We didn’t make any new trades this week.

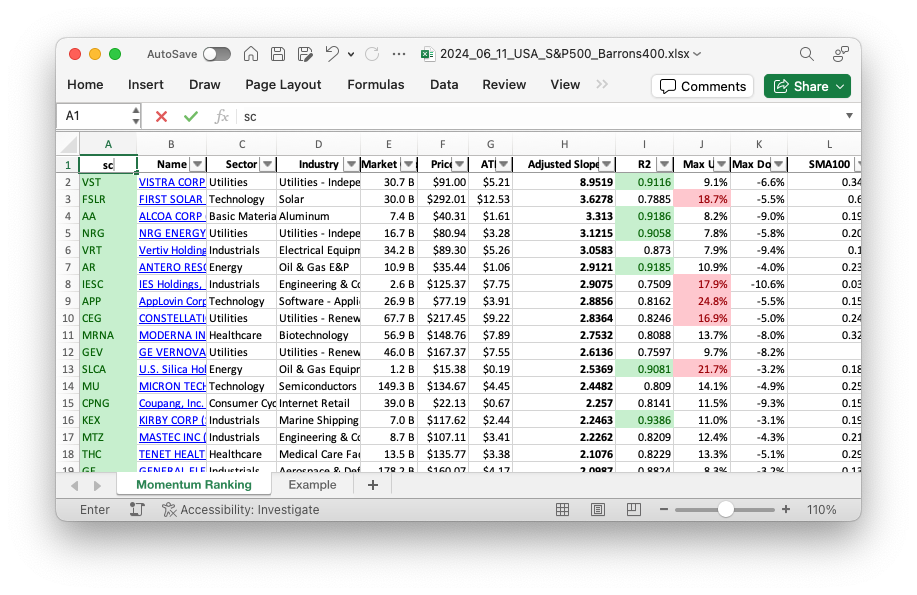

Discover the top-performing stocks of the week with our Momentum Ranking! Click here to access the latest data for week 24.

Weekly Trading Activity: Momentum Strategy Update

This week, our momentum-based trading strategy guided by Andreas Clenow’s principles in ‘Stocks On The Move’ has led to a few adjustments, though no new buys were initiated. Our portfolio saw some rebalancing with additions and reductions in existing holdings, while the largest portion remains in cash reserves to manage market risks effectively.

Portfolio Adjustments

Guided by the momentum-driven approach of ranking stocks based on their annualized adjusted slope, we rebalanced our positions without initiating new buys. This week’s transactions included:

- Rebalanced/added: WING

- Rebalanced/reduced: MOD, VRT

Wingstop Inc. (WING) - This well-known franchise specializes in chicken wings and continues to show robust momentum, making it a key player in our portfolio. By increasing our stake, we anticipate capturing more growth potential driven by consumer demand and effective market strategies.

Modine Manufacturing Company (MOD) and Vertiv Holdings (VRT) - Both of these positions saw reductions as part of our rebalancing effort to optimize the portfolio’s overall momentum score. This strategic adjustment ensures we stay aligned with our targeted performance metrics.

Portfolio Composition and Top Holdings

Interestingly, the largest share of our portfolio is currently allocated to cash reserves. This strategic choice reflects a cautious stance amid volatile market conditions, allowing us flexibility and the opportunity to seize potential buy opportunities when high-ranking momentum stocks emerge.

Among our top holdings, cash accounts for the most significant portion, emphasizing the importance of risk management. EMCOR Group, Inc. (EME) remains a vital holding as it continues to show solid performance in the industrial services sector. Similarly, our rebalancing decision to add to Wingstop Inc. (WING) underscores the optimism around its growth trajectory.

Conclusion

Overall, this week’s activity showcased strategic rebalancing without new purchases, aligning with our momentum ranking criteria. Keeping cash reserves as a substantial part of the portfolio highlights our cautious and flexible approach, ready to act on future momentum-driven opportunities. Stay tuned for more updates as we continue to navigate the dynamic trading landscape using the insights from ‘Stocks On The Move’.

This week’s transactions:

-

Sold:

- No sells in this week!

-

Bought:

- No buys in this week!

-

Rebalanced / added:

-

Rebalanced / reduced:

Index Distribution:

At the moment, we are holding mostly cash:

Current portfolio allocation:

Things are a bit quiet in the portfolio, mostly just cash and waiting for the right moment:

Weekly sector distribution:

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| cash | Cash | Cash | Cash | – | 130980 | 0.839 |

| EME | Emcor Group, Inc. | S&P 400 | Industrials | 17.62B | -6.74% | 0.038 |

| WING | Wingstop Inc | S&P 400 | Consumer Cyclical | 11.66B | -3.36% | 0.028 |

| CEG | Constellation Energy Corporation | S&P 500 | Utilities | 68.82B | -7.61% | 0.024 |

| GEV | GE Vernova Inc. | S&P 500 | Utilities | 46.11B | -7.96% | 0.017 |

| NVDA | NVIDIA Corp | S&P 500 | Technology | 2974.18B | -38.30% | 0.015 |

| VST | Vistra Corp | S&P 500 | Utilities | 31.70B | -14.94% | 0.015 |

| IESC | IES Holdings Inc | Barrons 400 | Industrials | 2.53B | -32.17% | 0.009 |

| VRT | Vertiv Holdings Co | Barrons 400 | Industrials | 33.43B | -18.28% | 0.009 |

| MOD | Modine Manufacturing Co. | Barrons 400 | Consumer Cyclical | 4.84B | -15.56% | 0.007 |

As always, more trades next week!