This week, we executed 1 new trades, including 0 buys and 1 sells.

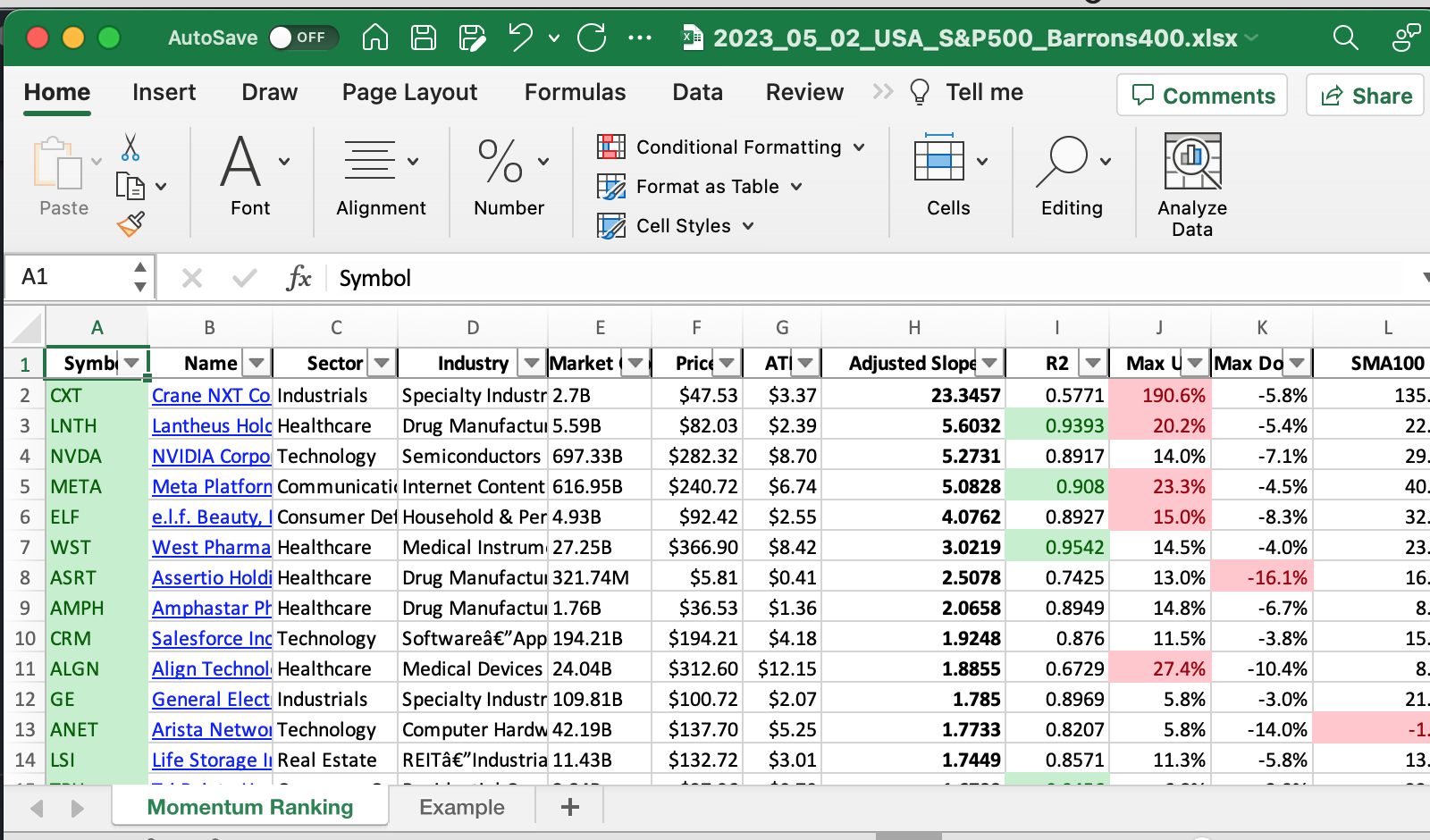

Discover the top-performing stocks of the week with our Momentum Ranking! Click here to access the latest data for week 18.

This week’s transactions:

-

Sold:

-

Bought:

- No buys in this week!

-

Rebalanced / added:

-

Rebalanced / reduced:

Index Distribution:

The S&P 500 index is currently contributing the most to our portfolio.

Current portfolio allocation:

Things are looking pretty cash-heavy in the portfolio at the moment:

Weekly sector distribution:

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| cash | Cash | Cash | Cash | – | 0.0 | 0.283 |

| ACGL | Arch Capital Group Ltd. | S&P 500 | Financial Services | 28.09B | -0.013 | 0.055 |

| GE | General Electric Company | S&P 500 | Industrials | 110.38B | -0.008 | 0.051 |

| CRM | Salesforce, Inc. | S&P 500 | Technology | 194.09B | -0.012 | 0.05 |

| FICO | Fair Isaac Corporation | S&P 500 | Technology | 18.47B | -0.016 | 0.042 |

| WST | West Pharmaceutical Services, Inc. | S&P 500 | Healthcare | 27.23B | -0.016 | 0.041 |

| AXON | Axon Enterprise, Inc. | S&P 400 | Industrials | 16.16B | -0.057 | 0.04 |

| PEN | Penumbra, Inc. | S&P 400 | Healthcare | 10.86B | -0.012 | 0.04 |

| ELF | e.l.f. Beauty, Inc. | Barrons 400 | Consumer Defensive | 4.95B | -0.044 | 0.04 |

| GEHC | GE HealthCare Technologies Inc. | S&P 500 | Healthcare | 35.99B | -0.08 | 0.039 |

| META | Meta Platforms, Inc. | S&P 500 | Communication Services | 617.49B | -0.007 | 0.038 |

| LVS | Las Vegas Sands Corp. | S&P 500 | Consumer Cyclical | 48.62B | -0.011 | 0.038 |

| MTH | Meritage Homes Corporation | Barrons 400 | Consumer Cyclical | 4.57B | -0.037 | 0.035 |

| LNTH | Lantheus Holdings, Inc. | S&P 400 | Healthcare | 5.62B | -0.09 | 0.035 |

| NVDA | NVIDIA Corporation | S&P 500 | Technology | 697.87B | -0.005 | 0.03 |

| WYNN | Wynn Resorts, Limited | S&P 500 | Consumer Cyclical | 12.84B | -0.019 | 0.027 |

| RCM | R1 RCM Inc. | S&P 400 | Healthcare | 6.47B | -0.426 | 0.025 |

| COTY | Coty Inc. | S&P 400 | Consumer Defensive | 10B | -0.066 | 0.021 |

| KD | Kyndryl Holdings, Inc. | S&P 400 | Technology | 3.21B | -0.164 | 0.017 |

| ESAB | ESAB Corporation | S&P 400 | Industrials | 3.43B | -0.084 | 0.017 |

| AMPH | Amphastar Pharmaceuticals, Inc. | Barrons 400 | Healthcare | 1.76B | -0.156 | 0.014 |

| ALGN | Align Technology, Inc. | S&P 500 | Healthcare | 23.82B | -0.14 | 0.012 |

| ACLS | Axcelis Technologies, Inc. | Barrons 400 | Technology | 4.01B | -0.097 | 0.011 |

As always, more trades next week!