During the past week, we made 5 new trades - 2 buys and 3 sells.

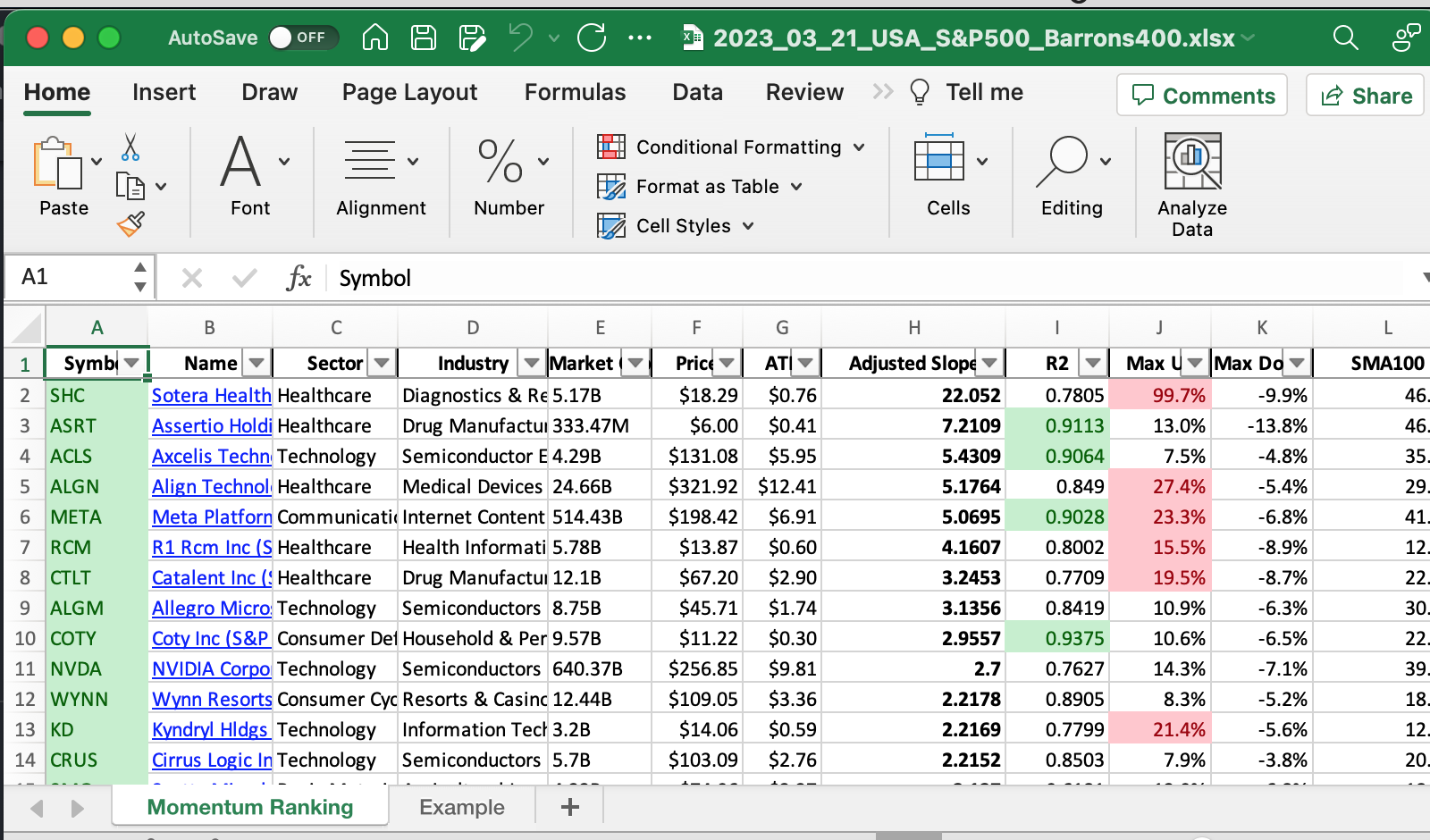

Whether you’re an investor or just interested in the stock market, our weekly Momentum Ranking report is a must-read! Click here to access the latest data for week 12 and stay up-to-date on the top performers.

