This week, we executed 2 new trades, including 0 buys and 2 sells.

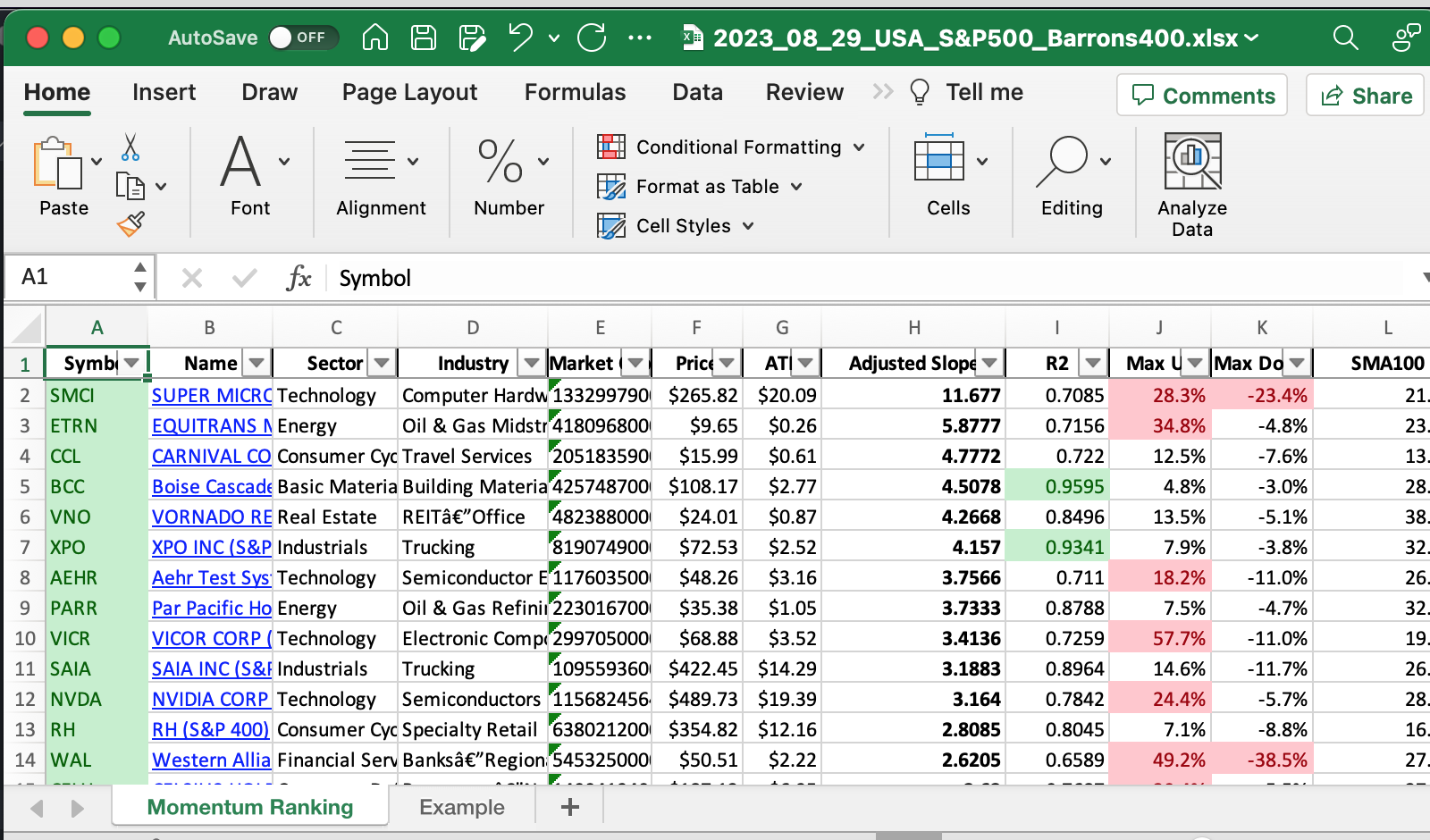

Looking for reliable stock performance data? Check out our weekly Momentum Ranking (based on Andreas Clenow’s book Stocks on the Move), updated every week with the latest figures! Click here to see the report for week 35.

This week’s transactions:

-

Sold:

-

Bought:

- No buys in this week!

-

Rebalanced / added:

-

Rebalanced / reduced:

- No positions were reduced in this week!

Index Distribution:

At the moment, we are holding mostly cash:

Current portfolio allocation:

We’re kind of just hoarding cash in the portfolio at the moment:

Weekly sector distribution:

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| cash | Cash | Cash | Cash | – | 0.0 | 0.495 |

| WMS | Advanced Drainage Systems, Inc. | S&P 400 | Industrials | 10.1B | -0.125 | 0.038 |

| ADBE | Adobe Inc. | S&P 500 | Technology | 245B | -0.042 | 0.036 |

| BCC | Boise Cascade, L.L.C. | Barrons 400 | Basic Materials | 4.29B | -0.042 | 0.036 |

| ETRN | Equitrans Midstream Corporation | S&P 400 | Energy | 4.17B | -0.079 | 0.032 |

| VECO | Veeco Instruments Inc. | Barrons 400 | Technology | 1.61B | -0.102 | 0.031 |

| MHO | M/I Homes, Inc. | Barrons 400 | Consumer Cyclical | 2.65B | -0.088 | 0.03 |

| META | Meta Platforms, Inc. | S&P 500 | Communication Services | 767B | -0.11 | 0.03 |

| SAIA | Saia, Inc. | S&P 400 | Industrials | 11.2B | -0.07 | 0.028 |

| VNO | Vornado Realty Trust | S&P 400 | Real Estate | 4.98B | -0.185 | 0.026 |

| NVDA | NVIDIA Corporation | S&P 500 | Technology | 1.21T | -0.068 | 0.024 |

| PARR | Par Pacific Holdings, Inc. Comm | Barrons 400 | Energy | 2.16B | -0.045 | 0.024 |

| CELH | Celsius Holdings, Inc. | S&P 400 | Consumer Defensive | 14.4B | -0.036 | 0.023 |

| XPO | XPO, Inc. | S&P 400 | Industrials | 8.41B | -0.08 | 0.023 |

| ACLS | Axcelis Technologies, Inc. | Barrons 400 | Technology | 6.05B | -0.142 | 0.021 |

| TSLA | Tesla, Inc. | S&P 500 | Consumer Cyclical | 809B | -0.239 | 0.016 |

| ELF | e.l.f. Beauty, Inc. | Barrons 400 | Consumer Defensive | 7.2B | -0.108 | 0.013 |

| BLDR | Builders FirstSource, Inc. | S&P 400 | Industrials | 17.4B | -0.153 | 0.013 |

| RCL | Royal Caribbean Cruises Ltd. | S&P 500 | Consumer Cyclical | 25.8B | -0.13 | 0.012 |

| AEHR | Aehr Test Systems | Barrons 400 | Technology | 1.37B | -0.175 | 0.011 |

| AMPH | Amphastar Pharmaceuticals, Inc. | Barrons 400 | Healthcare | 2.63B | -0.217 | 0.01 |

| RH | RH | S&P 400 | Consumer Cyclical | 6.55B | -0.146 | 0.009 |

| VICR | Vicor Corporation | S&P 400 | Technology | 3.05B | -0.312 | 0.009 |

| CCL | Carnival Corporation | S&P 500 | Consumer Cyclical | 21B | -0.196 | 0.008 |

As always, more trades next week!