We didn’t make any new trades this week.

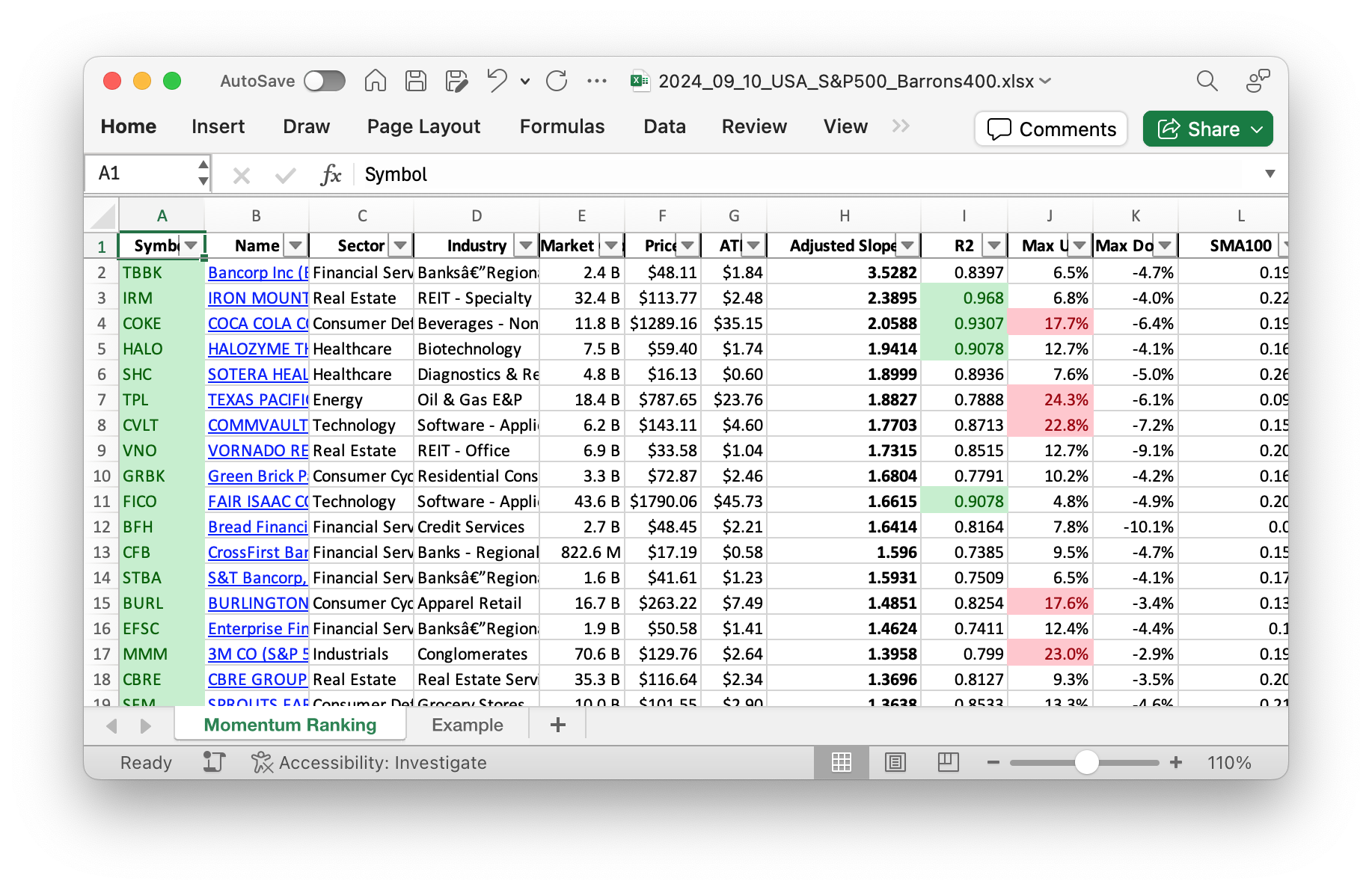

Discover the top-performing stocks of the week with our Momentum Ranking! Click here to access the latest data for week 37.

Weekly Trading Activity Report

Introduction

Welcome back to our weekly trading activity report! The S&P 500 continues to show strength, staying above its 200-day moving average for the past 214 days. This market condition allows us to explore new buying opportunities while closely monitoring our current holdings. Our trading strategy, derived from Andreas Clenow’s “Stocks On The Move,” emphasizes momentum and discipline. Let’s dive into this week’s transactions and portfolio performance.

Buys/Sells

This week, there were no new buys, sells, or rebalancing activities in our portfolio. Most of our portfolio remains in cash, reflecting the cautious approach we take during uncertain market periods. Currently, our top holdings include significant cash reserves, Corcept Therapeutics Incorporated (CORT), and United Therapeutics Corporation (UTHR).

Summary

The largest portion of our portfolio is allocated to cash, demonstrating our prepared stance to seize opportunities as they arise. Among our current holdings, LMB emerged as the best performer with a gain of 3.11% over the last seven trading days. Conversely, Cirrus Logic (CRUS) experienced a decline of 10.12%, marking it as the portfolio’s weakest performer during the same period.

Our momentum-driven strategy ensures that we stay invested in top-ranked stocks while adhering to strict selling rules. This means staying nimble and ready to adapt as market conditions change.

Closing Thoughts

In summary, this week’s activity was quiet, with no new transactions. We’re maintaining a strong cash position and continue to monitor our holdings closely. Our disciplined approach, focusing on momentum and market trends, helps us navigate both calm and turbulent periods effectively. We invite you to share your thoughts or questions in the comments below. Happy trading, and see you next week!

This week’s transactions:

-

Sold:

- No sells in this week!

-

Bought:

- No buys in this week!

-

Rebalanced / added:

- No positions were added to in this week!

-

Rebalanced / reduced:

- No positions were reduced in this week!

Index Distribution:

At the moment, we are holding mostly cash:

Current portfolio allocation:

The portfolio is in cash-mode right now, waiting for some good deals to come along:

Weekly sector distribution:

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| cash | Cash | Cash | Cash | – | 166669 | 0.917 |

| CORT | Corcept Therapeutics Inc | Barrons 400 | Healthcare | 3.66B | -11.87% | 0.014 |

| UTHR | United Therapeutics Corp | S&P 400 | Healthcare | 15.24B | -6.45% | 0.013 |

| HALO | Halozyme Therapeutics Inc. | S&P 400 | Healthcare | 7.51B | -9.57% | 0.013 |

| LMB | Limbach Holdings Inc | Barrons 400 | Industrials | 751.03M | 0.00% | 0.011 |

| CRUS | Cirrus Logic, Inc. | S&P 400 | Technology | 6.99B | -11.20% | 0.01 |

| TPL | Texas Pacific Land Corporation | S&P 400 | Energy | 18.10B | -10.61% | 0.009 |

| TBBK | Bancorp Inc. | Barrons 400 | Financial Services | 2.36B | -10.04% | 0.007 |

| LNTH | Lantheus Holdings Inc | S&P 400 | Healthcare | 6.88B | -21.92% | 0.006 |

As always, more trades next week!