This week’s transactions:

-

Sold:

-

Bought:

-

Rebalanced / added:

-

Rebalanced / reduced:

Index Distribution:

At the moment, we are holding mostly cash:

Current portfolio allocation:

The portfolio is in cash-mode right now, waiting for some good deals to come along:

Weekly sector distribution:

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| cash | Cash | Cash | Cash | – | 0.0 | 0.374 |

| COTY | Coty Inc. | S&P 400 | Consumer Defensive | 9.6B | -0.051 | 0.038 |

| GEHC | GE HealthCare Technologies Inc. | S&P 500 | Healthcare | 35.03B | -0.045 | 0.035 |

| ACGL | Arch Capital Group Ltd. | S&P 500 | Financial Services | 26.13B | -0.092 | 0.035 |

| META | Meta Platforms, Inc. | S&P 500 | Communication Services | 521.07B | -0.165 | 0.032 |

| MTH | Meritage Homes Corporation | Barrons 400 | Consumer Cyclical | 4.04B | -0.062 | 0.032 |

| BA | The Boeing Company | S&P 500 | Industrials | 122.86B | -0.075 | 0.032 |

| PEN | Penumbra, Inc. | S&P 400 | Healthcare | 10.25B | -0.031 | 0.031 |

| AXON | Axon Enterprise, Inc. | S&P 400 | Industrials | 15.94B | -0.054 | 0.029 |

| NVDA | NVIDIA Corporation | S&P 500 | Technology | 653.08B | -0.105 | 0.027 |

| ALGM | Allegro MicroSystems, Inc. | S&P 400 | Technology | 8.88B | -0.023 | 0.027 |

| NEOG | Neogen Corporation | S&P 400 | Healthcare | 4.06B | -0.489 | 0.027 |

| FICO | Fair Isaac Corporation | S&P 500 | Technology | 17.99B | -0.041 | 0.026 |

| WYNN | Wynn Resorts, Limited | S&P 500 | Consumer Cyclical | 12.4B | -0.076 | 0.026 |

| ALGN | Align Technology, Inc. | S&P 500 | Healthcare | 24.97B | -0.315 | 0.024 |

| CTLT | Catalent, Inc. | S&P 500 | Healthcare | 12.06B | -0.419 | 0.023 |

| RCM | R1 RCM Inc. | S&P 400 | Healthcare | 5.8B | -0.51 | 0.023 |

| ACLS | Axcelis Technologies, Inc. | Barrons 400 | Technology | 4.35B | -0.035 | 0.021 |

| CROX | Crocs, Inc. | S&P 400 | Consumer Cyclical | 7.55B | -0.174 | 0.021 |

| ATKR | Atkore Inc. | Barrons 400 | Industrials | 5.53B | -0.127 | 0.018 |

| LVS | Las Vegas Sands Corp. | S&P 500 | Consumer Cyclical | 42.32B | -0.099 | 0.017 |

| CLF | Cleveland-Cliffs Inc. | S&P 400 | Basic Materials | 9.47B | -0.475 | 0.017 |

| TPX | Tempur Sealy International, Inc. | S&P 400 | Consumer Cyclical | 6.97B | -0.163 | 0.016 |

| ESAB | ESAB Corporation | S&P 400 | Industrials | 3.53B | -0.091 | 0.014 |

| TEX | Terex Corporation | S&P 400 | Industrials | 3.32B | -0.227 | 0.013 |

| KD | Kyndryl Holdings, Inc. | S&P 400 | Technology | 3.21B | -0.2 | 0.012 |

| PVH | PVH Corp. | S&P 400 | Consumer Cyclical | 4.7B | -0.233 | 0.01 |

As always, more trades next week!