Our activity in the market this week involved 1 new trades, specifically 0 buys and 1 sells.

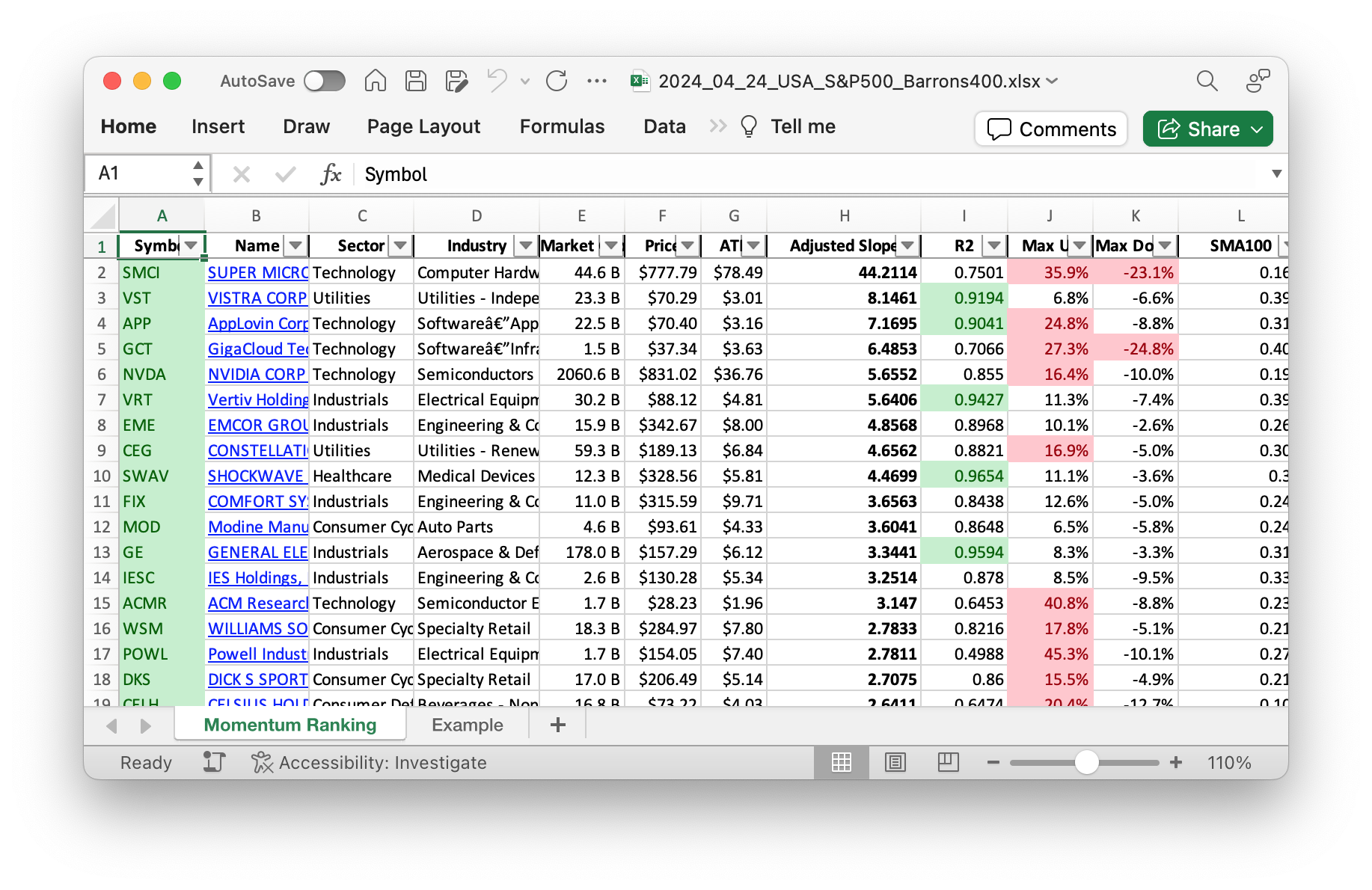

Click here for the Momentum Ranking of week 17.

This week’s transactions:

Index Distribution:

At the moment, we are holding mostly cash:

Current portfolio allocation:

Things are a bit quiet in the portfolio, mostly just cash and waiting for the right moment:

Weekly sector distribution:

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| cash | Cash | Cash | Cash | – | 85404 | 0.815 |

| EME | Emcor Group, Inc. | S&P 400 | Industrials | 16.03B | -7.83% | 0.039 |

| IBP | Installed Building Products Inc | Barrons 400 | Consumer Cyclical | 6.67B | -10.89% | 0.027 |

| VST | Vistra Corp | S&P 400 | Utilities | 24.60B | -6.81% | 0.025 |

| WING | Wingstop Inc | S&P 400 | Consumer Cyclical | 10.70B | -3.79% | 0.024 |

| MOD | Modine Manufacturing Co. | Barrons 400 | Consumer Cyclical | 4.90B | -11.53% | 0.016 |

| VRT | Vertiv Holdings Co | Barrons 400 | Industrials | 33.73B | -0.45% | 0.016 |

| NVDA | NVIDIA Corp | S&P 500 | Technology | 2075.75B | -14.75% | 0.016 |

| MKSI | MKS Instruments, Inc. | S&P 400 | Technology | 7.62B | -16.18% | 0.013 |

| COHR | Coherent Corp | S&P 400 | Technology | 8.08B | -21.63% | 0.009 |

As always, more trades next week!