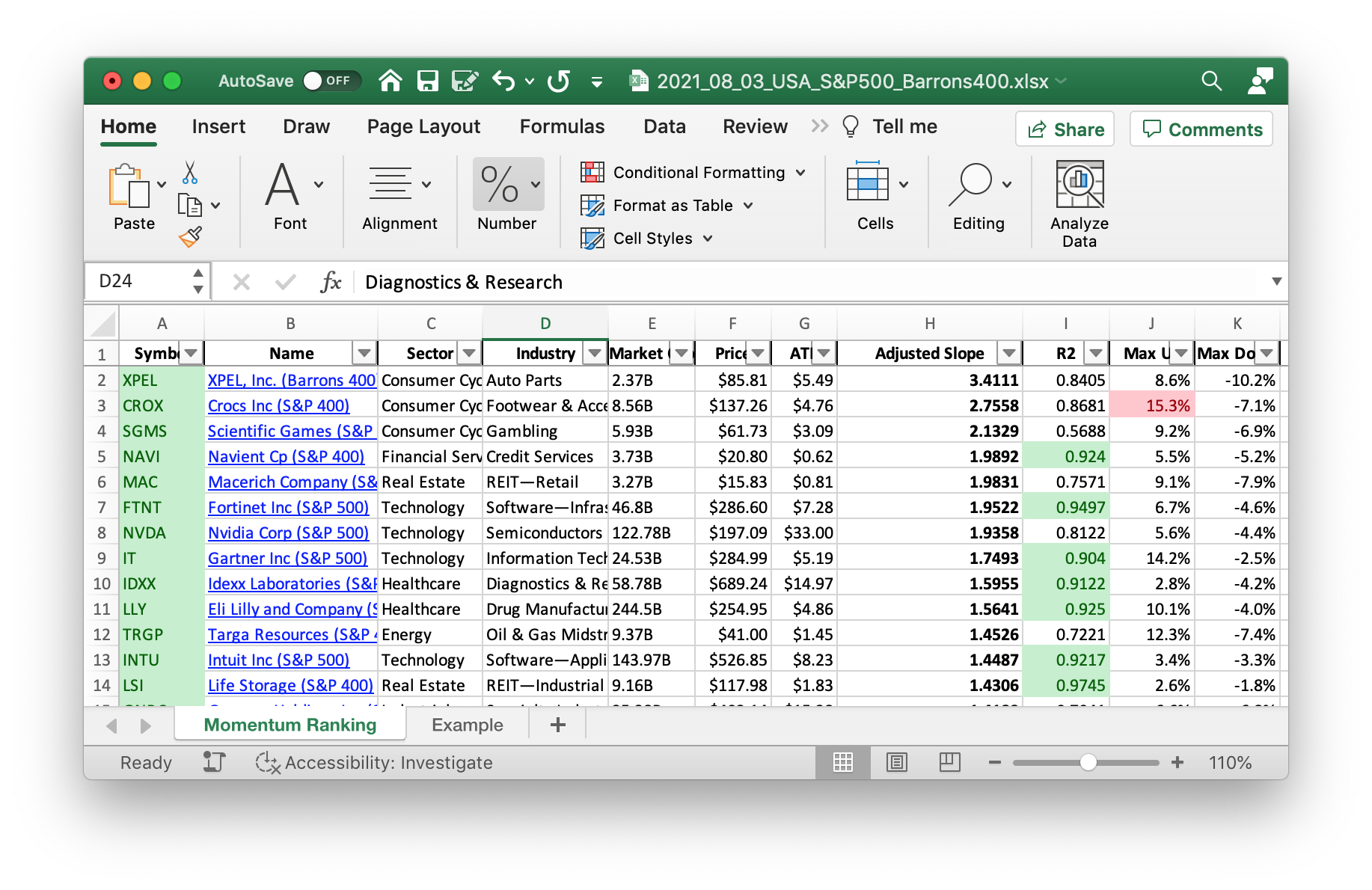

Click here for the Momentum Ranking of week 31.

