Our activity in the market this week involved 2 new trades, specifically 1 buys and 1 sells.

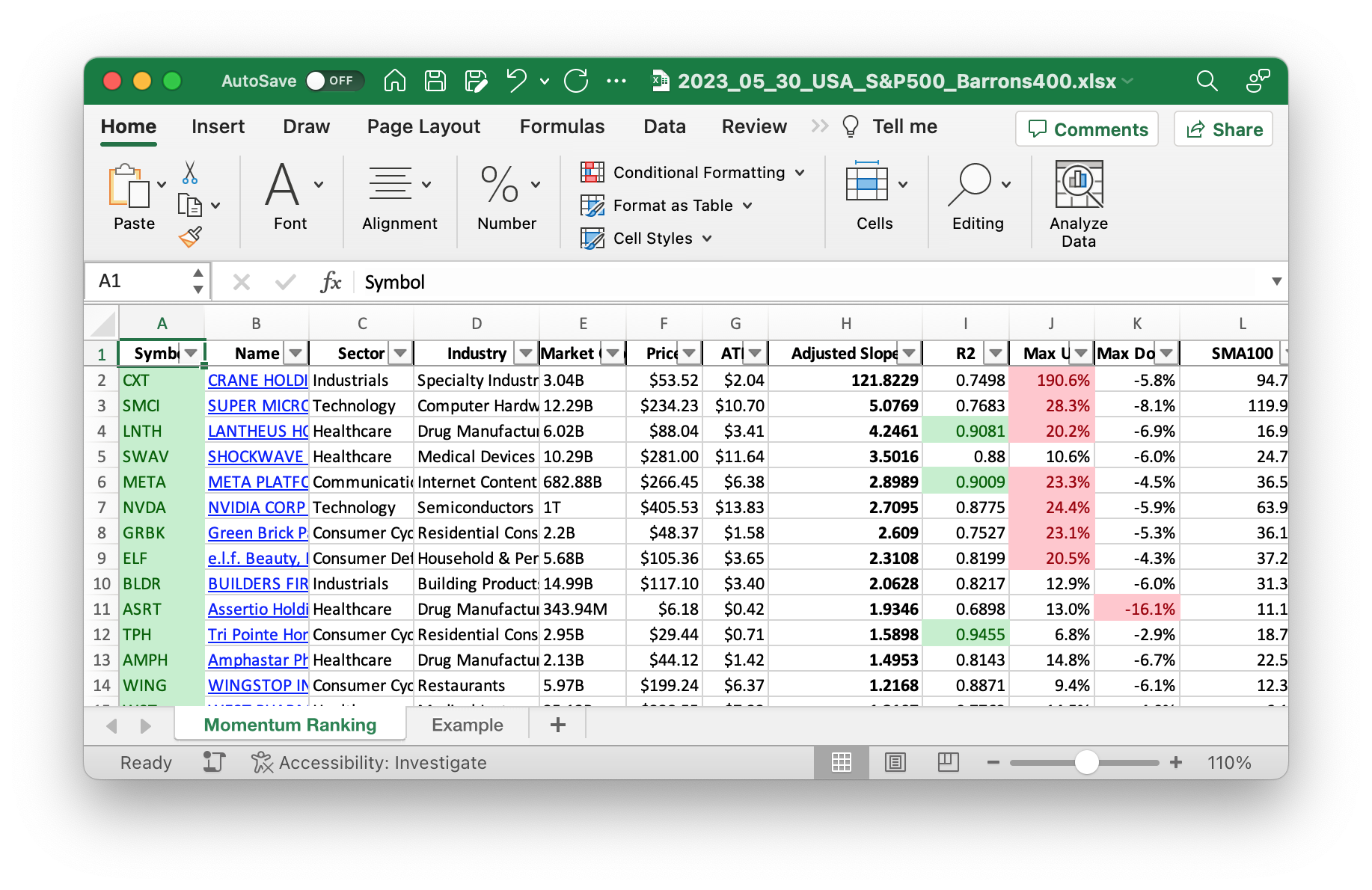

Click here for the Momentum Ranking of week 22.

This week’s transactions:

Index Distribution:

At the moment, we are holding mostly cash:

Current portfolio allocation:

We’re playing it safe with a lot of cash in the portfolio at the moment:

Weekly sector distribution:

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| cash | Cash | Cash | Cash | – | 0.0 | 0.427 |

| CRM | Salesforce, Inc. | S&P 500 | Technology | 212.36B | -0.03 | 0.05 |

| GE | General Electric Company | S&P 500 | Industrials | 111.08B | -0.03 | 0.047 |

| PEN | Penumbra, Inc. | S&P 400 | Healthcare | 11.86B | -0.055 | 0.04 |

| FICO | Fair Isaac Corporation | S&P 500 | Technology | 19.68B | -0.005 | 0.04 |

| META | Meta Platforms, Inc. | S&P 500 | Communication Services | 678B | -0.025 | 0.039 |

| GEHC | GE HealthCare Technologies Inc. | S&P 500 | Healthcare | 35.56B | -0.107 | 0.039 |

| BLDR | Builders FirstSource, Inc. | S&P 400 | Industrials | 14.98B | -0.06 | 0.034 |

| AMPH | Amphastar Pharmaceuticals, Inc. | Barrons 400 | Healthcare | 2.13B | -0.03 | 0.031 |

| GRBK | Green Brick Partners, Inc. | Barrons 400 | Consumer Cyclical | 2.19B | -0.106 | 0.029 |

| RCM | R1 RCM Inc. | S&P 400 | Healthcare | 6.7B | -0.407 | 0.028 |

| ACLS | Axcelis Technologies, Inc. | Barrons 400 | Technology | 5.29B | -0.038 | 0.027 |

| ELF | e.l.f. Beauty, Inc. | Barrons 400 | Consumer Defensive | 5.66B | -0.055 | 0.027 |

| LNTH | Lantheus Holdings, Inc. | S&P 400 | Healthcare | 6.06B | -0.097 | 0.026 |

| WST | West Pharmaceutical Services, Inc. | S&P 500 | Healthcare | 25.07B | -0.088 | 0.024 |

| ACGL | Arch Capital Group Ltd. | S&P 500 | Financial Services | 26.57B | -0.093 | 0.021 |

| SWAV | Shockwave Medical, Inc. | S&P 400 | Healthcare | 10.2B | -0.124 | 0.02 |

| NVDA | NVIDIA Corporation | S&P 500 | Technology | 992.11B | -0.071 | 0.02 |

| MTH | Meritage Homes Corporation | Barrons 400 | Consumer Cyclical | 4.33B | -0.104 | 0.018 |

| SMCI | Super Micro Computer, Inc. | S&P 400 | Technology | 12.18B | -0.098 | 0.013 |

As always, more trades next week!