There was no trading activity to report this week.

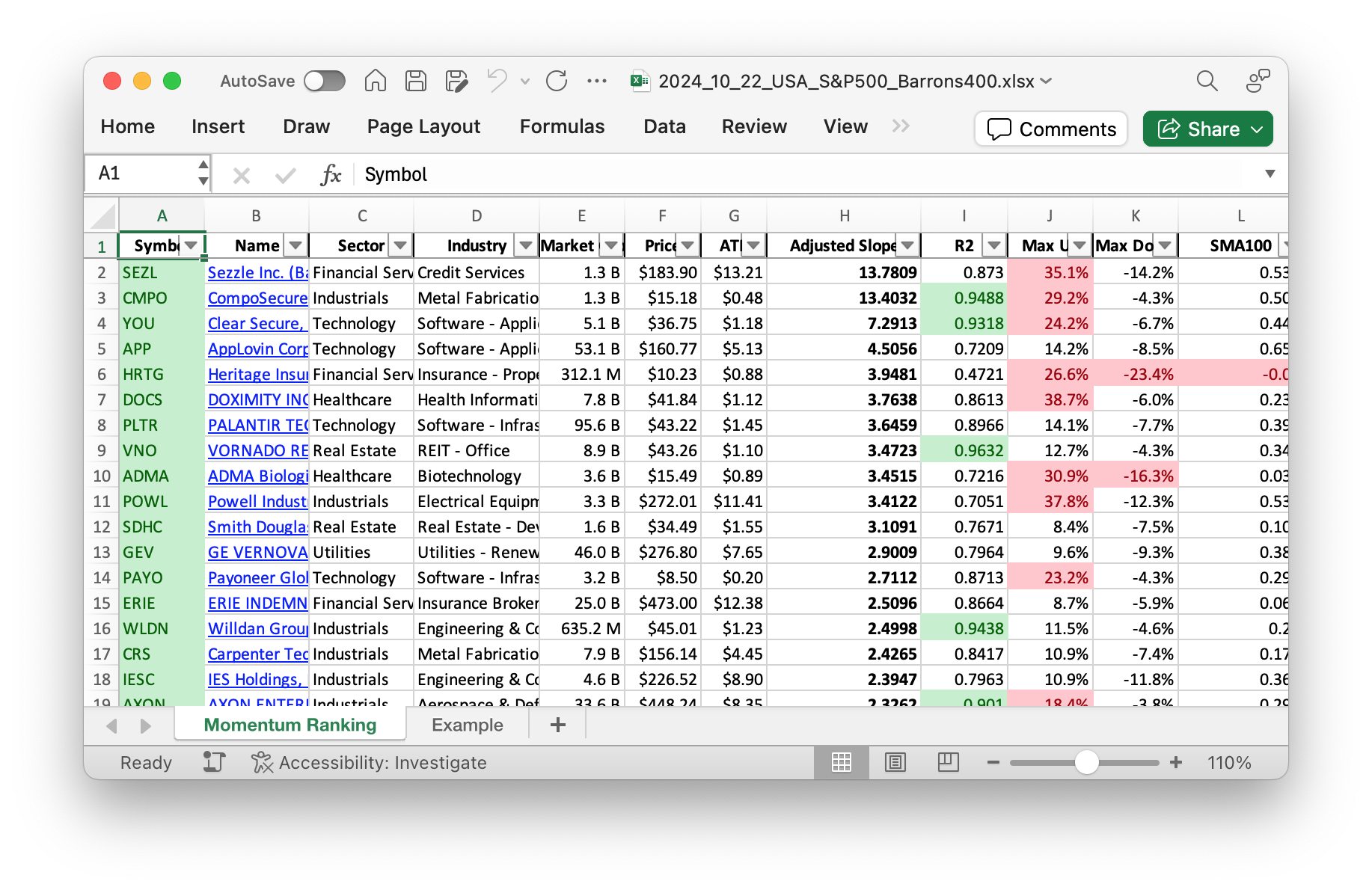

Discover the top-performing stocks of the week with our Momentum Ranking! Click here to access the latest data for week 43.

Weekly Trading Activity Overview

Hello, fellow investors and traders! It’s time to dive into this week’s trading activity. Our strategy, as outlined in Andreas Clenow’s book ‘Stocks On The Move,’ emphasizes a momentum ranking system based on the adjusted slope. By sticking to this, we make smart and calculated investment decisions. This week, the S&P500 continues to trade above its 200-day moving average, marking 244 consecutive days, offering some stability in the market environment.

Buys and Sells Recap

This week, our portfolio remained steady without any new trades. We chose not to introduce any fresh stocks into our holdings. No stocks were sold or rebalanced, either. Consequently, a significant portion of our portfolio remains in cash. Holding cash reserves provides us with the flexibility to act when opportunities align with our strategy.

Performance Summary and Outlook

The healthcare and real estate sectors currently host our notable holdings, such as CORT and TPL. This week’s highlight is CORT, which enjoyed a gain of 8.1%. However, it’s important to acknowledge that not all stocks performed well; ERIE experienced a decline of 10.6% over the last week. Despite minor fluctuations, our portfolio’s momentum-based approach continues to guide us in navigating the market effectively.

In conclusion, maintaining a disciplined strategy is crucial, especially in a market without new trading signals. While the biggest share of our portfolio remains in cash, ready for future opportunities, our top performers like CORT demonstrate the strength of our method. We encourage you to continue monitoring market trends and share your thoughts or questions in the comments below. Happy trading, and see you next week!

This week’s transactions:

-

Sold:

- No sells in this week!

-

Bought:

- No buys in this week!

-

Rebalanced / added:

- No positions were added to in this week!

-

Rebalanced / reduced:

- No positions were reduced in this week!

Index Distribution:

At the moment, we are holding mostly cash:

Current portfolio allocation:

We’re kind of just hoarding cash in the portfolio at the moment:

Weekly sector distribution:

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| cash | Cash | Cash | Cash | – | 207818 | 0.926 |

| CORT | Corcept Therapeutics Inc | Barrons 400 | Healthcare | 5.16B | -1.43% | 0.016 |

| TPL | Texas Pacific Land Corporation | S&P 400 | Energy | 25.05B | 0.60% | 0.014 |

| PLTR | Palantir Technologies Inc | S&P 500 | Technology | 96.12B | -3.31% | 0.011 |

| ERIE | Erie Indemnity Co. | S&P 500 | Financial Services | 22.07B | -13.37% | 0.011 |

| DOCS | Doximity Inc | S&P 400 | Healthcare | 7.75B | -6.97% | 0.01 |

| TBBK | Bancorp Inc. | Barrons 400 | Financial Services | 2.74B | -5.52% | 0.007 |

| CRS | Carpenter Technology Corp. | Barrons 400 | Industrials | 7.77B | -6.57% | 0.006 |

As always, more trades next week!