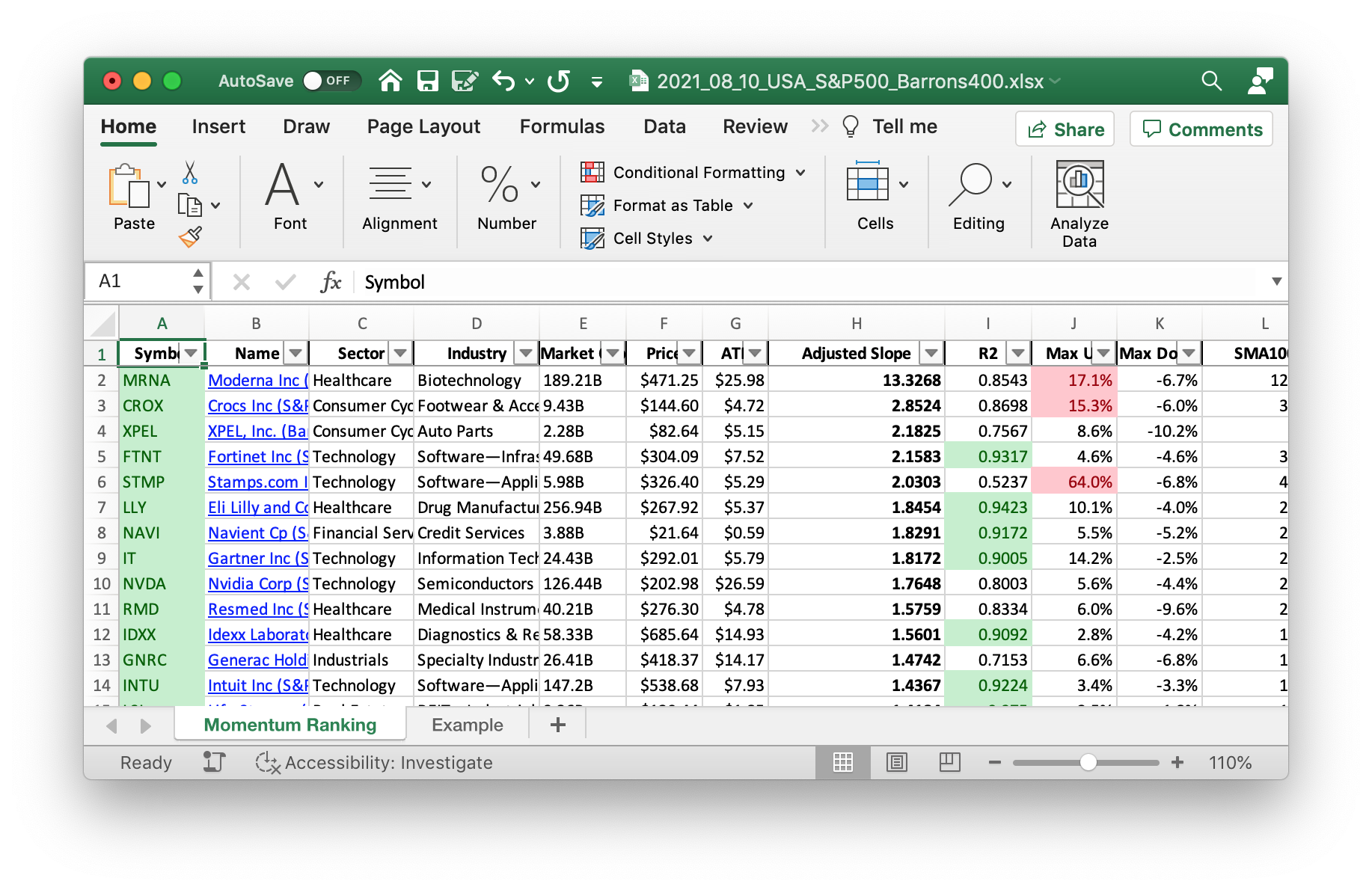

Click here for the Momentum Ranking of week 32.

