During the past week, we made 4 new trades - 2 buys and 2 sells.

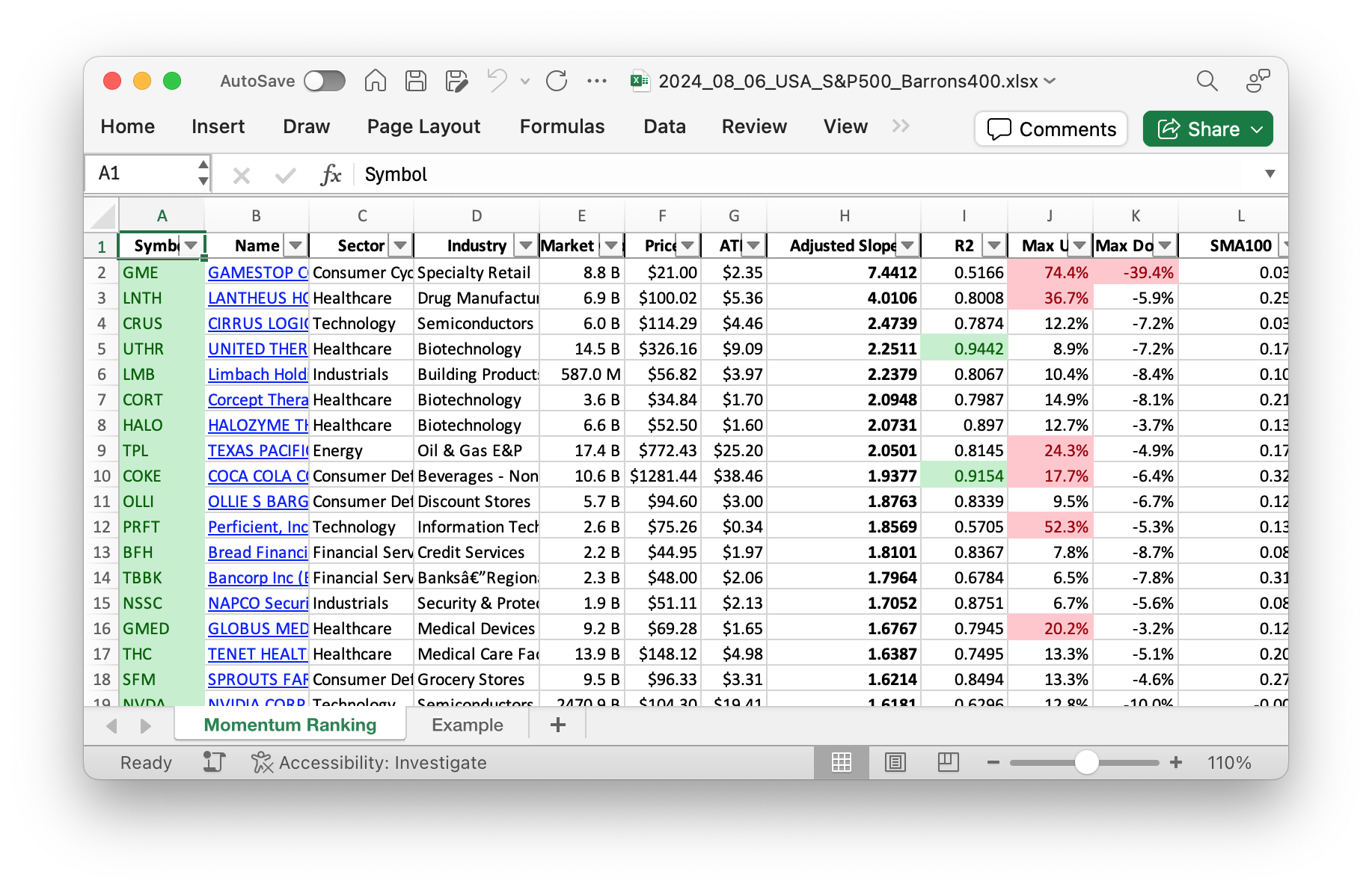

Whether you’re an investor or just interested in the stock market, our weekly Momentum Ranking report based on Andreas Clenow’s book Stocks on the Move is a must-read! Click here to access the latest data for week 32 and stay up-to-date on the top performers.

This Week’s Trading Update and Analysis

Welcome back to our weekly trading update! As we analyze the stock market activities, we notice some significant movements in our portfolio aligned with our strategy based on Andreas Clenow’s “Stocks on the Move”. This method, which emphasizes momentum ranking and adjusted slope, ensures we stay disciplined and positioned for potential gains. For the last 190 days, the S&P 500 has been trading above its 200-day moving average, indicating a favorable climate for new buys.

Buys and Sells

This week witnessed some interesting shifts. Notably, we’re selling NVDA and OLED as they no longer meet the top criteria. In their place, we introduced CORT and HALO into our holdings. Corcept Therapeutics (CORT) is a pharmaceutical company focused on developing medications that regulate the effects of cortisol. Halozyme Therapeutics (HALO) is a biotechnology company specializing in drug delivery and developing treatments for diabetes and cancer patients. These companies were selected based on their strong momentum ranking.

We also rebalanced some of our existing positions. We sold a portion of CRUS, GEV, LNTH, and UTHR to maintain an optimal portfolio mix.

Summary

Like any prudent trader, we emphasize maintaining cash reserves. This week, the majority of our portfolio is held in cash to preserve capital and remain flexible. Our top holdings include cash, CORT, and UTHR. Despite the changing landscape, our approach ensures we remain poised for opportunities as they arise.

Reflecting on the past seven trading days, our best-performing asset is cash with a stable gain of 0.0%. Our worst-performing stock is LMB, which experienced a loss of -0.17%. Nevertheless, we continue to monitor the market closely to take the necessary actions.

In conclusion, our momentum trading strategy continues to guide us efficiently through market fluctuations. This week, our activities highlight our cautious yet confident approach. We welcome your thoughts or questions in the comments below. Let’s keep the conversation about smart trading going strong!

This week’s transactions:

-

Rebalanced / added:

- No positions were added to in this week!

-

Rebalanced / reduced:

Index Distribution:

At the moment, we are holding mostly cash:

Current portfolio allocation:

We’re taking a bit of a breather in the portfolio, mostly just holding onto cash for now:

Weekly sector distribution:

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| cash | Cash | Cash | Cash | – | 108021 | 0.889 |

| CORT | Corcept Therapeutics Inc | Barrons 400 | Healthcare | 3.69B | -11.07% | 0.02 |

| UTHR | United Therapeutics Corp | S&P 400 | Healthcare | 14.49B | -5.34% | 0.019 |

| HALO | Halozyme Therapeutics Inc. | S&P 400 | Healthcare | 6.67B | -8.21% | 0.017 |

| CRUS | Cirrus Logic, Inc. | S&P 400 | Technology | 6.15B | -19.46% | 0.013 |

| LMB | Limbach Holdings Inc | Barrons 400 | Industrials | 631.78M | -15.20% | 0.013 |

| FSLR | First Solar Inc | S&P 500 | Technology | 22.80B | -30.59% | 0.01 |

| GEV | GE Vernova Inc. | S&P 500 | Utilities | 45.40B | -10.94% | 0.009 |

| LNTH | Lantheus Holdings Inc | S&P 400 | Healthcare | 6.98B | -20.74% | 0.009 |

As always, more trades next week!