This week, we carried out 1 new trades - 1 buys and 0 sells.

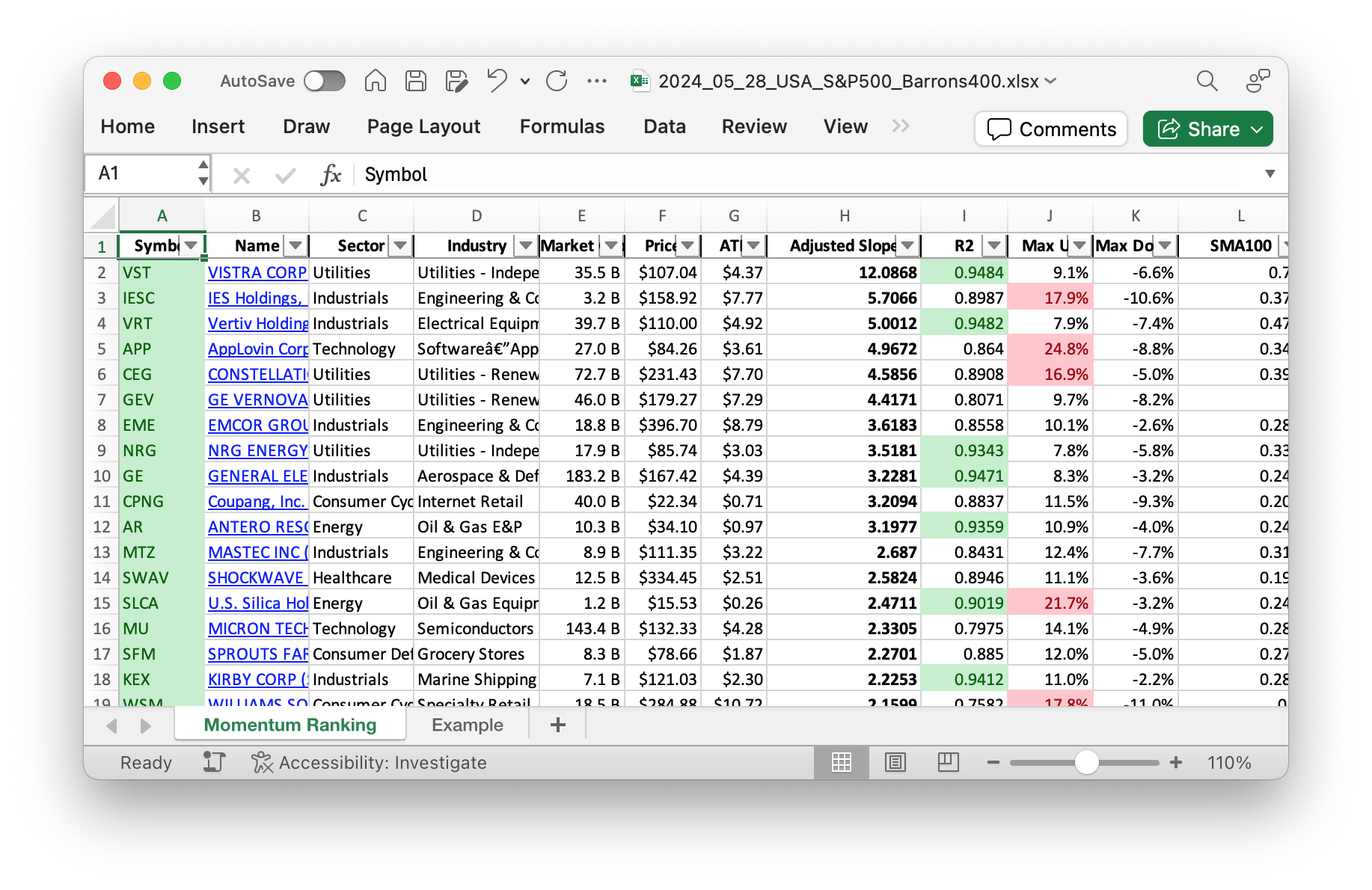

Click here for the Momentum Ranking of week 22.

Navigating Momentum: This Week’s Trading Moves in Our Portfolio

In this week’s trading activity, there were notable movements that reflect our momentum-based strategy. We’ve made some key changes: buying General Electric Ventures (GEV) and rebalancing some holdings. Moreover, our portfolio remains heavily invested in the Cash Flow sector, with EME and WING standing out among the top performers.

Introduction

Welcome to our weekly recap where we delve into the latest shifts in our momentum-driven portfolio. Utilizing the strategy from Andreas Clenow’s ‘Stocks On The Move’, we rank stocks based on their annualized adjusted slope to ensure only the best performers make it into our lineup. This week, some transactions have refined our holdings, and we’ve added promising new stocks to our portfolio.

Buys and Sells

Buys: This week, we’ve added General Electric Ventures (GEV) to our portfolio. GEV is known for its innovative approach in diverse industries like renewable energy and advanced manufacturing.

Rebalanced/Added: Alongside GEV, we’ve also increased our positions in EME and WING. EME (EMCOR Group, Inc.) specializes in mechanical and electrical construction services, while WING (Wingstop Inc.) is a fast-growing chain in the restaurant sector, famous for its chicken wings.

Summary

Our portfolio continues to demonstrate a strong emphasis on the Cash Flow sector, which makes up a significant portion of our investments, highlighted by top holdings like cash, EME, and WING. These adjustments are a testament to the effectiveness of our momentum ranking strategy, ensuring our portfolio remains robust and well-positioned for future growth.

Utilizing the principles from ‘Stocks On The Move’, we remain committed to leveraging the power of momentum in crafting a portfolio that promises strong potential returns. Keep an eye out for our next update as we continue to navigate the ever-evolving market landscape.

This week’s transactions:

-

Sold:

- No sells in this week!

-

Bought:

Index Distribution:

At the moment, we are holding mostly cash:

Current portfolio allocation:

Things are looking pretty cash-heavy in the portfolio at the moment:

Weekly sector distribution:

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| cash | Cash | Cash | Cash | – | 130439 | 0.822 |

| EME | Emcor Group, Inc. | S&P 400 | Industrials | 18.61B | -1.16% | 0.04 |

| WING | Wingstop Inc | S&P 400 | Consumer Cyclical | 11.52B | -2.21% | 0.029 |

| CEG | Constellation Energy Corporation | S&P 500 | Utilities | 73.01B | -1.99% | 0.025 |

| VST | Vistra Corp | S&P 500 | Utilities | 36.91B | 2.03% | 0.02 |

| VRT | Vertiv Holdings Co | Barrons 400 | Industrials | 39.57B | -3.28% | 0.014 |

| NVDA | NVIDIA Corp | S&P 500 | Technology | 2837.62B | 6.60% | 0.013 |

| GEV | GE Vernova Inc. | S&P 500 | Utilities | 49.15B | 0.87% | 0.013 |

| MOD | Modine Manufacturing Co. | Barrons 400 | Consumer Cyclical | 5.26B | -8.16% | 0.012 |

| IESC | IES Holdings Inc | Barrons 400 | Industrials | 3.21B | -13.87% | 0.011 |

As always, more trades next week!