MRNA (as a new entrant to the S&P 500) was added to the portfolio and one company was sold off.

This week’s transactions:

-

Sold:

- NLOK (price below MA100)

-

Bought:

- MRNA (Moderna Inc (S&P 500))

Index Distribution:

The S&P 500 continues to have the highest weight in the portfolio:

Current portfolio allocation: The three biggest sectors atm are Tech, Consumer Cyclical, and Industrials:

Weekly sector distribution:

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| TGT | Target Corporation | S&P 500 | Consumer Defensive | 130.94B | -0.011 | 0.071 |

| LSI | Life Storage, Inc. | S&P 400 | Real Estate | 9.41B | -0.011 | 0.061 |

| SEE | Sealed Air Corporation | S&P 500 | Consumer Cyclical | 8.97B | -0.013 | 0.057 |

| NSA | National Storage Affiliates Trust | S&P 400 | Real Estate | 4.88B | -0.01 | 0.057 |

| LLY | Eli Lilly and Company | S&P 500 | Healthcare | 255.36B | -0.022 | 0.052 |

| EFX | Equifax Inc. | S&P 500 | Industrials | 31.63B | -0.042 | 0.052 |

| EPAM | EPAM Systems, Inc. | Barrons 400 | Technology | 34.33B | -0.016 | 0.05 |

| IT | Gartner, Inc. | S&P 500 | Technology | 24.41B | -0.033 | 0.05 |

| IRM | Iron Mountain Incorporated | S&P 500 | Industrials | 13.4B | -0.043 | 0.049 |

| IDXX | IDEXX Laboratories, Inc. | S&P 500 | Healthcare | 57.66B | -0.029 | 0.045 |

| POOL | Pool Corporation | S&P 500 | Consumer Cyclical | 19.61B | -0.02 | 0.044 |

| FTNT | Fortinet, Inc. | S&P 500 | Technology | 49.3B | -0.018 | 0.039 |

| TXT | Textron Inc. | S&P 500 | Industrials | 16.49B | -0.02 | 0.037 |

| NAVI | Navient Corporation | S&P 400 | Financial Services | 3.63B | -0.014 | 0.036 |

| NVDA | NVIDIA Corporation | S&P 500 | Technology | 496.7B | -0.028 | 0.033 |

| MYRG | MYR Group Inc. | Barrons 400 | Industrials | 1.67B | -0.021 | 0.031 |

| NUE | Nucor Corporation | S&P 500 | Basic Materials | 33.62B | -0.062 | 0.031 |

| CPRX | Catalyst Pharmaceuticals, Inc. | Barrons 400 | Healthcare | 616.05M | -0.074 | 0.028 |

| CROX | Crocs, Inc. | S&P 400 | Consumer Cyclical | 9B | -0.031 | 0.028 |

| STLD | Steel Dynamics, Inc. | S&P 400 | Basic Materials | 13.8B | -0.053 | 0.026 |

| HIBB | Hibbett, Inc. | Barrons 400 | Consumer Cyclical | 1.45B | -0.124 | 0.022 |

| DXC | DXC Technology Company | S&P 500 | Technology | 10.16B | -0.085 | 0.02 |

| SGMS | Scientific Games Corporation | S&P 400 | Consumer Cyclical | 6.57B | -0.134 | 0.017 |

| DVN | Devon Energy Corporation | S&P 500 | Energy | 18.52B | -0.167 | 0.017 |

| MAC | The Macerich Company | S&P 400 | Real Estate | 3.61B | -0.352 | 0.016 |

| cash | Cash | Cash | Cash | – | 0.0 | 0.012 |

| MRNA | Moderna, Inc. | S&P 500 | Healthcare | 185.07B | -0.026 | 0.012 |

| XPEL | XPEL, Inc. | Barrons 400 | Consumer Cyclical | 2.32B | -0.211 | 0.009 |

As always, more trades next week!