This week, we executed 4 new trades, including 2 buys and 2 sells.

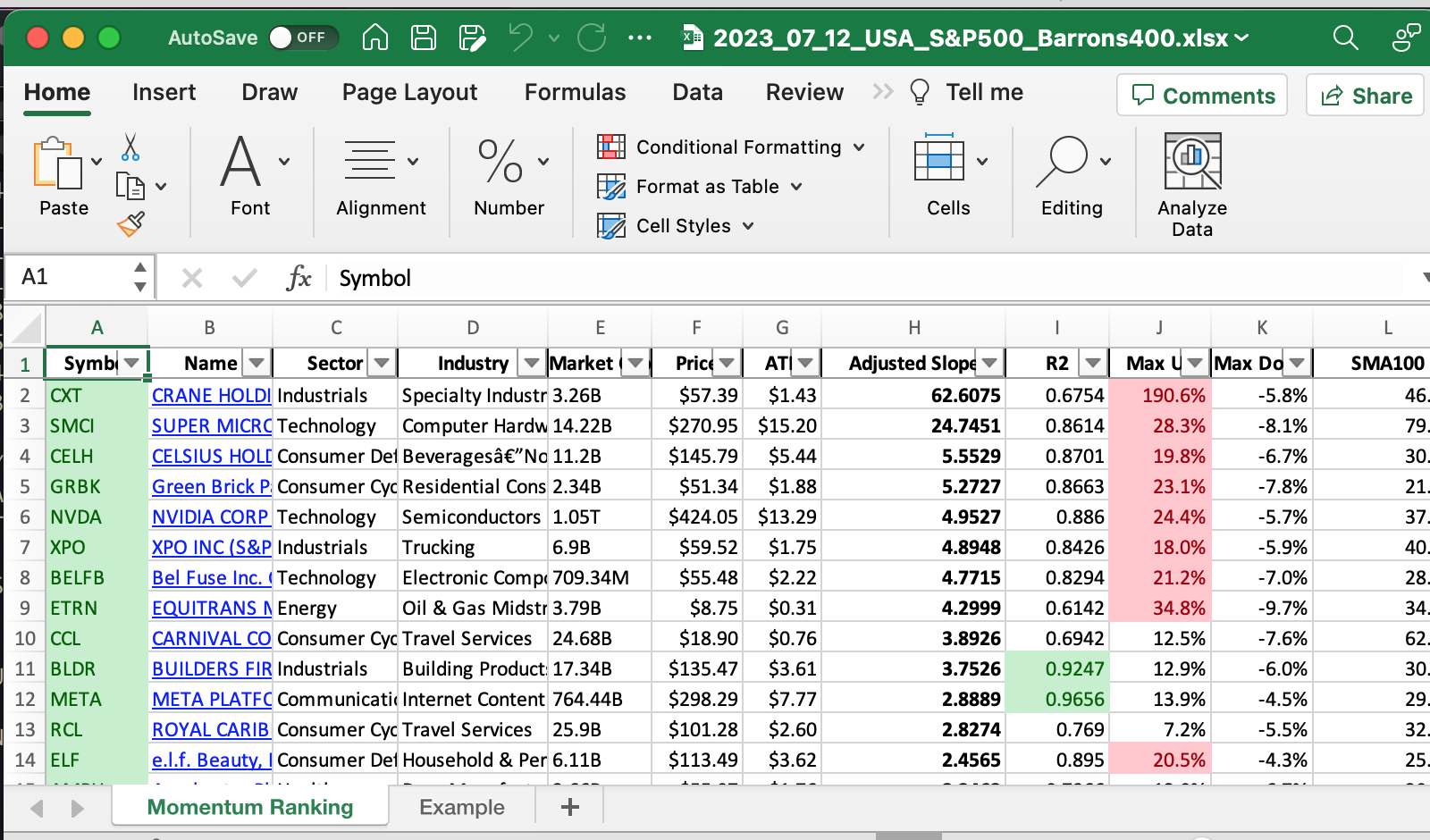

Click here for the Momentum Ranking of week 28.

This week’s transactions:

-

Rebalanced / added:

- No positions were added to in this week!

-

Rebalanced / reduced:

- No positions were reduced in this week!

Index Distribution:

At the moment, we are holding mostly cash:

Current portfolio allocation:

At the moment, the majority of the portfolio is in cash:

Weekly sector distribution:

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| cash | Cash | Cash | Cash | – | 0.0 | 0.401 |

| ETRN | Equitrans Midstream Corporation | S&P 400 | Energy | 3.85B | -0.116 | 0.046 |

| GE | General Electric Company | S&P 500 | Industrials | 122.18B | -0.007 | 0.045 |

| PEN | Penumbra, Inc. | S&P 400 | Healthcare | 12.2B | -0.078 | 0.037 |

| MTH | Meritage Homes Corporation | Barrons 400 | Consumer Cyclical | 5.24B | -0.037 | 0.037 |

| BLDR | Builders FirstSource, Inc. | S&P 400 | Industrials | 17.83B | -0.037 | 0.036 |

| FICO | Fair Isaac Corporation | S&P 500 | Technology | 20.24B | -0.009 | 0.036 |

| CRM | Salesforce, Inc. | S&P 500 | Technology | 225.98B | -0.018 | 0.035 |

| META | Meta Platforms, Inc. | S&P 500 | Communication Services | 798.3B | -0.035 | 0.034 |

| XPO | XPO, Inc. | S&P 400 | Industrials | 6.86B | -0.036 | 0.031 |

| RCM | R1 RCM Inc. | S&P 400 | Healthcare | 7.44B | -0.351 | 0.029 |

| AMPH | Amphastar Pharmaceuticals, Inc. | Barrons 400 | Healthcare | 2.65B | -0.063 | 0.029 |

| GRBK | Green Brick Partners, Inc. | Barrons 400 | Consumer Cyclical | 2.44B | -0.108 | 0.027 |

| ELF | e.l.f. Beauty, Inc. | Barrons 400 | Consumer Defensive | 6.18B | -0.02 | 0.027 |

| ACLS | Axcelis Technologies, Inc. | Barrons 400 | Technology | 5.72B | -0.067 | 0.026 |

| CELH | Celsius Holdings, Inc. | S&P 400 | Consumer Defensive | 11.61B | -0.053 | 0.024 |

| BELFB | Bel Fuse Inc. | Barrons 400 | Technology | 707.41M | -0.081 | 0.024 |

| SWAV | Shockwave Medical, Inc. | S&P 400 | Healthcare | 10.2B | -0.122 | 0.022 |

| CCL | Carnival Corporation & plc | S&P 500 | Consumer Cyclical | 23.95B | -0.033 | 0.02 |

| NVDA | NVIDIA Corporation | S&P 500 | Technology | 1.08T | -0.036 | 0.019 |

| SMCI | Super Micro Computer, Inc. | S&P 400 | Technology | 14.45B | -0.042 | 0.014 |

As always, more trades next week!