Our activity in the market this week involved 5 new trades, specifically 2 buys and 3 sells.

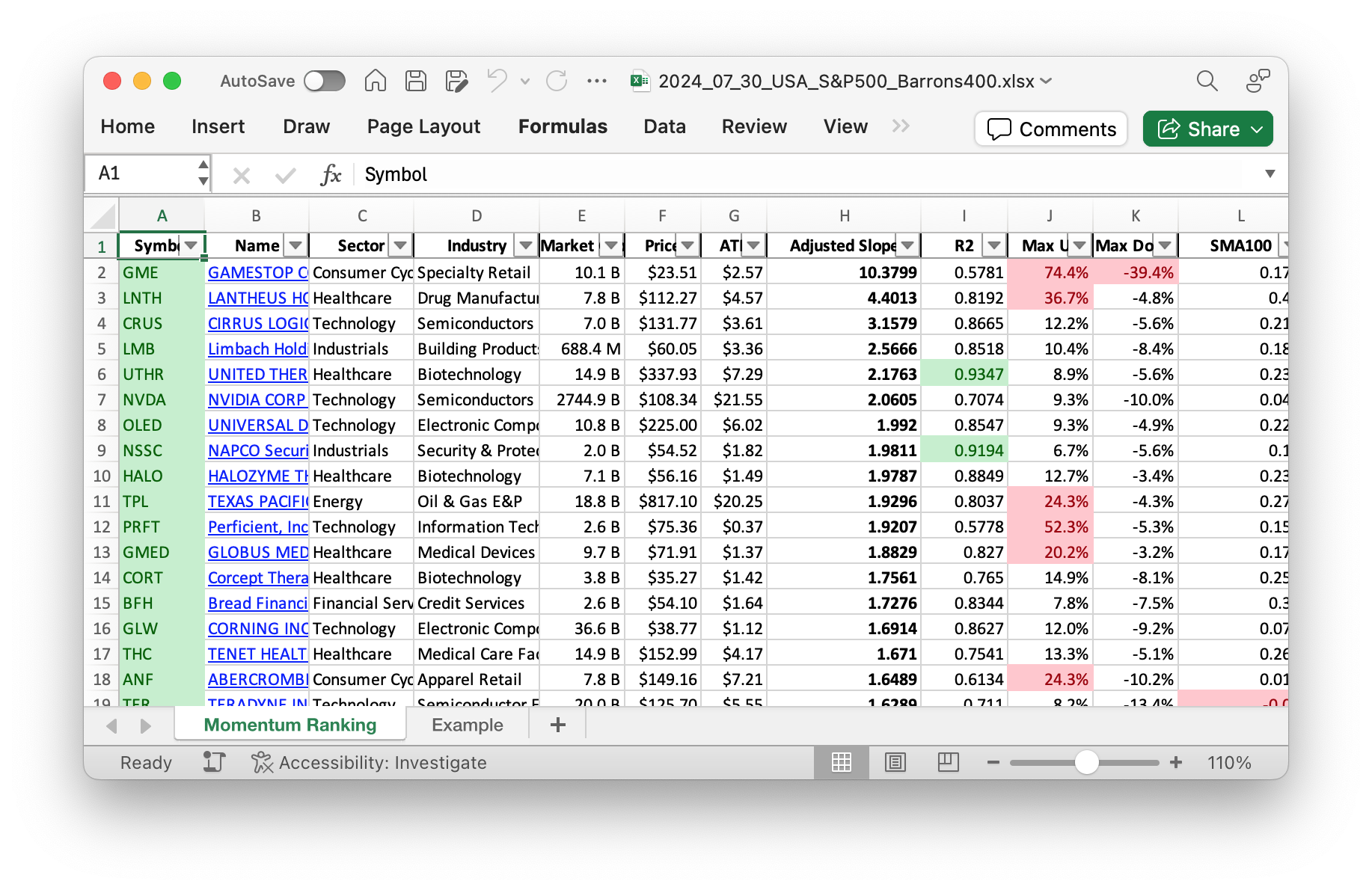

Discover the top-performing stocks of the week with our Momentum Ranking! Click here to access the latest data for week 31.

This Week’s Trading Activity: Buys, Sells, and Strategy Insights

In this week’s trading activity update, we focus on how our strategy performed based on the momentum ranking using the adjusted slope detailed by Andreas Clenow in the book “Stocks On The Move.” As of today, the S&P 500 has been above its 200-day moving average for 185 days. This positive trend has allowed us to make a few strategic buys while also letting go of some underperforming stocks.

Buys and Sells

This week, we sold IES Holdings (IESC), Teradyne Inc (TER), and Vistra Corp (VST) as they no longer ranked in the top 10% of momentum stocks. Additionally, we bought Universal Display Corp (OLED) and United Therapeutics Corp (UTHR). Universal Display Corp specializes in providing technology and materials to the OLED market, specifically for smartphones and other digital displays. United Therapeutics is focused on the biotechnology sector, specifically developing therapies for chronic and life-threatening conditions.

Aside from selling and new buys, we rebalanced our position in General Electric Ventures (GEV), adding to our existing holdings. GEV has been our best performer over the last seven trading days, gaining 5.33%. Still, we had to reduce our position in Cirrus Logic (CRUS) and Lantheus Holdings Inc (LNTH) due to their performance and ranking.

Summary

Our portfolio is cautiously optimistic, keeping substantial cash reserves while making strategic adjustments. Most of our shares are currently allocated in cash, CRUS, and LNTH, maintaining a defensive yet opportunistic stance. Despite the high market volatility, our focus on momentum ranking has helped us navigate through both gains and losses efficiently. The top gainer was GEV, while our worst performer was NVIDIA (NVDA), which saw a decline of 5.38%.

In summary, this week showcased our strategy’s ability to adapt to changing market dynamics while remaining aligned with Clenow’s principles. We are committed to following a disciplined approach to buying, selling, and rebalancing, driven by our momentum ranking system. We invite readers to share their thoughts or questions in the comments below. Let’s continue learning and growing together in our trading journey!

This week’s transactions:

-

Rebalanced / added:

- No positions were added to in this week!

-

Rebalanced / reduced:

Index Distribution:

At the moment, we are holding mostly cash:

Current portfolio allocation:

There’s not a lot going on in the portfolio right now, just a lot of cash sitting around:

Weekly sector distribution:

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| cash | Cash | Cash | Cash | – | 118523 | 0.832 |

| CRUS | Cirrus Logic, Inc. | S&P 400 | Technology | 6.99B | -8.44% | 0.037 |

| LNTH | Lantheus Holdings Inc | S&P 400 | Healthcare | 7.78B | -11.57% | 0.025 |

| OLED | Universal Display Corp. | S&P 400 | Technology | 10.64B | -5.36% | 0.024 |

| UTHR | United Therapeutics Corp | S&P 400 | Healthcare | 15.04B | -1.48% | 0.024 |

| GEV | GE Vernova Inc. | S&P 500 | Utilities | 46.56B | -8.67% | 0.021 |

| NVDA | NVIDIA Corp | S&P 500 | Technology | 2635.28B | -23.90% | 0.016 |

| LMB | Limbach Holdings Inc | Barrons 400 | Industrials | 670.46M | -10.01% | 0.013 |

| FSLR | First Solar Inc | S&P 500 | Technology | 23.55B | -28.27% | 0.009 |

As always, more trades next week!