The Momentum portfolio was up 2.7% in February (3.7% YTD).

In this week, there were 7 new trades: 2 buys and 5 sells.

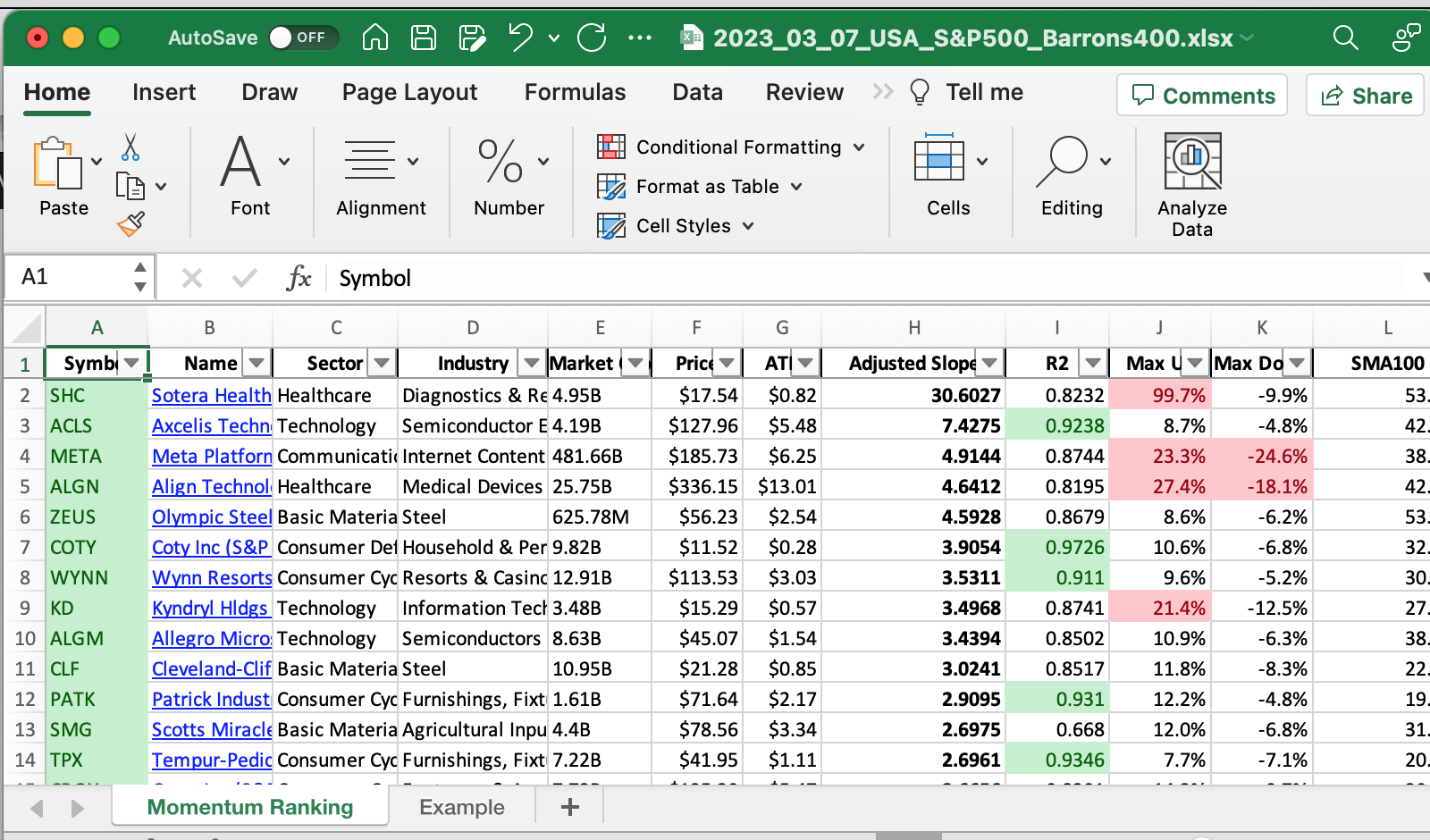

Click here for the Momentum Ranking of week 10.

