Our market activity this week included 1 new trades: 1 buys and 0 sells.

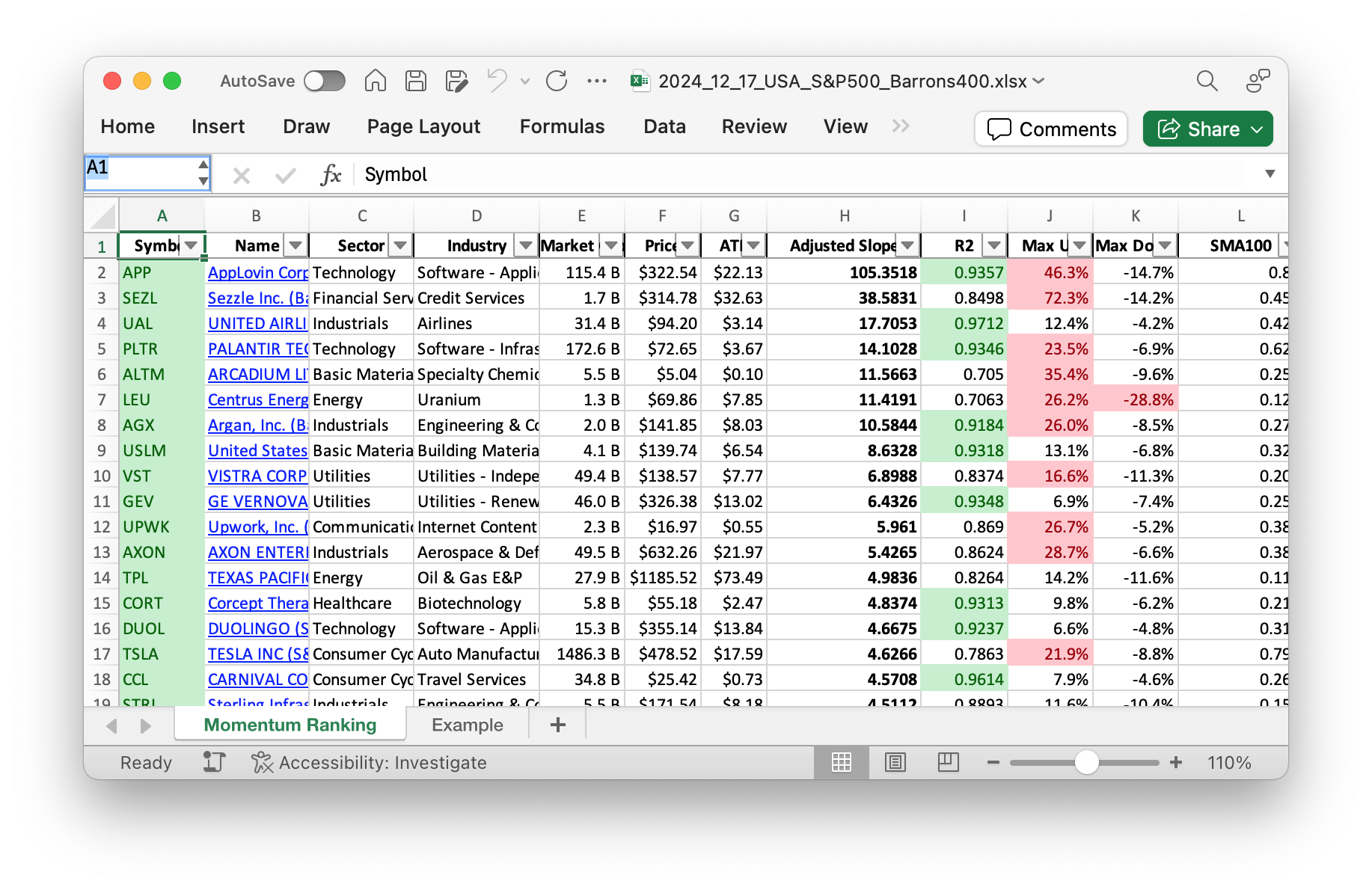

Discover the top-performing stocks of the week with our Momentum Ranking! Click here to access the latest data for week 51.

Momentum Investing: This Week’s Trading Activity

This week in our momentum trading portfolio, we’ve seen some changes that reflect our data-driven strategy illustrated in Andreas Clenow’s book, ‘Stocks On The Move’. The S&P 500 continues to trade above its 200-day moving average for the 283rd day, a positive indication allowing us to seek new opportunities. Our method focuses on the annualized adjusted slope to rank stocks. We hold stocks that are top-ranked and replace them as necessary.

