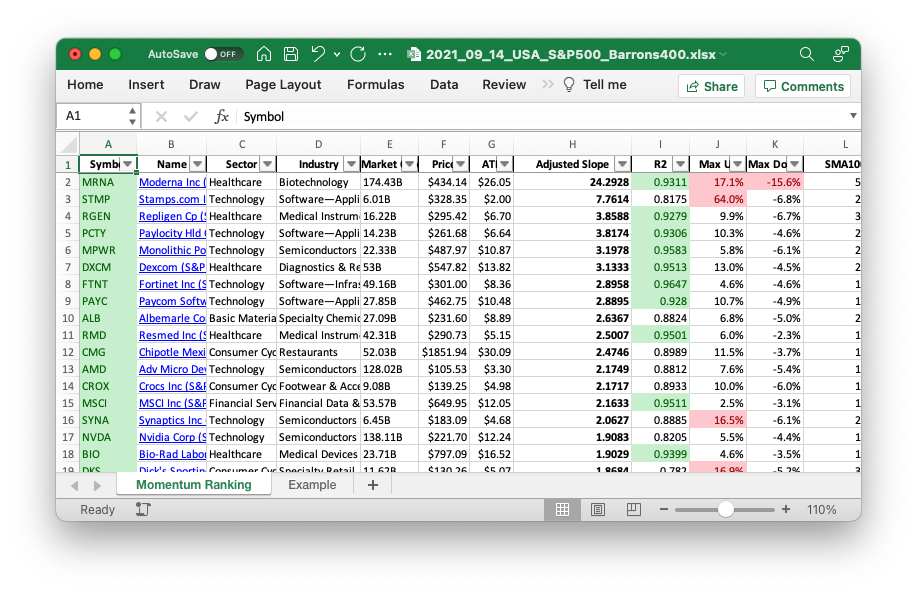

Click here for the Momentum Ranking of week 37.

This week’s transactions:

- Bought:

- RGEN (Repligen Cp (S&P 400))

- ALB (Albemarle Corp (S&P 500))

- MSCI (MSCI Inc (S&P 500))

Index Distribution:

The S&P 500 still has the highest weight in the portfolio:

Current portfolio allocation: Tech and Healthcare account for abut 50% of the portfolio:

Weekly sector distribution:

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| CMG | Chipotle Mexican Grill, Inc. | S&P 500 | Consumer Cyclical | 52.3B | -0.038 | 0.061 |

| LSI | Life Storage, Inc. | S&P 400 | Real Estate | 9.6B | -0.029 | 0.06 |

| INTU | Intuit Inc. | S&P 500 | Technology | 154.9B | -0.044 | 0.059 |

| EFX | Equifax Inc. | S&P 500 | Industrials | 33.73B | -0.021 | 0.058 |

| NSA | National Storage Affiliates Trust | S&P 400 | Real Estate | 5.11B | -0.019 | 0.058 |

| RMD | ResMed Inc. | S&P 500 | Healthcare | 42.52B | -0.041 | 0.056 |

| IT | Gartner, Inc. | S&P 500 | Technology | 26.13B | -0.028 | 0.053 |

| MSCI | MSCI Inc. | S&P 500 | Financial Services | 53.68B | -0.036 | 0.052 |

| WAT | Waters Corporation | S&P 500 | Healthcare | 25.22B | -0.058 | 0.049 |

| EPAM | EPAM Systems, Inc. | Barrons 400 | Technology | 35.62B | -0.048 | 0.045 |

| MPWR | Monolithic Power Systems, Inc. | S&P 500 | Technology | 22.58B | -0.033 | 0.044 |

| NAVI | Navient Corporation | S&P 400 | Financial Services | 3.92B | -0.008 | 0.043 |

| POOL | Pool Corporation | S&P 500 | Consumer Cyclical | 19.21B | -0.044 | 0.043 |

| RGEN | Repligen Corporation | S&P 400 | Healthcare | 16.26B | -0.027 | 0.042 |

| MYRG | MYR Group Inc. | Barrons 400 | Industrials | 1.76B | -0.046 | 0.038 |

| PCTY | Paylocity Holding Corporation | S&P 400 | Technology | 14.4B | -0.066 | 0.038 |

| DXCM | DexCom, Inc. | S&P 500 | Healthcare | 52.83B | -0.035 | 0.035 |

| TGT | Target Corporation | S&P 500 | Consumer Defensive | 118.95B | -0.09 | 0.032 |

| CROX | Crocs, Inc. | S&P 400 | Consumer Cyclical | 9.16B | -0.068 | 0.027 |

| ALB | Albemarle Corporation | S&P 500 | Basic Materials | 27.2B | -0.095 | 0.024 |

| LLY | Eli Lilly and Company | S&P 500 | Healthcare | 225.01B | -0.137 | 0.021 |

| FTNT | Fortinet, Inc. | S&P 500 | Technology | 49.49B | -0.078 | 0.019 |

| NVDA | NVIDIA Corporation | S&P 500 | Technology | 555.34B | -0.039 | 0.018 |

| IDXX | IDEXX Laboratories, Inc. | S&P 500 | Healthcare | 56.43B | -0.073 | 0.016 |

| cash | Cash | Cash | Cash | – | 0.0 | 0.011 |

As always, more trades next week!