Our activity in the market this week involved 2 new trades, specifically 1 buys and 1 sells.

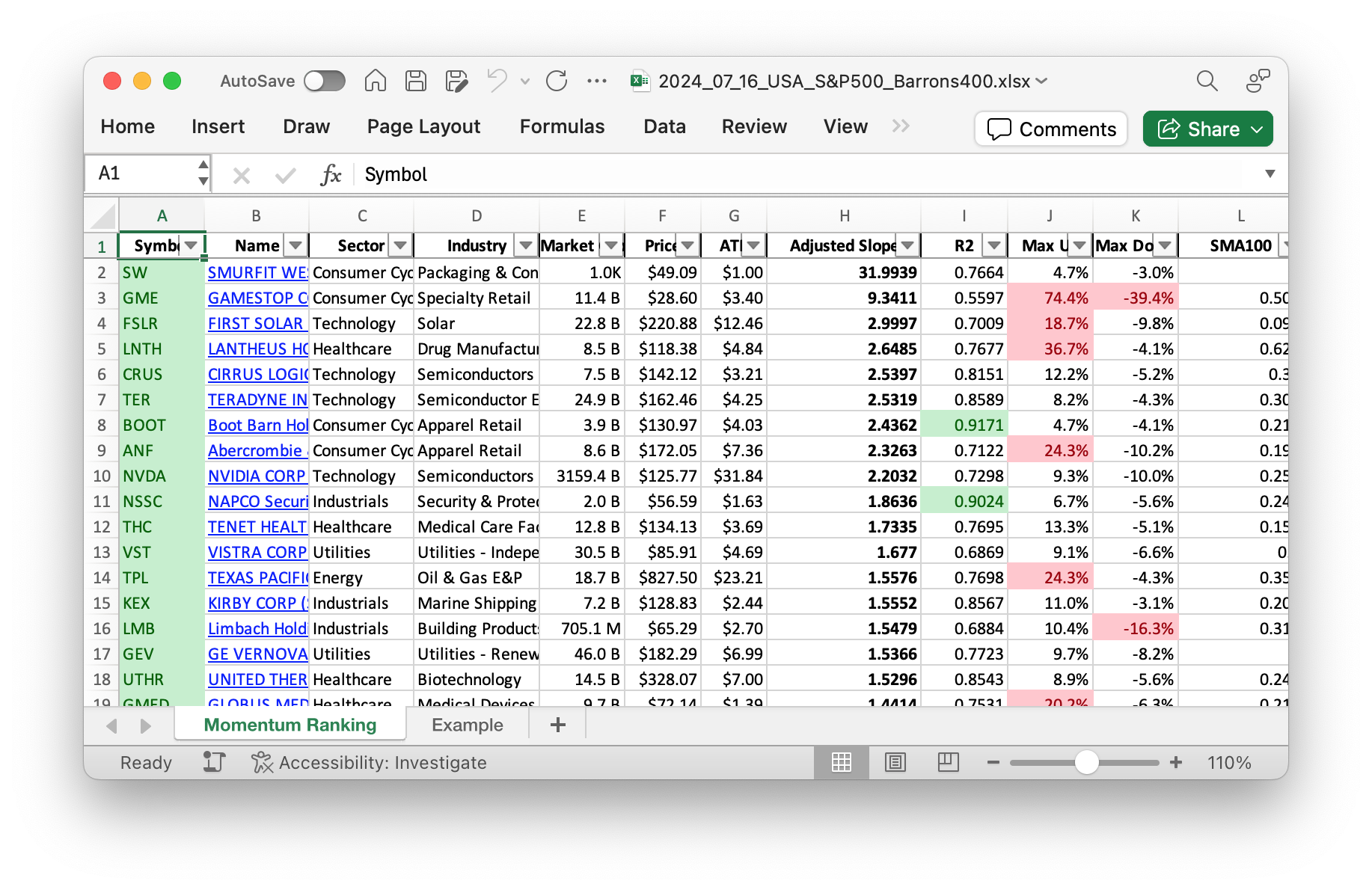

Want to stay on top of the market trends? Our Momentum Ranking report highlights the top stocks of the week, so you don’t have to! Click here to access the latest data for week 29.

This Week’s Trading Activity: Market Insights and Portfolio Updates

This week, we saw consistent trading activity guided by our momentum-based strategy, as detailed in Andreas Clenow’s book, “Stocks on the Move.” Our approach focuses on maintaining a dynamic portfolio based on the annualized adjusted slope of stock prices while carefully monitoring market conditions. Significantly, the S&P 500 has remained above its 200-day moving average for 175 days, allowing us to actively manage our positions.

Buys and Sells: Aligning with Momentum

In line with our strategy, we made a few key adjustments this week. We sold shares of EME as it no longer ranked within the top 10% of our adjusted slope rankings. This decision is part of our systematic approach to only hold top-performing stocks.

On the buying front, we added shares of Cirrus Logic (CRUS), a leading supplier of low-power, high-precision mixed-signal processing solutions for audio and energy applications. This addition comes as CRUS showed strong performance in our momentum ranking.

Furthermore, we rebalanced our portfolio by increasing our position in Wingstop (WING) and General Electric Ventures (GEV). It’s worth noting that WING had the poorest performance this week, with a loss of -7.77%, but its long-term growth potential remains compelling in our rankings.

Summary and Performance Highlights

Our portfolio has experienced varied performance among its holdings. Cash remains a significant portion of our investments, underscoring our cautious approach during volatile periods. This week, the best performing stock was IES Holdings (IESC), with a notable gain of 11.67%. In contrast, Wingstop (WING) had the most significant decline, shedding -7.77% over the last seven trading days.

Closing Thoughts

Overall, this week has been a testament to the resilience of our momentum-based strategy. By adhering to strict criteria and keeping a close eye on market trends, we ensure that our portfolio remains optimized and aligned with our goals. We’d love to hear your thoughts or questions about this week’s activities. Feel free to share your insights in the comments below!

This week’s transactions:

-

Rebalanced / added:

- No positions were added to in this week!

-

Rebalanced / reduced:

Index Distribution:

At the moment, we are holding mostly cash:

Current portfolio allocation:

The portfolio is mostly just cash right now, waiting for some good opportunities:

Weekly sector distribution:

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| cash | Cash | Cash | Cash | – | 158333 | 0.882 |

| GEV | GE Vernova Inc. | S&P 500 | Utilities | 50.03B | -1.60% | 0.02 |

| CRUS | Cirrus Logic, Inc. | S&P 400 | Technology | 7.63B | 0.54% | 0.019 |

| WING | Wingstop Inc | S&P 400 | Consumer Cyclical | 11.36B | -10.30% | 0.015 |

| VST | Vistra Corp | S&P 500 | Utilities | 29.81B | -20.01% | 0.015 |

| NVDA | NVIDIA Corp | S&P 500 | Technology | 3097.14B | -10.56% | 0.014 |

| CEG | Constellation Energy Corporation | S&P 500 | Utilities | 64.72B | -13.12% | 0.011 |

| IESC | IES Holdings Inc | Barrons 400 | Industrials | 3.23B | -13.38% | 0.01 |

| VRT | Vertiv Holdings Co | Barrons 400 | Industrials | 33.62B | -17.80% | 0.007 |

| FSLR | First Solar Inc | S&P 500 | Technology | 23.53B | -28.34% | 0.007 |

As always, more trades next week!