Our activity in the market this week involved 2 new trades, specifically 1 buys and 1 sells.

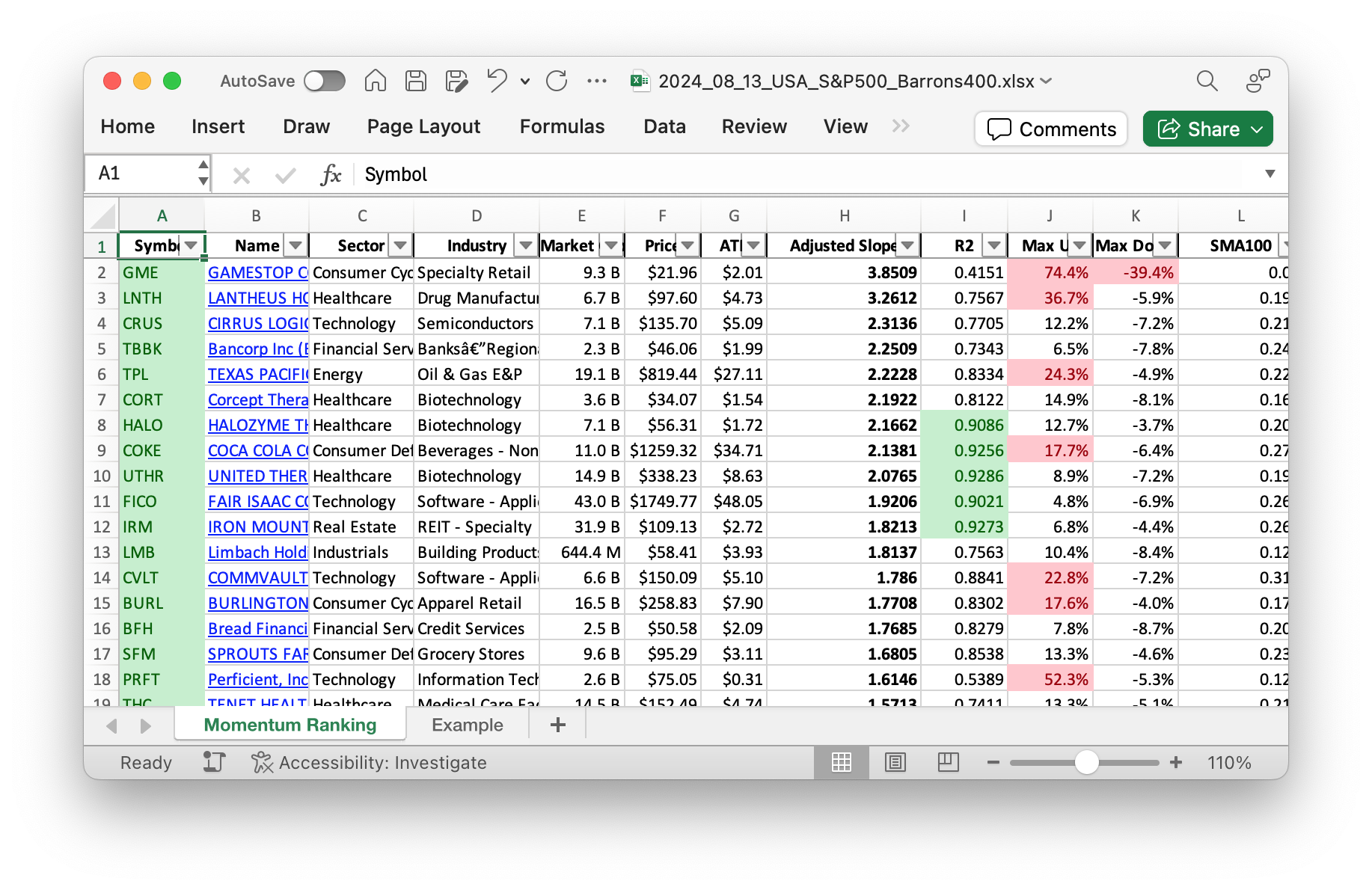

Click here for the Momentum Ranking of week 33.

This Week’s Momentum Trading Activity: Overview and Insights

Hello Traders! Welcome back to our weekly update on momentum trading. As always, we’re using the strategy detailed in Andreas Clenow’s Stocks On The Move to guide our decisions. This week, we had an interesting mix of market movements and some changes to our portfolio. The S&P 500 has been above its 200-day moving average for the last 195 days, allowing us to make new purchases.

Buys and Sells

We made a few adjustments to our portfolio. We had to sell our shares in First Solar, Inc. (FSLR). According to our strategy, we sell a stock if it falls out of the top 10% of our momentum ranking or if it trades below its 100-day moving average.

On the buying side, we added The Bancorp, Inc. (TBBK) to our portfolio. The Bancorp is a well-known financial institution focusing on providing banking solutions tailored for non-bank financial services companies. While TBBK had a rough week with a slight loss of -5.21%, we believe in its long-term potential as part of our strategy.

Portfolio Insights

Currently, our largest holding is in cash, reflecting our cautious approach given the current market conditions. Among our top holdings, Corcept Therapeutics (CORT) and United Therapeutics Corporation (UTHR) stand out.

The best performing stock in our portfolio this week was Cirrus Logic, Inc. (CRUS) with an impressive gain of 15.10%. On the other hand, our new addition TBBK was the worst performer over the last seven trading days. These fluctuations are a normal part of our momentum-based strategy, and we keep a close eye on them for future rebalancing.

Summary

This week had its mix of highs and lows. We made some new buys, sold off a less-performing stock, and kept a significant portion of our portfolio in cash. This approach helps us stay nimble and ready to capitalize on fresh opportunities.

Overall, our strategy stays the course, and we’re confident in our momentum ranking system’s ability to guide us through the ups and downs of the market. If you have any questions or comments, please feel free to share them below. Happy trading, everyone!

This week’s transactions:

-

Rebalanced / added:

- No positions were added to in this week!

-

Rebalanced / reduced:

- No positions were reduced in this week!

Index Distribution:

At the moment, we are holding mostly cash:

Current portfolio allocation:

We’re keeping most of our money in cash for the time being in the portfolio:

Weekly sector distribution:

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| cash | Cash | Cash | Cash | – | 119673 | 0.895 |

| CORT | Corcept Therapeutics Inc | Barrons 400 | Healthcare | 3.58B | -13.79% | 0.018 |

| UTHR | United Therapeutics Corp | S&P 400 | Healthcare | 15.05B | -1.68% | 0.017 |

| HALO | Halozyme Therapeutics Inc. | S&P 400 | Healthcare | 7.13B | -1.34% | 0.017 |

| CRUS | Cirrus Logic, Inc. | S&P 400 | Technology | 7.26B | -4.80% | 0.014 |

| LMB | Limbach Holdings Inc | Barrons 400 | Industrials | 659.52M | -12.18% | 0.013 |

| TBBK | Bancorp Inc. | Barrons 400 | Financial Services | 2.38B | -14.10% | 0.009 |

| GEV | GE Vernova Inc. | S&P 500 | Utilities | 48.63B | -4.61% | 0.009 |

| LNTH | Lantheus Holdings Inc | S&P 400 | Healthcare | 6.77B | -23.15% | 0.008 |

As always, more trades next week!