In the past week, we made 6 new trades: 3 buys and 3 sells.

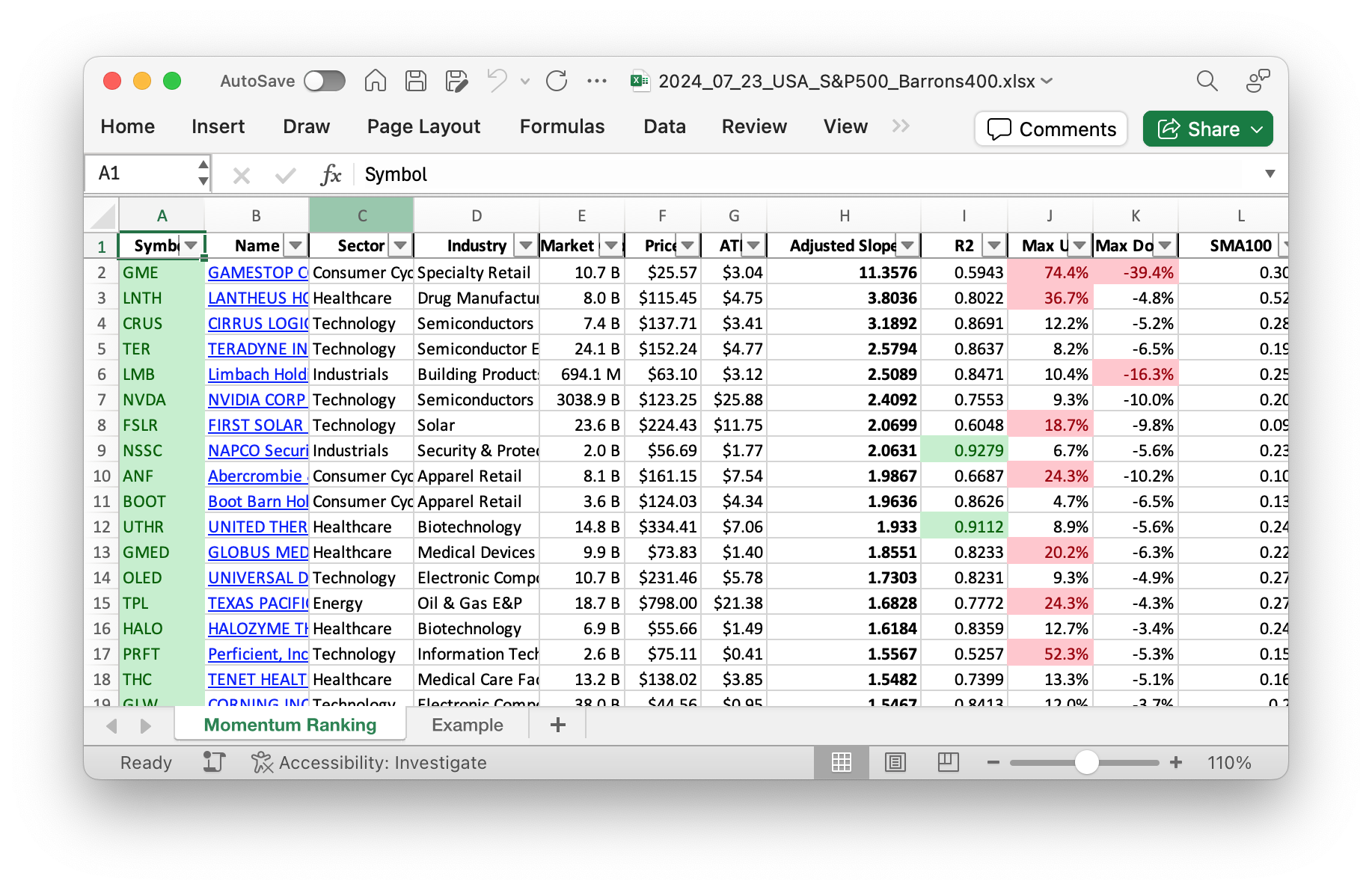

Click here for the Momentum Ranking of week 30.

This Week’s Momentum Trading Activity

This week, we’ve seen continued momentum in the market. The S&P 500 has been above its 200-day moving average for 180 days now, giving us confidence in the current bullish regime. Based on Andreas Clenow’s strategy from his book, Stocks On The Move, we made several adjustments to our portfolio.

Buys and Sells

We made a series of transactions this week. We sold shares of Constellation Energy (CEG), Vertiv Holdings (VRT), and Wingstop (WING) as they no longer ranked in the top 10% of our momentum ranking. These stocks have either fallen behind in performance or dipped below their 100-day moving averages.

On the buy side, we added several new stocks to our portfolio. Limbach Holdings (LMB) is a construction services company with significant momentum. Lantheus Holdings (LNTH), a healthcare company specializing in diagnostic medical imaging, has also shown strong performance. Teradyne Inc. (TER), a semiconductor testing company, was another addition this week, demonstrating solid growth potential.

We also rebalanced our holdings, specifically adding more shares to our existing position in Cirrus Logic, Inc. (CRUS), a leader in the tech sector. Noteworthy, we have been cautious with new purchases, so our largest allocation remains in cash reserves, reflecting our strategic approach.

Summary and Portfolio Performance

The majority of our portfolio is in cash and strong-performing stocks like Cirrus Logic (CRUS) and Teradyne Inc. (TER). This positioning helps us stay agile and ready to act on emerging opportunities. Our best performing stock this week was IES Holdings (IESC), with a modest gain of 0.0189. On the other hand, Vistra Corp. (VST) was the worst performer, losing -0.1331 over the past seven trading days.

Overall, this week’s market activity is a reminder of the dynamic nature of trading. Our momentum strategy, as outlined in Stocks On The Move, guides us in making calculated decisions.

We’d love to hear your thoughts on this week’s trades. Drop us a comment with your questions or insights. Happy trading!

This week’s transactions:

-

Rebalanced / added:

-

Rebalanced / reduced:

- No positions were reduced in this week!

Index Distribution:

At the moment, we are holding mostly cash:

Current portfolio allocation:

We’re taking a bit of a breather in the portfolio, mostly just holding onto cash for now:

Weekly sector distribution:

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| cash | Cash | Cash | Cash | – | 128466 | 0.826 |

| CRUS | Cirrus Logic, Inc. | S&P 400 | Technology | 7.36B | -3.56% | 0.036 |

| TER | Teradyne, Inc. | S&P 500 | Technology | 23.77B | -6.69% | 0.03 |

| LNTH | Lantheus Holdings Inc | S&P 400 | Healthcare | 7.99B | -9.13% | 0.024 |

| GEV | GE Vernova Inc. | S&P 500 | Utilities | 46.57B | -8.42% | 0.021 |

| NVDA | NVIDIA Corp | S&P 500 | Technology | 3020.14B | -12.78% | 0.016 |

| VST | Vistra Corp | S&P 500 | Utilities | 28.02B | -24.80% | 0.016 |

| LMB | Limbach Holdings Inc | Barrons 400 | Industrials | 710.04M | -4.70% | 0.012 |

| IESC | IES Holdings Inc | Barrons 400 | Industrials | 3.27B | -12.43% | 0.011 |

| FSLR | First Solar Inc | S&P 500 | Technology | 23.99B | -26.94% | 0.008 |

As always, more trades next week!