The S&P 500 is back above the 200 day moving average - time to go shopping!

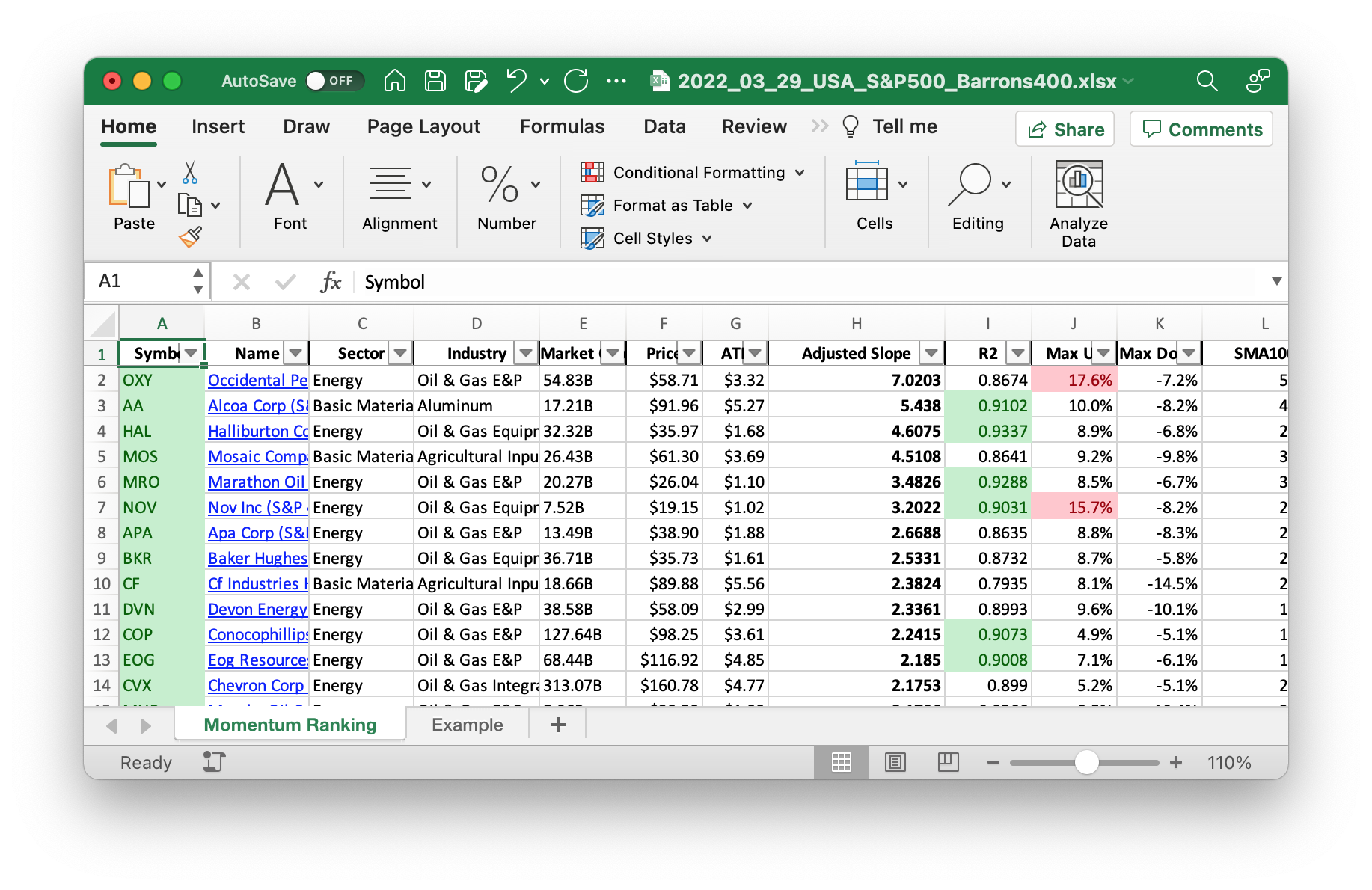

Click here to see the latest transaction and the Momentum Ranking of week 13.

