Our market activity this week included 3 new trades: 1 buys and 2 sells.

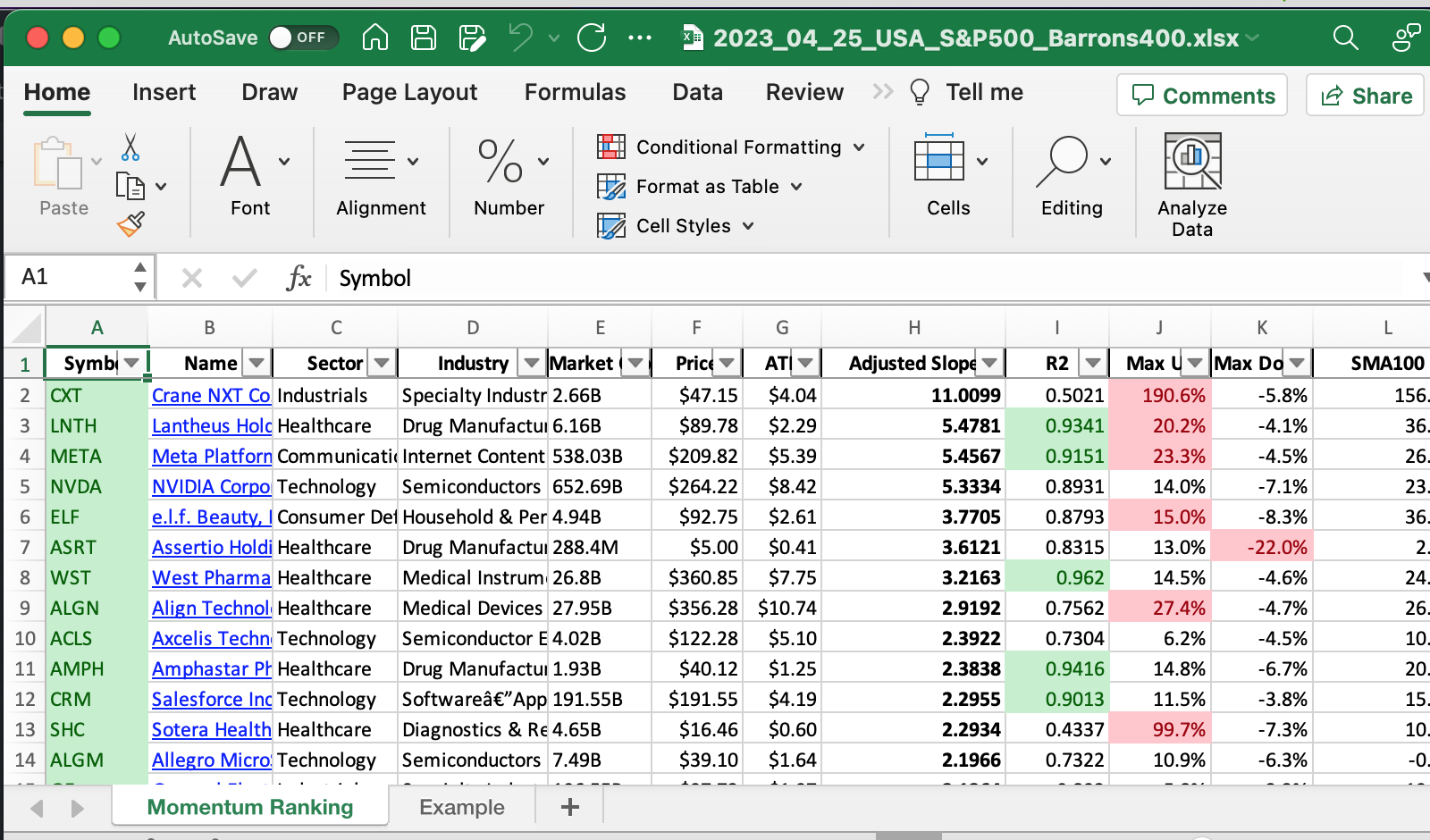

Want to stay on top of the market trends? Our Momentum Ranking report highlights the top stocks of the week, so you don’t have to! Click here to access the latest data for week 17.

This week’s transactions:

Index Distribution:

We have a lot of stocks from the S&P 500 index in our portfolio at the moment.

Current portfolio allocation:

The biggest share of our portfolio is currently allocated to the Healthcare sector.

Weekly sector distribution:

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| cash | Cash | Cash | Cash | – | 0.0 | 0.204 |

| ACGL | Arch Capital Group Ltd. | S&P 500 | Financial Services | 27.36B | -0.009 | 0.052 |

| GE | General Electric Company | S&P 500 | Industrials | 106.81B | -0.018 | 0.049 |

| CRM | Salesforce, Inc. | S&P 500 | Technology | 190.75B | -0.026 | 0.048 |

| GEHC | GE HealthCare Technologies Inc. | S&P 500 | Healthcare | 36.89B | -0.0 | 0.042 |

| AXON | Axon Enterprise, Inc. | S&P 400 | Industrials | 16.34B | -0.02 | 0.041 |

| WST | West Pharmaceutical Services, Inc. | S&P 500 | Healthcare | 26.53B | -0.0 | 0.041 |

| ELF | e.l.f. Beauty, Inc. | Barrons 400 | Consumer Defensive | 4.91B | -0.023 | 0.04 |

| FICO | Fair Isaac Corporation | S&P 500 | Technology | 17.97B | -0.021 | 0.039 |

| COTY | Coty Inc. | S&P 400 | Consumer Defensive | 10.16B | -0.047 | 0.039 |

| LNTH | Lantheus Holdings, Inc. | S&P 400 | Healthcare | 6.17B | -0.004 | 0.037 |

| LVS | Las Vegas Sands Corp. | S&P 500 | Consumer Cyclical | 48.93B | -0.0 | 0.037 |

| MTH | Meritage Homes Corporation | Barrons 400 | Consumer Cyclical | 4.66B | -0.021 | 0.035 |

| ESAB | ESAB Corporation | S&P 400 | Industrials | 3.53B | -0.067 | 0.035 |

| ALGN | Align Technology, Inc. | S&P 500 | Healthcare | 27.75B | -0.042 | 0.033 |

| META | Meta Platforms, Inc. | S&P 500 | Communication Services | 535.86B | -0.051 | 0.033 |

| AMPH | Amphastar Pharmaceuticals, Inc. | Barrons 400 | Healthcare | 1.9B | -0.073 | 0.032 |

| PEN | Penumbra, Inc. | S&P 400 | Healthcare | 11.23B | -0.002 | 0.032 |

| NVDA | NVIDIA Corporation | S&P 500 | Technology | 653.29B | -0.038 | 0.027 |

| WYNN | Wynn Resorts, Limited | S&P 500 | Consumer Cyclical | 12.68B | -0.023 | 0.026 |

| CROX | Crocs, Inc. | S&P 400 | Consumer Cyclical | 9.28B | -0.001 | 0.025 |

| RCM | R1 RCM Inc. | S&P 400 | Healthcare | 6.39B | -0.429 | 0.025 |

| KD | Kyndryl Holdings, Inc. | S&P 400 | Technology | 3.21B | -0.169 | 0.017 |

| ACLS | Axcelis Technologies, Inc. | Barrons 400 | Technology | 3.92B | -0.076 | 0.012 |

As always, more trades next week!