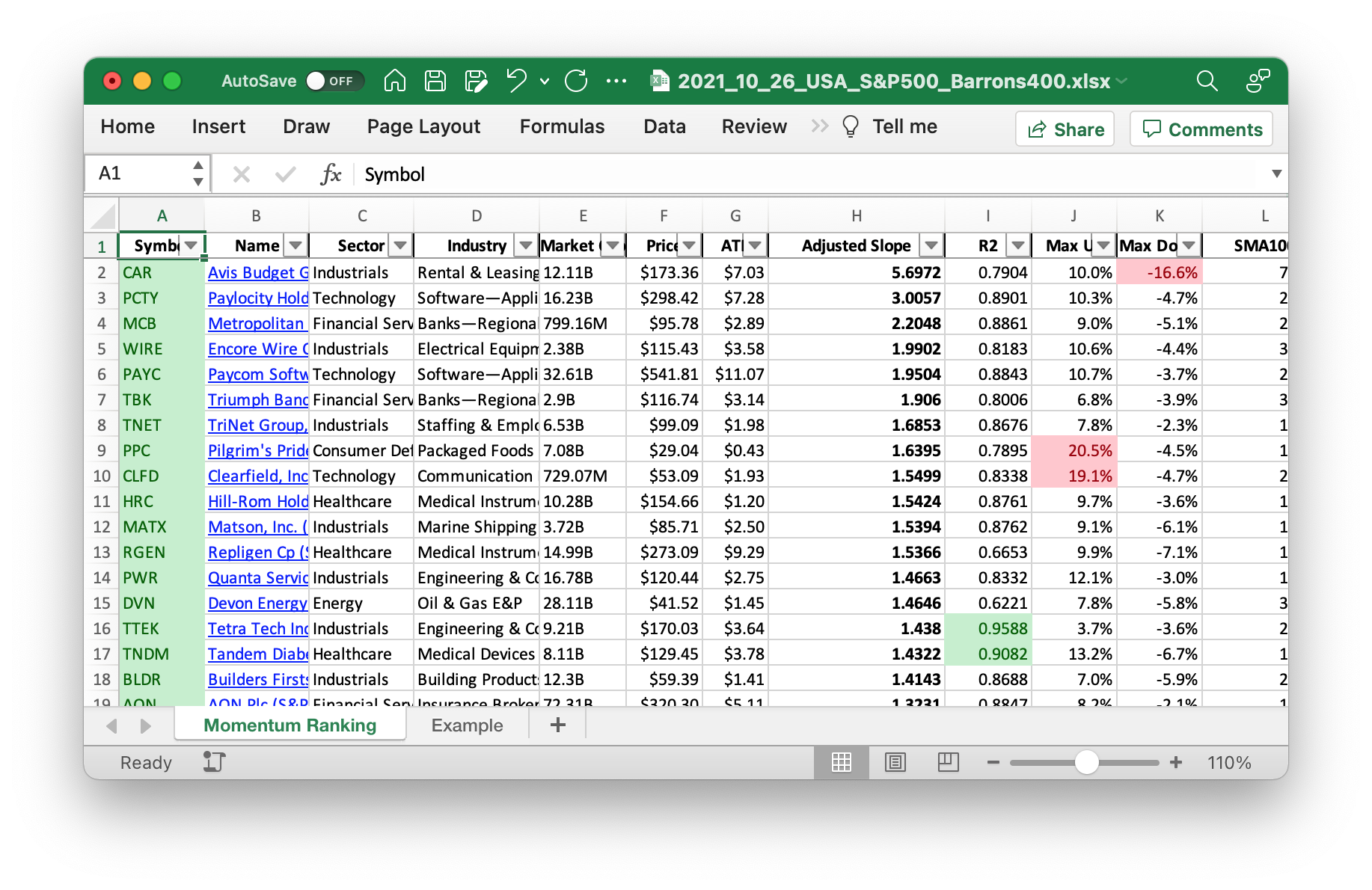

Click here for the Momentum Ranking of week 43.