This week’s transactions:

-

Sold:

-

Bought:

-

Rebalanced / added:

-

Rebalanced / reduced:

Index Distribution:

Currently, most stocks of the portfolio are coming from the S&P 400:

Current portfolio allocation:

The Consumer Cyclical sector now has the largest share in the portfolio:

Weekly sector distribution:

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| cash | Cash | Cash | Cash | – | 0.0 | 0.166 |

| ACGL | Arch Capital Group Ltd. | S&P 500 | Financial Services | 26.3B | -0.008 | 0.057 |

| UNVR | Univar Solutions Inc. | S&P 400 | Basic Materials | 5.44B | -0.021 | 0.04 |

| TEX | Terex Corporation | S&P 400 | Industrials | 3.97B | -0.024 | 0.039 |

| BA | The Boeing Company | S&P 500 | Industrials | 125.59B | -0.043 | 0.038 |

| FICO | Fair Isaac Corporation | S&P 400 | Technology | 17.71B | -0.021 | 0.038 |

| TPX | Tempur Sealy International, Inc. | S&P 400 | Consumer Cyclical | 7.27B | -0.05 | 0.038 |

| ESAB | ESAB Corporation | S&P 400 | Industrials | 3.76B | -0.05 | 0.037 |

| COTY | Coty Inc. | S&P 400 | Consumer Defensive | 9.65B | -0.011 | 0.037 |

| LVS | Las Vegas Sands Corp. | S&P 500 | Consumer Cyclical | 45.13B | -0.017 | 0.036 |

| GEHC | GE HealthCare Technologies Inc. | S&P 500 | Healthcare | 34.72B | -0.006 | 0.034 |

| ALGM | Allegro MicroSystems, Inc. | S&P 400 | Technology | 8.75B | -0.033 | 0.033 |

| MTH | Meritage Homes Corporation | Barrons 400 | Consumer Cyclical | 3.98B | -0.068 | 0.033 |

| PATK | Patrick Industries, Inc. | Barrons 400 | Consumer Cyclical | 1.62B | -0.062 | 0.03 |

| ATKR | Atkore Inc. | Barrons 400 | Industrials | 6.01B | -0.016 | 0.029 |

| META | Meta Platforms, Inc. | S&P 500 | Communication Services | 482.7B | -0.219 | 0.028 |

| AXON | Axon Enterprise, Inc. | S&P 400 | Industrials | 16.28B | -0.014 | 0.028 |

| PEN | Penumbra, Inc. | S&P 400 | Healthcare | 9.74B | -0.073 | 0.028 |

| WYNN | Wynn Resorts, Limited | S&P 500 | Consumer Cyclical | 12.96B | -0.01 | 0.026 |

| ACLS | Axcelis Technologies, Inc. | Barrons 400 | Technology | 4.21B | -0.031 | 0.026 |

| KD | Kyndryl Holdings, Inc. | S&P 400 | Technology | 3.49B | -0.099 | 0.025 |

| CROX | Crocs, Inc. | S&P 400 | Consumer Cyclical | 7.8B | -0.129 | 0.025 |

| ALGN | Align Technology, Inc. | S&P 500 | Healthcare | 25.95B | -0.273 | 0.024 |

| ZEUS | Olympic Steel, Inc. | Barrons 400 | Basic Materials | 616.21M | -0.063 | 0.024 |

| NVDA | NVIDIA Corporation | S&P 500 | Technology | 598.75B | -0.186 | 0.023 |

| CLF | Cleveland-Cliffs Inc. | S&P 400 | Basic Materials | 11.03B | -0.359 | 0.019 |

| NEOG | Neogen Corporation | S&P 400 | Healthcare | 3.97B | -0.484 | 0.015 |

| FCX | Freeport-McMoRan Inc. | S&P 500 | Basic Materials | 58.09B | -0.178 | 0.014 |

| PVH | PVH Corp. | S&P 400 | Consumer Cyclical | 5.14B | -0.149 | 0.01 |

As always, more trades next week!