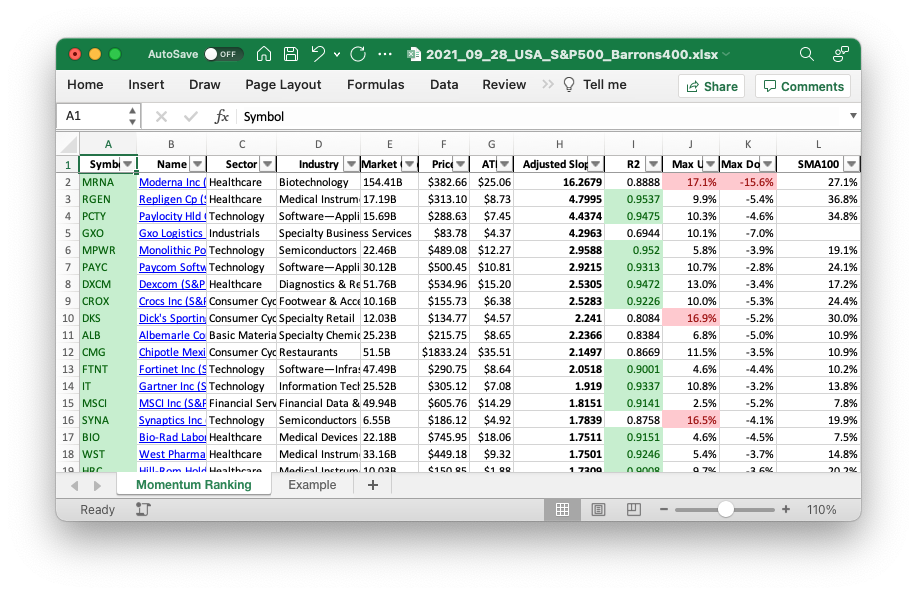

Click here for the Momentum Ranking of week 39.

This week’s transactions:

-

Sold:

- IDXX (price below MA100)

-

Bought:

- HRC (Hill-Rom Holdings Inc (S&P 400))

This week HRC, a medical equipment maker, was added to the portfolio and it is now the largest position. I am not very fond of this because on 9/2, it was announced that medtech firm Baxter is buying Hill-Rom for $156 a share. Since then, the price didn’t move much. I don’t like to trade these takeover situations, but as of now HRC is still part of the universe of shares and had to be ought according to the ranking.

Index Distribution:

The S&P 500 still has the highest weight in the portfolio:

Current portfolio allocation:

Tech and Healthcare are the largest sectors in the portfolio:

Weekly sector distribution:

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| cash | Cash | Cash | Cash | – | 0.0 | 0.174 |

| HRC | Hill-Rom Holdings, Inc. | S&P 400 | Healthcare | 9.84B | -0.02 | 0.077 |

| INTU | Intuit Inc. | S&P 500 | Technology | 150.25B | -0.027 | 0.052 |

| WST | West Pharmaceutical Services, Inc. | S&P 500 | Healthcare | 31.73B | -0.071 | 0.048 |

| CMG | Chipotle Mexican Grill, Inc. | S&P 500 | Consumer Cyclical | 51.78B | -0.03 | 0.047 |

| NSA | National Storage Affiliates Trust | S&P 400 | Real Estate | 4.79B | -0.092 | 0.044 |

| LSI | Life Storage, Inc. | S&P 400 | Real Estate | 9.44B | -0.121 | 0.043 |

| PAYC | Paycom Software, Inc. | S&P 500 | Technology | 29.7B | -0.016 | 0.042 |

| IT | Gartner, Inc. | S&P 500 | Technology | 25.64B | -0.037 | 0.042 |

| RMD | ResMed Inc. | S&P 500 | Healthcare | 38.68B | -0.102 | 0.04 |

| MPWR | Monolithic Power Systems, Inc. | S&P 500 | Technology | 22.77B | -0.024 | 0.038 |

| SYNA | Synaptics Incorporated | S&P 400 | Technology | 7.08B | -0.034 | 0.037 |

| PCTY | Paylocity Holding Corporation | S&P 400 | Technology | 15.43B | -0.02 | 0.036 |

| RGEN | Repligen Corporation | S&P 400 | Healthcare | 15.77B | -0.061 | 0.033 |

| DXCM | DexCom, Inc. | S&P 500 | Healthcare | 52.35B | -0.052 | 0.032 |

| DKS | DICK’S Sporting Goods, Inc. | S&P 400 | Consumer Cyclical | 11.52B | -0.112 | 0.029 |

| EFX | Equifax Inc. | S&P 500 | Industrials | 31.35B | -0.061 | 0.026 |

| CROX | Crocs, Inc. | S&P 400 | Consumer Cyclical | 9.46B | -0.059 | 0.023 |

| WAT | Waters Corporation | S&P 500 | Healthcare | 22.68B | -0.111 | 0.022 |

| MSCI | MSCI Inc. | S&P 500 | Financial Services | 49.74B | -0.043 | 0.021 |

| NAVI | Navient Corporation | S&P 400 | Financial Services | 3.8B | -0.027 | 0.019 |

| NVDA | NVIDIA Corporation | S&P 500 | Technology | 522.07B | -0.06 | 0.018 |

| GXO | GXO Logistics, Inc. | S&P 400 | Industrials | 8.91B | -0.12 | 0.018 |

| FTNT | Fortinet, Inc. | S&P 500 | Technology | 47.47B | -0.067 | 0.015 |

| EPAM | EPAM Systems, Inc. | Barrons 400 | Technology | 32.58B | -0.079 | 0.015 |

| ALB | Albemarle Corporation | S&P 500 | Basic Materials | 25.66B | -0.122 | 0.011 |

As always, more trades next week!