This week was quiet on the trading front - no new buys or sells.

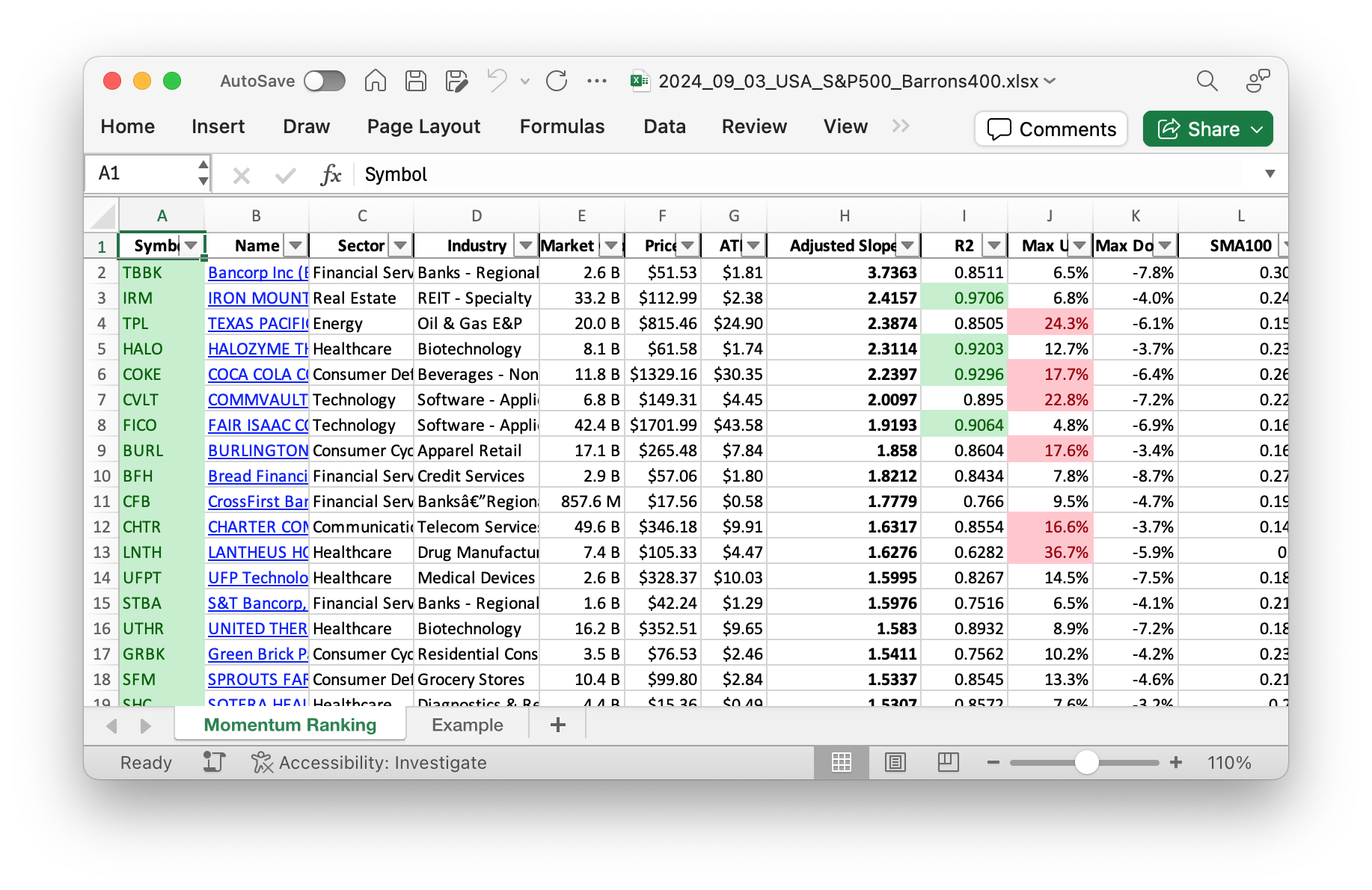

Looking for reliable stock performance data? Check out our weekly Momentum Ranking (based on Andreas Clenow’s book Stocks on the Move), updated every week with the latest figures! Click here to see the report for week 36.

This Week’s Trading Activity: A Steady Path Forward

Hello, fellow traders and investors! As we wrap up another week in the financial markets, let’s take a closer look at our trading activities and portfolio adjustments. The momentum ranking strategy we follow, as outlined in Andreas Clenow’s ‘Stocks On The Move’, continues to guide our decisions. This strategy ranks stocks by their annualized adjusted slope, helping us pick only the top-performing stocks.

In the past seven days, the S&P 500 has maintained a positive position by being above its 200-day moving average for 209 days. This positive market regime means we could have been open to making new buys. However, this week, there were no new buys or sells in our portfolio.

Currently, the most significant portion of our portfolio is in cash reserves, ensuring we are ready to seize new opportunities as they arise. Our top holdings include cash, HALO, and UTHR. This cautious approach helps us manage risk while positioning ourselves strategically for potential future gains.

This week, our best-performing stock was TBBK, with a gain of approximately 5.79%. On the other hand, cash held steady with no losses, highlighting the stability of our holdings.

As we continue to navigate the markets, our momentum ranking strategy ensures that we remain disciplined and focused. Remember, even when the market conditions are favorable for new buys, staying prepared with cash reserves can be a prudent approach.

Thanks for following our weekly updates. We appreciate your engagement and encourage you to share your thoughts or questions in the comments below. Happy trading, and see you next week!

This week’s transactions:

-

Sold:

- No sells in this week!

-

Bought:

- No buys in this week!

-

Rebalanced / added:

- No positions were added to in this week!

-

Rebalanced / reduced:

- No positions were reduced in this week!

Index Distribution:

At the moment, we are holding mostly cash:

Current portfolio allocation:

We’re playing it safe with a lot of cash in the portfolio at the moment:

Weekly sector distribution:

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| cash | Cash | Cash | Cash | – | 153401 | 0.906 |

| HALO | Halozyme Therapeutics Inc. | S&P 400 | Healthcare | 7.80B | -6.05% | 0.015 |

| UTHR | United Therapeutics Corp | S&P 400 | Healthcare | 15.73B | -3.38% | 0.015 |

| CORT | Corcept Therapeutics Inc | Barrons 400 | Healthcare | 3.58B | -13.81% | 0.015 |

| CRUS | Cirrus Logic, Inc. | S&P 400 | Technology | 7.31B | -7.14% | 0.012 |

| LMB | Limbach Holdings Inc | Barrons 400 | Industrials | 676.76M | -9.89% | 0.011 |

| TPL | Texas Pacific Land Corporation | S&P 400 | Energy | 18.75B | -7.41% | 0.01 |

| TBBK | Bancorp Inc. | Barrons 400 | Financial Services | 2.52B | -3.69% | 0.008 |

| LNTH | Lantheus Holdings Inc | S&P 400 | Healthcare | 7.27B | -17.49% | 0.007 |

As always, more trades next week!