This week’s transactions:

-

Bought:

- AA

- ABBV

- APA

- BPMP

- CCMP

- CERN

- CF

- CHD

- CVS

- CVX

- DLTR

- DVN

- EOG

- FANG

- MCK

- MKC

- MRO

- SFM

- VRTX

-

Sold:

- CHD

- DLTR

Index Distribution:

Now the S&P 500 has the highest weight in the portfolio:

Current portfolio allocation: Suddenly, most stocks are from the Energy sector:

Let’s see if Energy can continue to lead the market!

Weekly sector distribution:

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| CERN | Cerner Corporation | S&P 500 | Technology | 27.48B | -0.003 | 0.133 |

| cash | Cash | Cash | Cash | – | 0.0 | 0.065 |

| CCMP | CMC Materials, Inc. | S&P 400 | Technology | 5.39B | -0.052 | 0.062 |

| ABBV | AbbVie Inc. | S&P 500 | Healthcare | 286.03B | -0.008 | 0.059 |

| FHN | First Horizon Corporation | S&P 400 | Financial Services | 12.53B | -0.034 | 0.052 |

| MCK | McKesson Corporation | S&P 500 | Healthcare | 45.94B | -0.006 | 0.048 |

| MKC | McCormick & Company, Incorporated | S&P 500 | Consumer Defensive | 25.64B | -0.091 | 0.047 |

| VRTX | Vertex Pharmaceuticals Incorporated | S&P 500 | Healthcare | 64.45B | -0.01 | 0.044 |

| CVS | CVS Health Corporation | S&P 500 | Healthcare | 137.73B | -0.029 | 0.042 |

| CVX | Chevron Corporation | S&P 500 | Energy | 315.33B | -0.048 | 0.033 |

| SFM | Sprouts Farmers Market, Inc. | S&P 400 | Communication Services | 3.56B | -0.074 | 0.032 |

| BPMP | BP Midstream Partners LP | Barrons 400 | Energy | 1.75B | -0.113 | 0.03 |

| XOM | Exxon Mobil Corporation | S&P 500 | Energy | 342.84B | -0.095 | 0.029 |

| PXD | Pioneer Natural Resources Company | S&P 500 | Energy | 60.62B | -0.017 | 0.028 |

| EOG | EOG Resources, Inc. | S&P 500 | Energy | 69.4B | -0.032 | 0.028 |

| COP | ConocoPhillips | S&P 500 | Energy | 129.5B | -0.037 | 0.028 |

| BKR | Baker Hughes Company | S&P 500 | Energy | 37.35B | -0.07 | 0.022 |

| MRO | Marathon Oil Corporation | S&P 500 | Energy | 18.05B | -0.035 | 0.021 |

| FANG | Diamondback Energy, Inc. | S&P 500 | Energy | 24.11B | -0.049 | 0.019 |

| NOV | NOV Inc. | S&P 400 | Energy | 7.53B | -0.204 | 0.019 |

| CF | CF Industries Holdings, Inc. | S&P 500 | Basic Materials | 20.29B | -0.043 | 0.018 |

| MOS | The Mosaic Company | S&P 500 | Basic Materials | 23.23B | -0.049 | 0.018 |

| APA | APA Corporation | S&P 500 | Energy | 13.75B | -0.053 | 0.018 |

| DVN | Devon Energy Corporation | S&P 500 | Energy | 39.26B | -0.044 | 0.017 |

| SLB | Schlumberger Limited | S&P 500 | Basic Materials | 58.4B | -0.098 | 0.016 |

| HAL | Halliburton Company | S&P 500 | Energy | 33.14B | -0.052 | 0.016 |

| MUR | Murphy Oil Corporation | S&P 400 | Energy | 6.07B | -0.086 | 0.015 |

| PDCE | PDC Energy, Inc. | S&P 400 | Energy | 7.09B | -0.053 | 0.015 |

| OXY | Occidental Petroleum Corporation | S&P 500 | Energy | 52.29B | -0.104 | 0.012 |

| AA | Alcoa Corporation | S&P 400 | Basic Materials | 16.45B | -0.057 | 0.012 |

As always, more trades next week!