There was no trading activity to report this week.

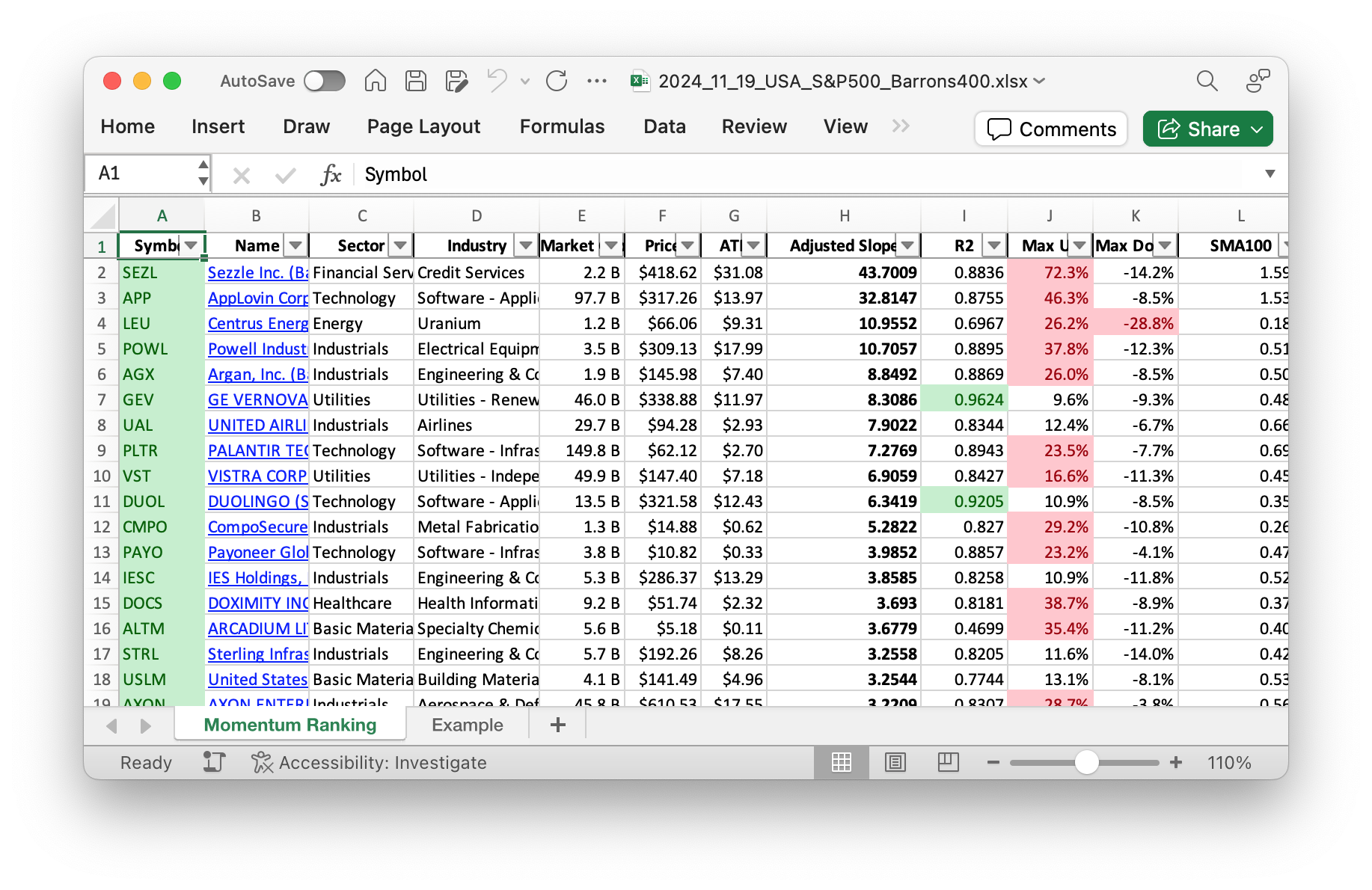

Discover the top-performing stocks of the week with our Momentum Ranking! Click here to access the latest data for week 47.

This Week’s Trading Activity Breakdown

This week in the market, our strategy remains tied closely to Andreas Clenow’s “Stocks On The Move.” The S&P 500, holding strong for 264 days above its 200-day moving average, sets the tone for our trading decisions. The discipline of using the annualized adjusted slope to rank stocks continues to help us make informed investment choices.

In terms of trading activity, this week was relatively quiet, with no new buys or sells occurring. However, we did rebalance some of our existing holdings, adding to our positions in Carpenter Technology Corporation (CRS) and Doximity (DOCS). This strategic increase aligns with our momentum-based approach, ensuring that our portfolio remains robust and in tune with market movements.

At the moment, our portfolio holds a significant portion in cash, underscoring our cautious stance in the current market. The cash reserves provide flexibility and security should the market sentiment shift. Meanwhile, our top holdings include AppLovin Corporation (APP) and Carpenter Technology Corporation (CRS), which are poised to benefit from their respective market conditions. Over the past seven trading days, Palantir Technologies Inc. (PLTR) was the best performer with a small but notable gain, while Corcept Therapeutics Incorporated (CORT) experienced some losses.

In summary, this week was about strengthening our current positions, reflecting a strategic pause on new acquisitions due to the market’s status. We continue to leverage the adjusted slope strategy, anticipating shifts with a mix of patience and readiness. As we look ahead, we invite readers to share their thoughts and queries in the comments below. Your insights are invaluable to us as we navigate the dynamic world of trading together.

This week’s transactions:

-

Sold:

- No sells in this week!

-

Bought:

- No buys in this week!

-

Rebalanced / added:

-

Rebalanced / reduced:

- No positions were reduced in this week!

Index Distribution:

At the moment, we are holding mostly cash:

Current portfolio allocation:

Things are a bit quiet in the portfolio, mostly just cash and waiting for the right moment:

Weekly sector distribution:

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| cash | Cash | Cash | Cash | – | 136986 | 0.842 |

| APP | Applovin Corp | Barrons 400 | Technology | 107.09B | 5.47% | 0.037 |

| CRS | Carpenter Technology Corp | Barrons 400 | Industrials | 9.17B | 0.78% | 0.029 |

| TPL | Texas Pacific Land Corporation | S&P 400 | Energy | 32.35B | -0.91% | 0.026 |

| CORT | Corcept Therapeutics Inc | Barrons 400 | Healthcare | 5.64B | -12.67% | 0.023 |

| DOCS | Doximity Inc | S&P 400 | Healthcare | 9.64B | -16.34% | 0.022 |

| PLTR | Palantir Technologies Inc | S&P 500 | Technology | 142.23B | -5.40% | 0.021 |

As always, more trades next week!