We didn’t make any new trades this week.

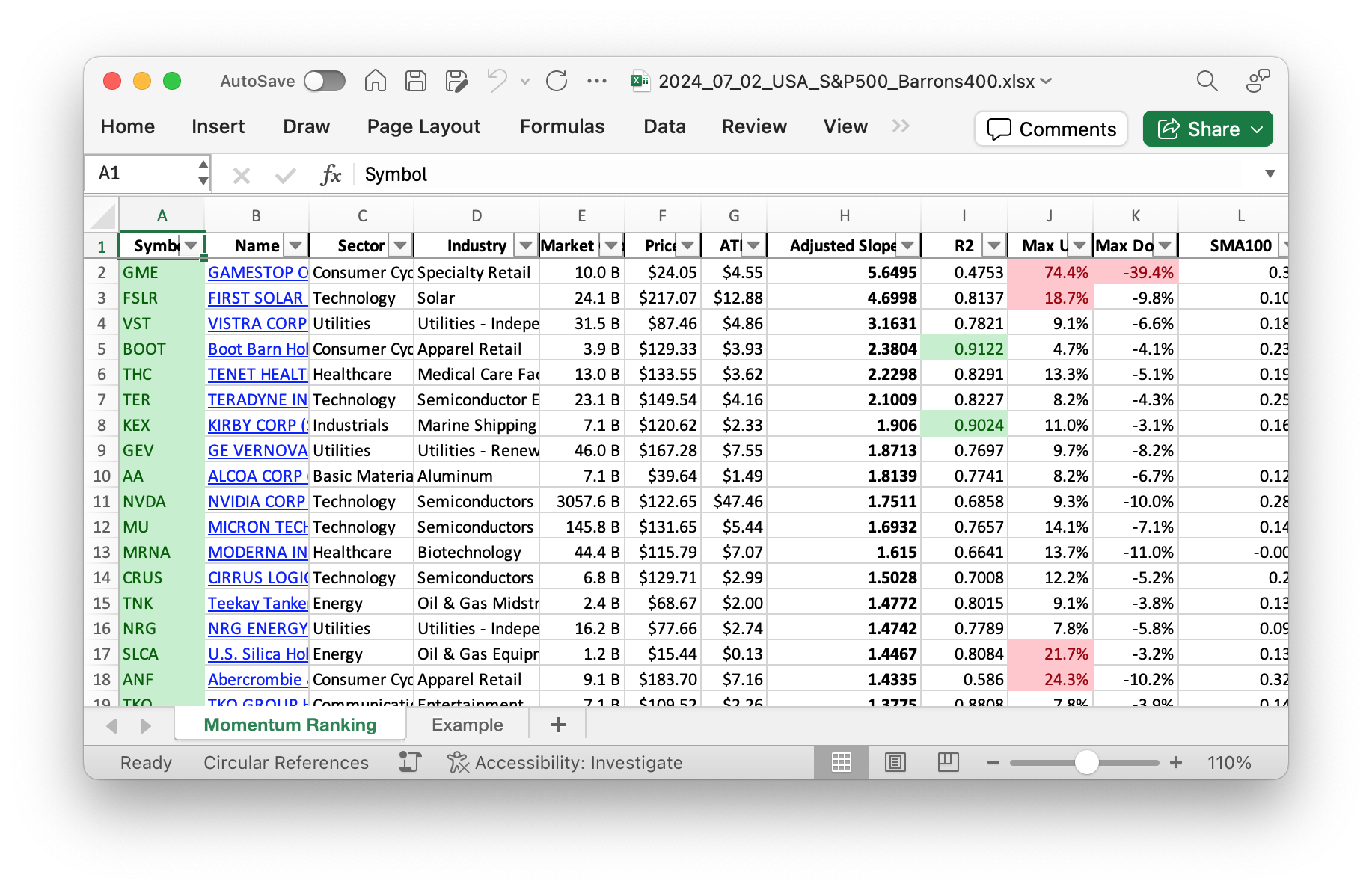

Click here for the Momentum Ranking of week 27.

Weekly Trading Activity Overview

This week’s trading activity was relatively quiet, with some rebalancing transactions but no new purchases or full sales. Our portfolio currently holds a significant portion of cash, reflecting our cautious stance in the current market environment. The majority of our top holdings remain stable, contributing to a balanced performance.

Introduction to This Week’s Activity

In the realm of momentum trading, particularly the strategy outlined by Andreas Clenow in “Stocks On The Move,” we focus on stocks with top annualized adjusted slopes. This week, transactions were minimal. No new stocks were added or fully sold, but we did make some important rebalancing adjustments.

Buys/Sells

We adjusted our existing positions by increasing our holdings in VST (Vistra Corp.) and WING (Wingstop Inc.), both of which had promising momentum scores. Conversely, we reduced positions in CEG (Constellation Energy Corp.) and EME (EMCOR Group Inc.), making slight modifications based on their relative momentum rankings.

One of our top holdings, Wingstop Inc. (WING), continues to perform solidly in the fast-casual restaurant sector. Our cash reserves, currently the largest sector in our portfolio, ensure that we are prepared to seize opportunities as they arise. GEV (General Electric Vertebrales Aviation) also remains a top holding, contributing to the portfolio’s stability.

This week, the standout performer was IESC, which registered a gain of 2.72%. On the downside, First Solar Inc. (FSLR) saw a decline of 13.97%, reminding us of the market’s volatility.

Closing Summary

In summary, this week was marked by minor rebalancing within our portfolio according to the momentum strategy we follow. Maintaining a significant cash reserve reflects our cautious optimism in volatile times. Feel free to share your thoughts or questions in the comments below, and keep following for more updates on our momentum-based trading strategy!

This week’s transactions:

-

Sold:

- No sells in this week!

-

Bought:

- No buys in this week!

-

Rebalanced / added:

-

Rebalanced / reduced:

Index Distribution:

At the moment, we are holding mostly cash:

Current portfolio allocation:

We’re kind of just hoarding cash in the portfolio at the moment:

Weekly sector distribution:

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| cash | Cash | Cash | Cash | – | 145765 | 0.864 |

| WING | Wingstop Inc | S&P 400 | Consumer Cyclical | 12.40B | -2.05% | 0.033 |

| GEV | GE Vernova Inc. | S&P 500 | Utilities | 46.28B | -8.98% | 0.02 |

| EME | Emcor Group, Inc. | S&P 400 | Industrials | 16.80B | -11.09% | 0.017 |

| VST | Vistra Corp | S&P 500 | Utilities | 30.40B | -18.40% | 0.016 |

| NVDA | NVIDIA Corp | S&P 500 | Technology | 3019.40B | -12.80% | 0.015 |

| CEG | Constellation Energy Corporation | S&P 500 | Utilities | 65.06B | -12.66% | 0.011 |

| IESC | IES Holdings Inc | Barrons 400 | Industrials | 2.75B | -26.29% | 0.009 |

| FSLR | First Solar Inc | S&P 500 | Technology | 23.24B | -29.22% | 0.008 |

| VRT | Vertiv Holdings Co | Barrons 400 | Industrials | 32.92B | -19.53% | 0.008 |

As always, more trades next week!