The scaling-out in April paid off and last month achieved a small gain of +2.2% while the S&P 500 was down 8.8%. For the year, the TradeTuesday Momentum Portfolio is at -1.9%, compared to -13% of the S&P 500.

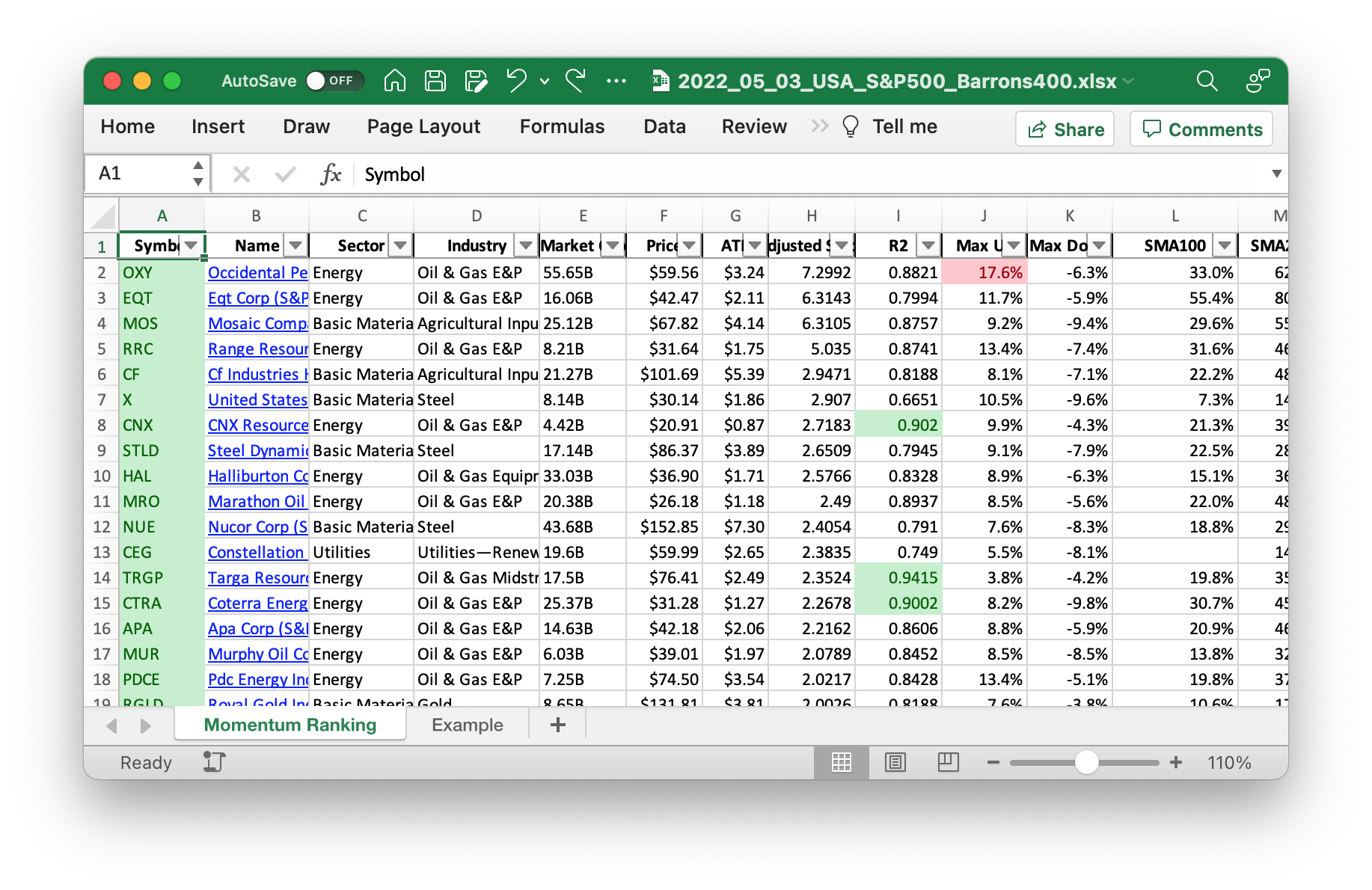

Click here for the Momentum Ranking of week 18.

No new trades in this week, as the S&P 500 is still well below the 200 day moving average.

This week’s transactions:

No new buys or sells in this week.

Index Distribution:

Cash is now at almost 50% of the portfolio:

Current portfolio allocation: After cash, the energy sector now has the largest share in the portfolio:

Weekly sector distribution:

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| cash | Cash | Cash | Cash | – | 0.0 | 0.484 |

| FHN | First Horizon Corporation | S&P 400 | Financial Services | 11.9B | -0.071 | 0.039 |

| VRTX | Vertex Pharmaceuticals Incorporated | S&P 500 | Healthcare | 68.52B | -0.105 | 0.035 |

| CVX | Chevron Corporation | S&P 500 | Energy | 318.72B | -0.086 | 0.033 |

| XOM | Exxon Mobil Corporation | S&P 500 | Energy | 372.62B | -0.056 | 0.032 |

| TRGP | Targa Resources Corp. | S&P 400 | Energy | 17.41B | -0.089 | 0.03 |

| PXD | Pioneer Natural Resources Company | S&P 500 | Energy | 58.73B | -0.093 | 0.027 |

| COP | ConocoPhillips | S&P 500 | Energy | 128.01B | -0.108 | 0.025 |

| EOG | EOG Resources, Inc. | S&P 500 | Energy | 70.76B | -0.091 | 0.024 |

| MCK | McKesson Corporation | S&P 500 | Healthcare | 46.1B | -0.086 | 0.022 |

| APA | APA Corporation | S&P 500 | Energy | 14.7B | -0.102 | 0.019 |

| ABBV | AbbVie Inc. | S&P 500 | Healthcare | 262.4B | -0.159 | 0.018 |

| FANG | Diamondback Energy, Inc. | S&P 500 | Energy | 24.11B | -0.138 | 0.018 |

| CF | CF Industries Holdings, Inc. | S&P 500 | Basic Materials | 21.15B | -0.15 | 0.017 |

| DVN | Devon Energy Corporation | S&P 500 | Energy | 42.17B | -0.108 | 0.017 |

| MOS | The Mosaic Company | S&P 500 | Basic Materials | 24.46B | -0.213 | 0.017 |

| MRO | Marathon Oil Corporation | S&P 500 | Energy | 18.81B | -0.108 | 0.016 |

| HAL | Halliburton Company | S&P 500 | Energy | 33.12B | -0.156 | 0.016 |

| ADM | Archer-Daniels-Midland Company | S&P 500 | Consumer Defensive | 50.46B | -0.097 | 0.016 |

| SLB | Schlumberger Limited | S&P 500 | Basic Materials | 56.67B | -0.155 | 0.016 |

| MUR | Murphy Oil Corporation | S&P 400 | Energy | 6.07B | -0.164 | 0.015 |

| PDCE | PDC Energy, Inc. | S&P 400 | Energy | 7.09B | -0.132 | 0.015 |

| SFM | Sprouts Farmers Market, Inc. | S&P 400 | Communication Services | 3.39B | -0.143 | 0.014 |

| NOV | NOV Inc. | S&P 400 | Energy | 7.4B | -0.226 | 0.013 |

| OXY | Occidental Petroleum Corporation | S&P 500 | Energy | 55.53B | -0.083 | 0.013 |

| BKR | Baker Hughes Company | S&P 500 | Energy | 34.03B | -0.223 | 0.009 |

As always, more trades next week!