Over the course of the week, we made 2 new trades - 1 buys and 1 sells.

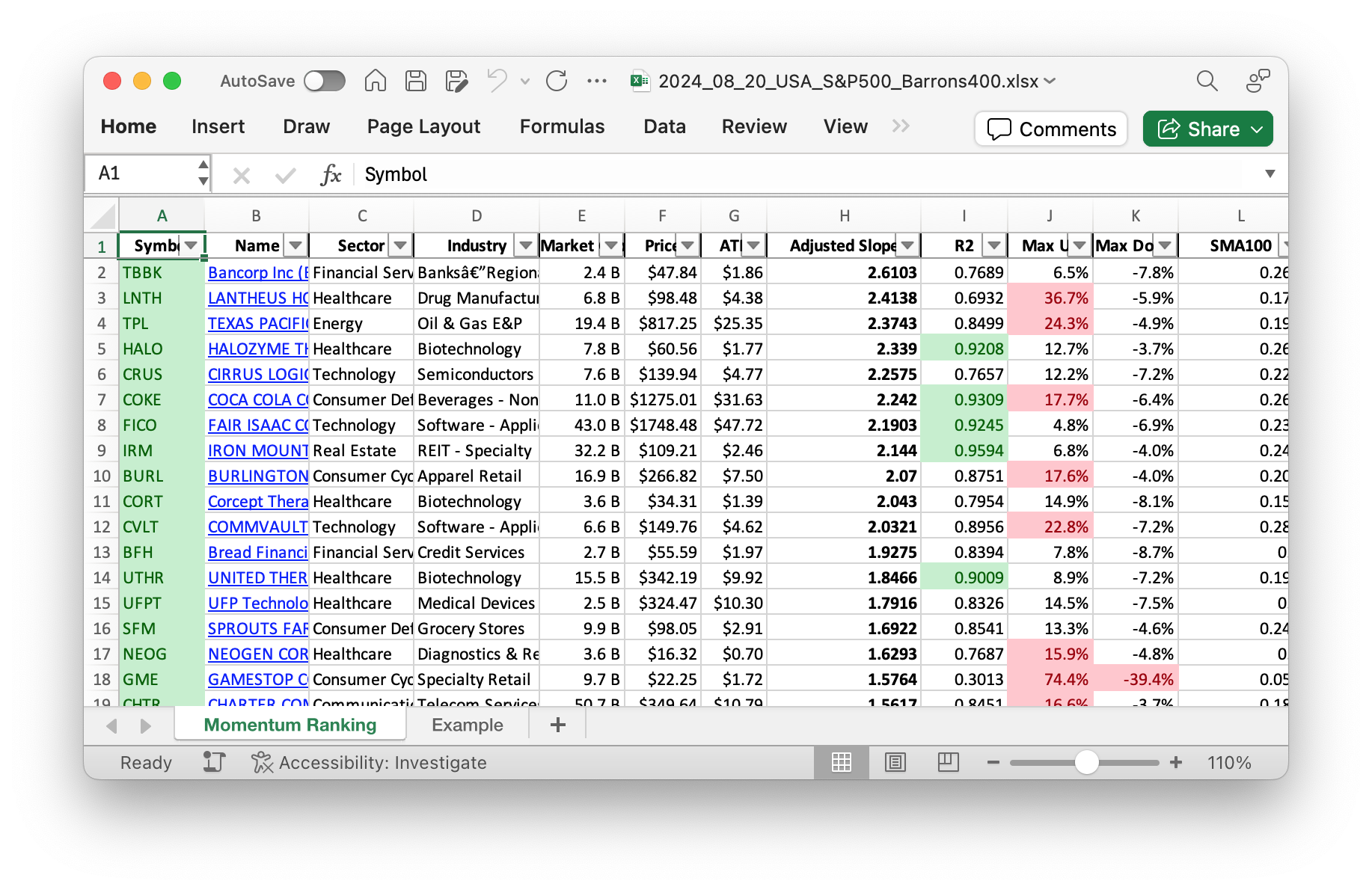

Want to stay on top of the market trends? Our Momentum Ranking report highlights the top stocks of the week, so you don’t have to! Click here to access the latest data for week 34.

This Week’s Trading Activity: A Momentum-Based Approach

This week has been a mixed bag for our momentum-based trading strategy. As always, we are guided by the principles laid out in Andreas Clenow’s “Stocks On The Move,” focusing on stocks with the highest momentum, evaluated using the annualized adjusted slope. Our strategy keeps us disciplined, buying and selling based on strict criteria.

Buys and Sells

The S&P 500 has been trading above its 200-day moving average, which has given us the green light to proceed with new buys. This week, we sold GEV as it no longer ranks in the top 10% of our adjusted slope rankings. In its place, we added Texas Pacific Land Corporation (TPL) to our portfolio. TPL has been performing well, showing strong momentum. The company primarily operates in land management and resource extraction, which adds a different flavor to our portfolio.

No stocks needed rebalancing or reduction this week.

Portfolio and Performance

Most of our portfolio remains in cash reserves, signaling a cautious approach during these volatile times. Currently, our significant holdings include HALO, CORT, and, of course, cash. HALO has shown the best performance this week, gaining approximately 11.8%. On the other hand, our cash reserve holds steady, losing nothing. This conservative positioning helps us manage risk while waiting for clear momentum signals.

Our biggest sector allocation is in cash, reflecting our strategic reserve to take advantage of future buy opportunities when the timing is right. As always, we remain vigilant, ready to adjust the portfolio according to our momentum-based strategy.

Closing Thoughts

This week has been a testament to the importance of having a disciplined trading approach. Keeping a substantial part of our portfolio in cash and making strategic buys and sells based on momentum has kept us on a steady path. We are particularly pleased with the addition of TPL, which diversifies our holdings while fitting our momentum criteria.

Feel free to share your thoughts or questions in the comments. We’re always interested in hearing how others perceive market shifts and strategies. Happy trading!

This week’s transactions:

-

Rebalanced / added:

- No positions were added to in this week!

-

Rebalanced / reduced:

- No positions were reduced in this week!

Index Distribution:

At the moment, we are holding mostly cash:

Current portfolio allocation:

There’s not a lot going on in the portfolio right now, just a lot of cash sitting around:

Weekly sector distribution:

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| cash | Cash | Cash | Cash | – | 158461 | 0.912 |

| HALO | Halozyme Therapeutics Inc. | S&P 400 | Healthcare | 7.68B | -1.84% | 0.014 |

| CORT | Corcept Therapeutics Inc | Barrons 400 | Healthcare | 3.56B | -14.24% | 0.014 |

| UTHR | United Therapeutics Corp | S&P 400 | Healthcare | 15.24B | -2.32% | 0.014 |

| CRUS | Cirrus Logic, Inc. | S&P 400 | Technology | 7.46B | -2.23% | 0.011 |

| LMB | Limbach Holdings Inc | Barrons 400 | Industrials | 669.55M | -10.85% | 0.01 |

| TPL | Texas Pacific Land Corporation | S&P 400 | Energy | 18.84B | -4.07% | 0.01 |

| TBBK | Bancorp Inc. | Barrons 400 | Financial Services | 2.35B | -10.32% | 0.008 |

| LNTH | Lantheus Holdings Inc | S&P 400 | Healthcare | 6.86B | -22.12% | 0.006 |

As always, more trades next week!