This week, we carried out 6 new trades - 3 buys and 3 sells.

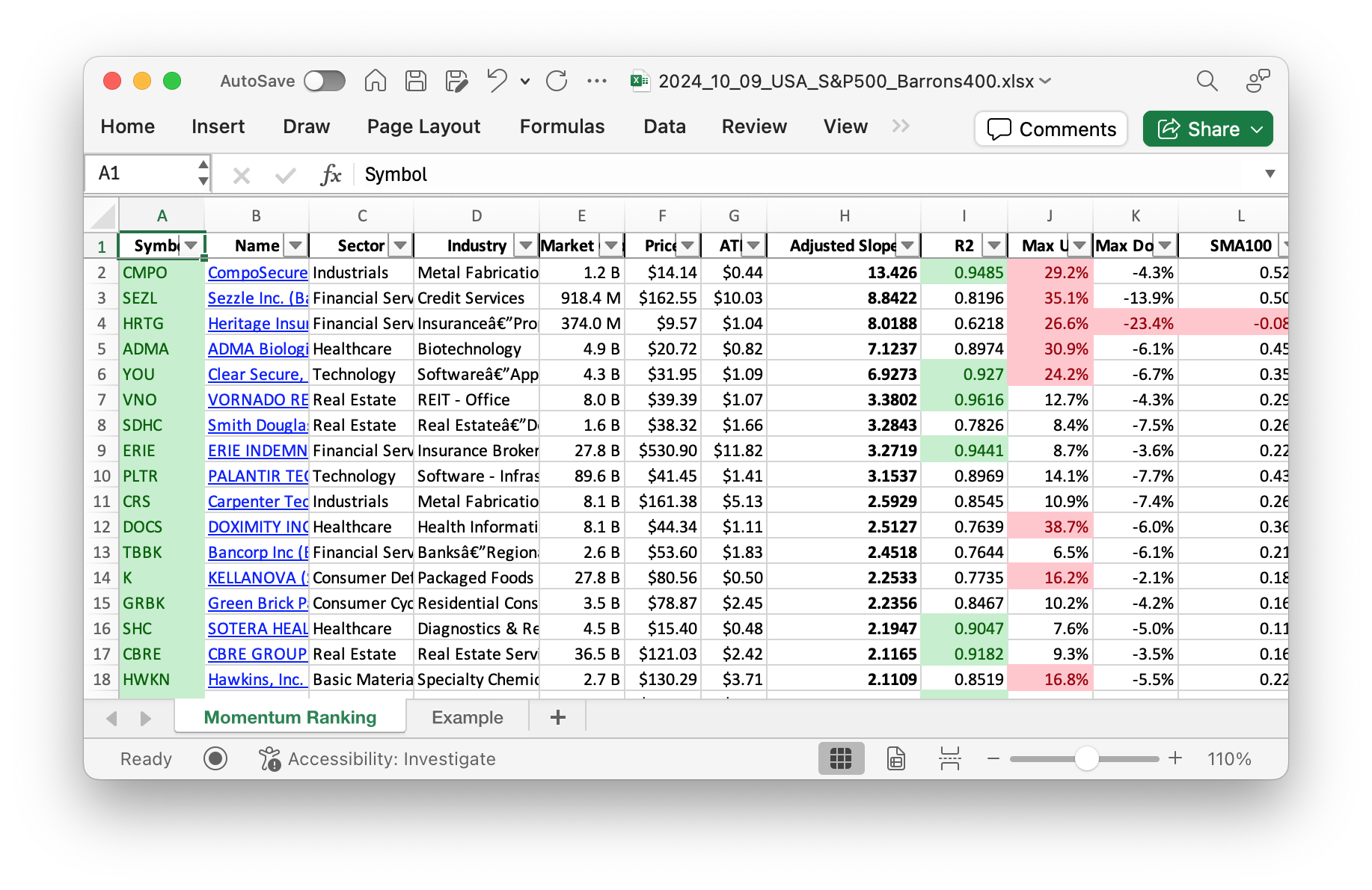

Discover the top-performing stocks of the week with our Momentum Ranking! Click here to access the latest data for week 41.

This week in trading brought a few changes to our portfolio, processed slightly later than usual due to our Trading Tuesday operations moving to Wednesday. Such adjustments keep us nimble in today’s dynamic market environment. Let’s delve into this week’s activities and see how our portfolio fared.

In this week’s trades, we parted ways with HALO, LNTH, and UTHR. On the buying side, we’ve welcomed three promising stocks: CRS, DOCS, and ERIE. Carpenter Technology Corporation (CRS) offers valuable insights into the world of specialty metals, essential for diverse industries. Sharecare Inc. (DOCS), meanwhile, provides digital health solutions, an increasingly relevant sector. Lastly, Erie Indemnity (ERIE) is a key player in the insurance brokerage service, rounding out our new acquisitions. Alongside these additions, we’ve chosen to increase our holdings in some areas, ensuring our strategy remains robust.

Our portfolio currently holds a significant position in cash reserves, indicating a cautious approach during these times. On the performance front, PLTR has been our top performer with a 11.4% gain over the last seven trading days, while ERIE has been the least propitious, with a slight loss of 1.41%. It’s essential to note that the S&P 500 remains comfortably above its 200-day moving average, facilitating strategic buys.

This week’s trading activities reflect our ongoing commitment to the strategy anchored by momentum ranking, as detailed in Andreas Clenow’s ‘Stocks On The Move’. Our focus on high-ranking stocks aims to build a resilient portfolio. We invite you to share your thoughts or any questions about our trading endeavors in the comments section below!

This week’s transactions:

-

Rebalanced / added:

- No positions were added to in this week!

-

Rebalanced / reduced:

- No positions were reduced in this week!

Index Distribution:

At the moment, we are holding mostly cash:

Current portfolio allocation:

Things are a bit quiet in the portfolio, mostly just cash and waiting for the right moment:

Weekly sector distribution:

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| cash | Cash | Cash | Cash | – | 194517 | 0.922 |

| CORT | Corcept Therapeutics Inc | Barrons 400 | Healthcare | 4.73B | -5.03% | 0.015 |

| TPL | Texas Pacific Land Corporation | S&P 400 | Energy | 22.40B | -2.11% | 0.014 |

| ERIE | Erie Indemnity Co. | S&P 500 | Financial Services | 24.82B | -2.59% | 0.013 |

| DOCS | Doximity Inc | S&P 400 | Healthcare | 8.22B | -1.39% | 0.012 |

| PLTR | Palantir Technologies Inc | S&P 500 | Technology | 96.14B | 3.47% | 0.011 |

| TBBK | Bancorp Inc. | Barrons 400 | Financial Services | 2.63B | -2.44% | 0.007 |

| CRS | Carpenter Technology Corp. | Barrons 400 | Industrials | 8.03B | -3.45% | 0.006 |

As always, more trades next week!