In this week, there were 2 new trades: 1 buys and 1 sells.

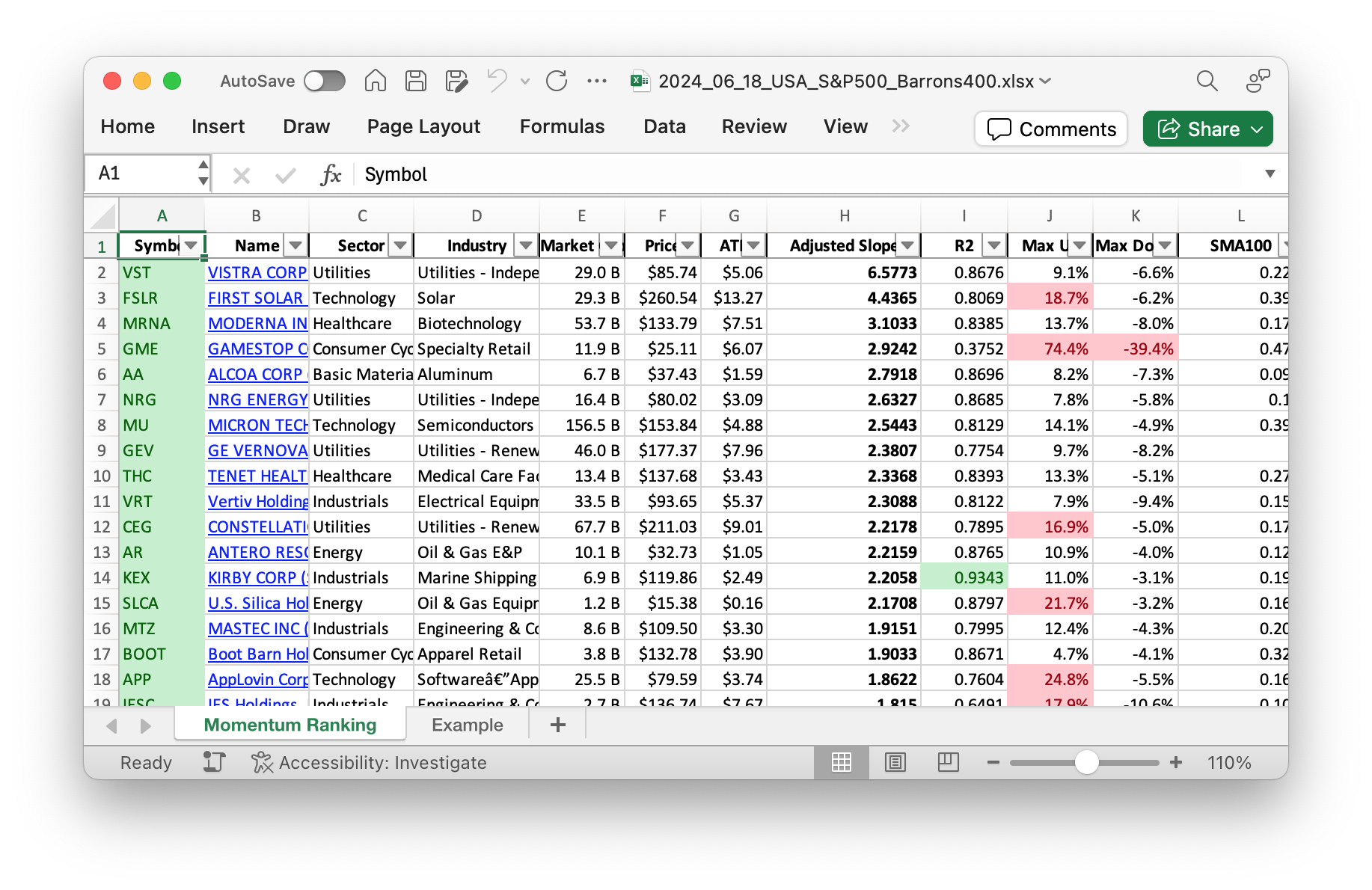

Looking for reliable stock performance data? Check out our weekly Momentum Ranking (based on Andreas Clenow’s book Stocks on the Move), updated every week with the latest figures! Click here to see the report for week 25.

Weekly Trading Activity: Balancing Momentum and Cash Reserves

This week, our trading activity reflected a cautious yet strategic approach, with a focus on maintaining liquidity while adjusting our momentum-based portfolio. We executed a sale, initiated a new buy, and continued to hold a significant portion of our portfolio in cash. This strategy is driven by the principles outlined in Andreas Clenow’s ‘Stocks On The Move’, ensuring that we maintain a dynamic yet risk-managed portfolio.

In line with our momentum ranking approach, we sold our position in Modine Manufacturing Company (MOD) and allocated resources to First Solar, Inc. (FSLR). Modine Manufacturing Company, a player in thermal management systems, no longer met the stringent criteria of our momentum strategy. On the other hand, First Solar, Inc., a leading provider in solar energy solutions, showed promising momentum, compelling us to establish a new position.

Our decision to hold a substantial portion of the portfolio in cash reflects a defensive stance, given the current market conditions. Alongside cash, our top holdings include EMCOR Group, Inc. (EME), a leader in mechanical and electrical construction services, and Wingstop Inc. (WING), a fast-growing operator and franchisor of restaurants. This diverse mix ensures a balanced risk-return profile in our portfolio.

To summarize, this week saw a significant shift with the divestment from MOD and an entry into FSLR, aligned with our momentum criteria. Our substantial cash reserves indicate a prudent approach to manage risks while waiting for the right market opportunities. By following Clenow’s momentum strategy, we aim to capitalize on top-performing stocks while safeguarding our portfolio against market volatility. Stay tuned for more updates on our trading activities and insights into the evolving market trends.

This week’s transactions:

-

Rebalanced / added:

- No positions were added to in this week!

-

Rebalanced / reduced:

- No positions were reduced in this week!

Index Distribution:

At the moment, we are holding mostly cash:

Current portfolio allocation:

We’re playing it safe with a lot of cash in the portfolio at the moment:

Weekly sector distribution:

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| cash | Cash | Cash | Cash | – | 137811 | 0.841 |

| EME | Emcor Group, Inc. | S&P 400 | Industrials | 18.16B | -3.87% | 0.037 |

| WING | Wingstop Inc | S&P 400 | Consumer Cyclical | 12.54B | 2.31% | 0.028 |

| CEG | Constellation Energy Corporation | S&P 500 | Utilities | 69.12B | -7.21% | 0.022 |

| GEV | GE Vernova Inc. | S&P 500 | Utilities | 48.92B | -2.35% | 0.016 |

| NVDA | NVIDIA Corp | S&P 500 | Technology | 3341.39B | 1.57% | 0.016 |

| VST | Vistra Corp | S&P 500 | Utilities | 29.78B | -20.07% | 0.013 |

| FSLR | First Solar Inc | S&P 500 | Technology | 28.06B | -14.55% | 0.01 |

| IESC | IES Holdings Inc | Barrons 400 | Industrials | 2.74B | -26.52% | 0.009 |

| VRT | Vertiv Holdings Co | Barrons 400 | Industrials | 35.38B | -13.50% | 0.008 |

As always, more trades next week!