L Brands (LB) split off Victoria’s Secret (VSCO) and renamed itself to Bath & Body Works (BBWI) (not to be confused with Bed Bath & Beyond LOL). I sold all VSCO and BBWI shares. Read on for the other transactions of this week.

This week’s transactions:

-

Sold:

- BBWI

- VSCO (spin-off)

- CC

- VVV (no longer in top 20%)

-

Bought:

- LLY (Eli Lilly and Company (S&P 500))

Index Distribution:

The majority of companies in the portfolio now belong to the S&P 500:

Current portfolio allocation: The Tech sector is about 1/4 of the portfolio, followed by the Industrials:

Weekly sector distribution:

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| TGT | Target Corporation | S&P 500 | Consumer Defensive | 130.06B | -0.024 | 0.072 |

| LSI | Life Storage, Inc. | S&P 400 | Real Estate | 9.13B | -0.016 | 0.062 |

| IT | Gartner, Inc. | S&P 500 | Technology | 25.07B | -0.1 | 0.06 |

| SEE | Sealed Air Corporation | S&P 500 | Consumer Cyclical | 8.83B | -0.057 | 0.056 |

| EFX | Equifax Inc. | S&P 500 | Industrials | 31.57B | -0.022 | 0.054 |

| EPAM | EPAM Systems, Inc. | Barrons 400 | Technology | 32.07B | -0.023 | 0.052 |

| NSA | National Storage Affiliates Trust | S&P 400 | Real Estate | 4.78B | -0.022 | 0.052 |

| IDXX | IDEXX Laboratories, Inc. | S&P 500 | Healthcare | 59.01B | -0.04 | 0.051 |

| FTNT | Fortinet, Inc. | S&P 500 | Technology | 48B | -0.032 | 0.05 |

| LLY | Eli Lilly and Company | S&P 500 | Healthcare | 244.46B | -0.049 | 0.05 |

| IRM | Iron Mountain Incorporated | S&P 500 | Industrials | 12.58B | -0.076 | 0.049 |

| POOL | Pool Corporation | S&P 500 | Consumer Cyclical | 19.29B | -0.019 | 0.044 |

| TXT | Textron Inc. | S&P 500 | Industrials | 15.71B | -0.036 | 0.036 |

| NAVI | Navient Corporation | S&P 400 | Financial Services | 3.48B | -0.012 | 0.035 |

| NVDA | NVIDIA Corporation | S&P 500 | Technology | 494.69B | -0.054 | 0.033 |

| MYRG | MYR Group Inc. | Barrons 400 | Industrials | 1.62B | -0.05 | 0.031 |

| NUE | Nucor Corporation | S&P 500 | Basic Materials | 30.96B | -0.08 | 0.03 |

| DXC | DXC Technology Company | S&P 500 | Technology | 11.06B | -0.035 | 0.029 |

| CROX | Crocs, Inc. | S&P 400 | Consumer Cyclical | 8.59B | -0.031 | 0.028 |

| STLD | Steel Dynamics, Inc. | S&P 400 | Basic Materials | 13.15B | -0.059 | 0.027 |

| HIBB | Hibbett, Inc. | Barrons 400 | Consumer Cyclical | 1.44B | -0.096 | 0.023 |

| NLOK | NortonLifeLock Inc. | S&P 500 | Technology | 14.39B | -0.149 | 0.018 |

| CPRX | Catalyst Pharmaceuticals, Inc. | Barrons 400 | Healthcare | 595.38M | -0.051 | 0.015 |

| XPEL | XPEL, Inc. | Barrons 400 | Consumer Cyclical | 2.37B | -0.105 | 0.011 |

| DVN | Devon Energy Corporation | S&P 500 | Energy | 17.63B | -0.203 | 0.009 |

| MAC | The Macerich Company | S&P 400 | Real Estate | 3.31B | -0.379 | 0.008 |

| SGMS | Scientific Games Corporation | S&P 400 | Consumer Cyclical | 5.9B | -0.22 | 0.007 |

| cash | Cash | Cash | Cash | – | 0.0 | 0.006 |

As always, more trades next week!