In trading activity this week, we’ve integrated Apollo Global Management (APO) into our portfolio. Apollo, a prominent player in the financial sector, is known for its private equity, credit, and real estate investment strategies. We’ve opted to rebalance and reduce positions in Sterling Infrastructure (STRL), United Airlines (UAL), and Vertiv Holdings Co. (VRT). APO joins PAYO and UAL as top holdings, showcasing our focus on the industrious sector, specifically tapping into financial growth and mobility.

Our strongest performer this week is Clearway Energy (CMPO), with a modest gain, while our weakest is IES Holdings (IESC), experiencing a significant dip. These fluctuations are natural in momentum investing, where maintaining a diversified portfolio can balance out individual stock volatility.

To sum up this week’s activity, our portfolio management aligns closely with the momentum strategy, making calculated adjustments based on rigorous analysis. Even with market fluctuations, we maintain confidence in our balanced approach. We’d love to hear your thoughts or questions in the comments below. Let’s keep this conversation going!

This week’s transactions:

-

Sold:

- No sells in this week!

-

Bought:

Index Distribution:

Right now, most of the stocks in our portfolio are from the Barrons 400 category.

Current portfolio allocation:

Right now, the Industrials sector is where most of our money is at.

Weekly sector distribution:

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| APO | Apollo Global Management Inc | Barrons 400 | Financial Services | 98.41B | -8.22% | 0.071 |

| PAYO | Payoneer Global Inc | Barrons 400 | Technology | 3.69B | -8.41% | 0.064 |

| UAL | United Airlines Holdings Inc | S&P 500 | Industrials | 30.98B | -10.38% | 0.058 |

| UPWK | Upwork Inc | Barrons 400 | Communication Services | 2.26B | -4.87% | 0.057 |

| LITE | Lumentum Holdings Inc | S&P 400 | Technology | 6.14B | -7.07% | 0.053 |

| DUOL | Duolingo Inc | S&P 400 | Technology | 15.71B | -5.62% | 0.053 |

| GEV | GE Vernova Inc | S&P 500 | Utilities | 89.62B | -8.96% | 0.051 |

| ALTM | Arcadium Lithium PLC | S&P 400 | Basic Materials | 5.42B | -30.63% | 0.051 |

| CCL | Carnival Corp | S&P 500 | Consumer Cyclical | 32.09B | -5.82% | 0.051 |

| AXON | Axon Enterprise Inc | S&P 500 | Industrials | 48.51B | -8.95% | 0.049 |

| CORT | Corcept Therapeutics Inc | Barrons 400 | Healthcare | 5.75B | -11.83% | 0.048 |

| DOCS | Doximity Inc | S&P 400 | Healthcare | 9.85B | -14.58% | 0.047 |

| CMPO | CompoSecure Inc | Barrons 400 | Industrials | 1.56B | -5.01% | 0.047 |

| USLM | United States Lime & Minerals Inc | Barrons 400 | Basic Materials | 3.95B | -13.45% | 0.046 |

| NCLH | Norwegian Cruise Line Holdings Ltd | S&P 500 | Consumer Cyclical | 11.54B | -8.38% | 0.041 |

| VST | Vistra Corp | S&P 500 | Utilities | 46.58B | -18.84% | 0.033 |

| PLTR | Palantir Technologies Inc | S&P 500 | Technology | 166.50B | -9.67% | 0.032 |

| AGX | Argan, Inc | Barrons 400 | Industrials | 1.92B | -14.63% | 0.025 |

| TPL | Texas Pacific Land Corporation | S&P 500 | Energy | 27.15B | -33.20% | 0.023 |

| VRT | Vertiv Holdings Co | Barrons 400 | Industrials | 45.27B | -17.20% | 0.022 |

| IESC | IES Holdings Inc | Barrons 400 | Industrials | 4.25B | -33.47% | 0.021 |

| STRL | Sterling Infrastructure Inc | Barrons 400 | Industrials | 5.26B | -15.88% | 0.02 |

| APP | Applovin Corp | Barrons 400 | Technology | 110.06B | -21.47% | 0.02 |

| cash | Cash | Cash | Cash | – | 835 | 0.016 |

As always, more trades next week!