This week’s transactions:

-

Sold:

- LSI

- EFX (no longer in top 20%)

-

Bought:

- WIRE (Encore Wire Corporation (Barrons 400))

Index Distribution:

The S&P 500 accounts for about 50% of the portfolio :

Current portfolio allocation: Tech is the largest sector in the portfolio:

Weekly sector distribution:

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| AON | Aon plc | S&P 500 | Financial Services | 72.33B | -0.007 | 0.06 |

| TNET | TriNet Group, Inc. | Barrons 400 | Industrials | 6.49B | -0.052 | 0.053 |

| INTU | Intuit Inc. | S&P 500 | Technology | 165.37B | -0.018 | 0.049 |

| PAYC | Paycom Software, Inc. | S&P 500 | Technology | 32.38B | -0.014 | 0.049 |

| IT | Gartner, Inc. | S&P 500 | Technology | 27.06B | -0.012 | 0.048 |

| NSP | Insperity, Inc. | S&P 400 | Industrials | 4.82B | -0.005 | 0.047 |

| MPWR | Monolithic Power Systems, Inc. | S&P 500 | Technology | 23.99B | -0.012 | 0.043 |

| EPAM | EPAM Systems, Inc. | Barrons 400 | Technology | 36.69B | -0.011 | 0.043 |

| MSCI | MSCI Inc. | S&P 500 | Financial Services | 54.01B | -0.023 | 0.043 |

| TTEK | Tetra Tech, Inc. | S&P 400 | Industrials | 9.15B | -0.015 | 0.043 |

| CDAY | Ceridian HCM Holding Inc. | S&P 500 | Technology | 19.24B | -0.01 | 0.042 |

| MCB | Metropolitan Bank Holding Corp. | Barrons 400 | Financial Services | 1B | -0.001 | 0.037 |

| PCTY | Paylocity Holding Corporation | S&P 400 | Technology | 16.32B | -0.012 | 0.036 |

| FTNT | Fortinet, Inc. | S&P 500 | Technology | 53.61B | -0.039 | 0.035 |

| MATX | Matson, Inc. | Barrons 400 | Industrials | 3.71B | -0.063 | 0.035 |

| TNDM | Tandem Diabetes Care, Inc. | S&P 400 | Healthcare | 8.15B | -0.05 | 0.034 |

| WIRE | Encore Wire Corporation | Barrons 400 | Technology | 2.39B | -0.024 | 0.033 |

| ALB | Albemarle Corporation | S&P 500 | Basic Materials | 27.56B | -0.054 | 0.029 |

| RGEN | Repligen Corporation | S&P 400 | Healthcare | 15.04B | -0.161 | 0.029 |

| BLDR | Builders FirstSource, Inc. | S&P 400 | Industrials | 12.2B | -0.005 | 0.029 |

| DKS | DICK’S Sporting Goods, Inc. | S&P 400 | Consumer Cyclical | 11.13B | -0.132 | 0.027 |

| CLFD | Clearfield, Inc. | Barrons 400 | Technology | 720.11M | -0.065 | 0.025 |

| NOW | ServiceNow, Inc. | S&P 500 | Technology | 136.22B | -0.007 | 0.023 |

| INVA | Innoviva, Inc. | Barrons 400 | Healthcare | 1.12B | -0.087 | 0.017 |

| WST | West Pharmaceutical Services, Inc. | S&P 500 | Healthcare | 31.45B | -0.122 | 0.017 |

| SYNA | Synaptics Incorporated | S&P 400 | Technology | 6.97B | -0.066 | 0.016 |

| CMG | Chipotle Mexican Grill, Inc. | S&P 500 | Consumer Cyclical | 49.22B | -0.094 | 0.015 |

| DXCM | DexCom, Inc. | S&P 500 | Healthcare | 54.97B | -0.018 | 0.014 |

| NVDA | NVIDIA Corporation | S&P 500 | Technology | 611.74B | -0.083 | 0.011 |

| GXO | GXO Logistics, Inc. | S&P 400 | Industrials | 10.24B | -0.059 | 0.01 |

| cash | Cash | Cash | Cash | – | 0.0 | 0.008 |

As always, more trades next week!