Over the course of the week, we made 1 new trades - 1 buy(s) and 0 sell(s).

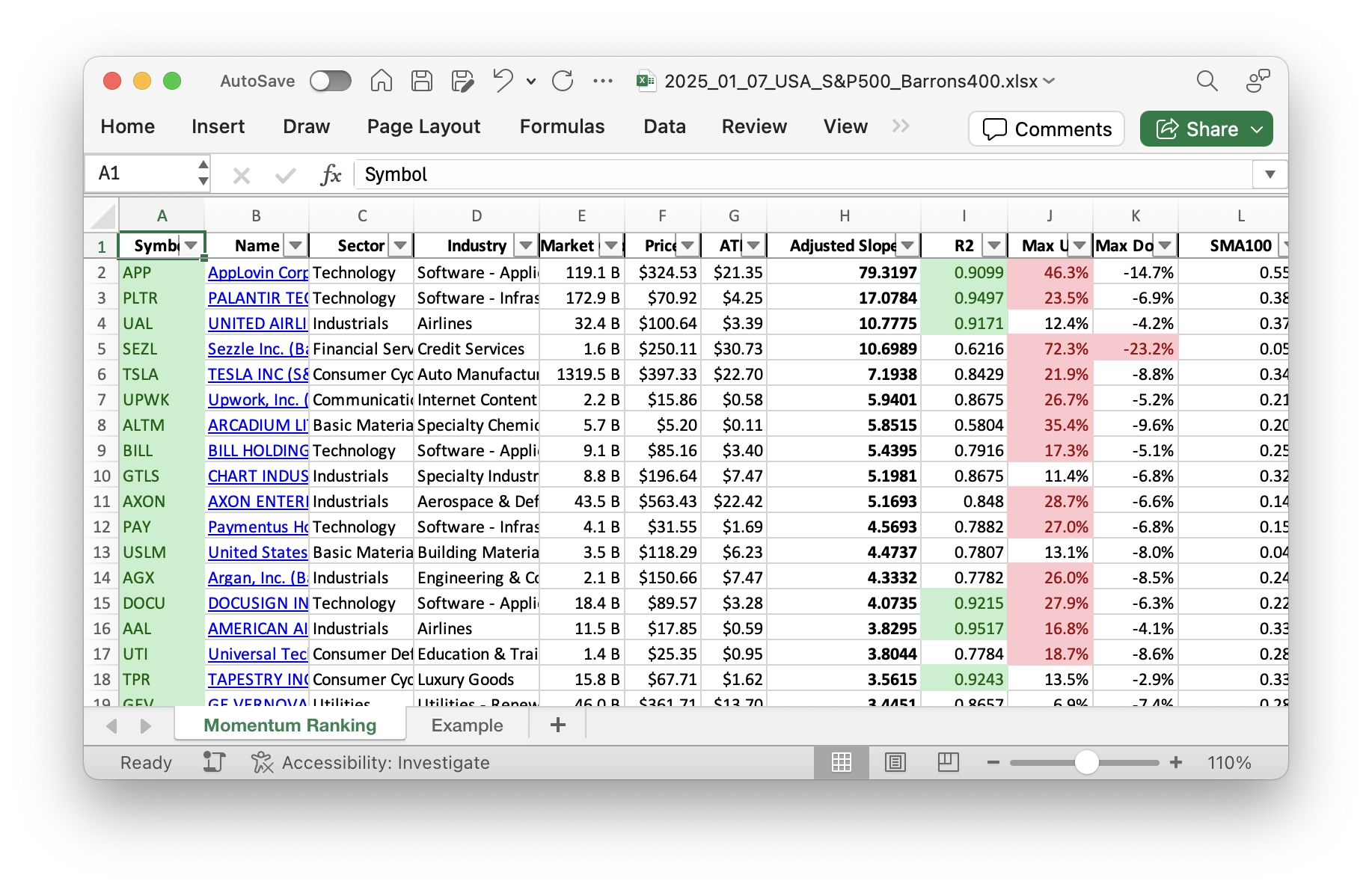

Want to stay on top of the market trends? Our Momentum Ranking report highlights the top stocks of the week, so you don’t have to! Click here to access the latest data for week 02.

A Look at This Week’s Trading Activity: Starting 2025 Strong

Happy New Year, fellow investors! As we step into the first week of 2025, the S&P 500 continues its robust stance, marking 296 positive days above the 200-day moving average. This momentum allows us to explore new buy opportunities while adhering to our strategic approach described in Andreas Clenow’s ‘Stocks On The Move’. The focus is on momentum ranking using the annualized adjusted slope.

This week, we saw some portfolio adjustments. We introduced American Airlines Group (AAL) into our holdings. This major player in the airline industry is known for its extensive domestic and international operations. Our momentum strategy pointed towards AAL as it climbed to the top ranks. Several existing stocks were also rebalanced or added to. These include AGX, LITE, STRL, USLM, and VRT. Meanwhile, positions in AXON, CCL, PAY, and UPWK were slightly reduced.

Our portfolio remains heavily weighted in the Industrials sector, with top holdings like PAYO, UAL, and GEV leading our charge. Over the past week, VST emerged as the best performer, posting a gain of 13.77%. On the flip side, USLM registered a negative return of 11.47%, marking it as the week’s least performer.

To sum up, this week has been a balanced mix of strategic buys and portfolio rebalancing, guided by our momentum strategy. As we maintain a strong position in Industrials, our eyes remain open for upcoming trends. We invite you to share your thoughts or questions in the comments below. Here’s to a prosperous year of trading!

This week’s transactions:

-

Sold:

- No sells in this week!

-

Bought:

Index Distribution:

We have a lot of stocks from the Barrons 400 index in our portfolio at the moment.

Current portfolio allocation:

Our portfolio is heavily invested in the Industrials sector right now.

Weekly sector distribution:

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| PAYO | Payoneer Global Inc | Barrons 400 | Technology | 3.64B | -9.52% | 0.065 |

| UAL | United Airlines Holdings Inc | S&P 500 | Industrials | 33.36B | -3.48% | 0.061 |

| GEV | GE Vernova Inc | S&P 500 | Utilities | 101.51B | -2.14% | 0.057 |

| GTLS | Chart Industries Inc | S&P 400 | Industrials | 8.62B | -4.47% | 0.056 |

| ALTM | Arcadium Lithium PLC | S&P 400 | Basic Materials | 5.67B | -24.80% | 0.053 |

| DOCS | Doximity Inc | S&P 400 | Healthcare | 10.40B | -9.82% | 0.051 |

| LITE | Lumentum Holdings Inc | S&P 400 | Technology | 5.94B | -10.16% | 0.046 |

| AAL | American Airlines Group Inc | S&P 400 | Industrials | 11.63B | -2.75% | 0.044 |

| CMPO | CompoSecure Inc | Barrons 400 | Industrials | 1.46B | -14.12% | 0.043 |

| VRT | Vertiv Holdings Co | Barrons 400 | Industrials | 49.47B | -9.51% | 0.042 |

| STRL | Sterling Infrastructure Inc | Barrons 400 | Industrials | 5.13B | -17.96% | 0.041 |

| NCLH | Norwegian Cruise Line Holdings Ltd | S&P 500 | Consumer Cyclical | 11.14B | -11.53% | 0.04 |

| AGX | Argan, Inc | Barrons 400 | Industrials | 2.03B | -9.72% | 0.039 |

| VST | Vistra Corp | S&P 500 | Utilities | 55.37B | -3.52% | 0.038 |

| USLM | United States Lime & Minerals Inc | Barrons 400 | Basic Materials | 3.40B | -25.48% | 0.038 |

| PAY | Paymentus Holdings Inc | Barrons 400 | Technology | 3.96B | -18.46% | 0.038 |

| APO | Apollo Global Management Inc | S&P 500 | Financial Services | 92.69B | -13.55% | 0.033 |

| PLTR | Palantir Technologies Inc | S&P 500 | Technology | 161.65B | -16.32% | 0.032 |

| UPWK | Upwork Inc | