This week was uneventful in terms of trading - no new buys or sells.

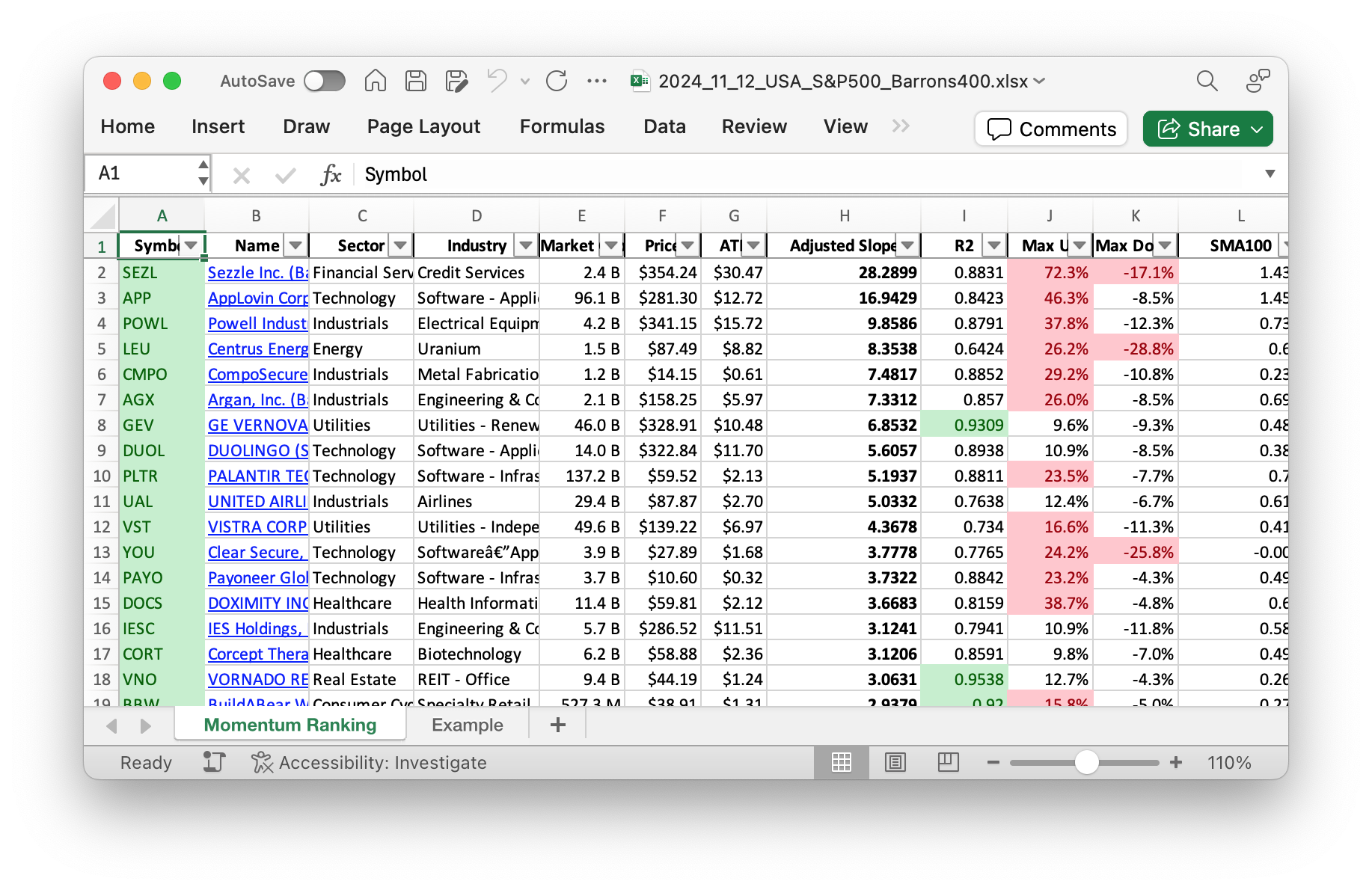

Looking for reliable stock performance data? Check out our weekly Momentum Ranking (based on Andreas Clenow’s book Stocks on the Move), updated every week with the latest figures! Click here to see the report for week 46.

This Week’s Trading Recap

In the world of systematic trading, patience is key. This week has been a calm one for our portfolio, with no new trades taking place. Our strategy, inspired by Andreas Clenow’s book ‘Stocks On The Move’, involves ranking stocks by their annualized adjusted slope to identify top performers. It’s a systematic approach to momentum investing, ensuring we only hold onto the strongest stocks.

The majority of our portfolio remains in cash. This conscious choice reflects the current market conditions, as we see the S&P 500 standing above its 200-day moving average for 259 days. Additionally, no stocks were sold or added to our portfolio this week. As a result, cash, along with some top holdings like AppLovin (APP) and Texas Pacific Land Corporation (TPL), dominates our allocations.

Over the past week, the best-performer has been APP with a respectable gain. On the other hand, holdings in cash have remained flat with no change. Despite the lack of trading activity, it’s important to maintain a disciplined approach, continuously monitoring the portfolio for potential opportunities.

In summary, while this week didn’t see any buying or selling, it reinforces the value of sticking to a well-defined trading strategy. We appreciate our readers’ ongoing engagement and invite you to share your thoughts or questions in the comments. Remember, staying informed and disciplined is crucial in navigating the financial markets.

This week’s transactions:

-

Sold:

- No sells in this week!

-

Bought:

- No buys in this week!

-

Rebalanced / added:

- No positions were added to in this week!

-

Rebalanced / reduced:

- No positions were reduced in this week!

Index Distribution:

At the moment, we are holding mostly cash:

Current portfolio allocation:

At the moment, the majority of the portfolio is in cash:

Weekly sector distribution:

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| cash | Cash | Cash | Cash | – | 201924 | 0.9 |

| APP | Applovin Corp | Barrons 400 | Technology | 95.60B | -2.73% | 0.026 |

| TPL | Texas Pacific Land Corporation | S&P 400 | Energy | 32.05B | -1.60% | 0.019 |

| CORT | Corcept Therapeutics Inc | Barrons 400 | Healthcare | 6.06B | -6.22% | 0.019 |

| PLTR | Palantir Technologies Inc | S&P 500 | Technology | 135.45B | -4.22% | 0.015 |

| DOCS | Doximity Inc | S&P 400 | Healthcare | 10.86B | -4.30% | 0.015 |

| CRS | Carpenter Technology Corp | Barrons 400 | Industrials | 8.84B | -2.79% | 0.006 |

As always, more trades next week!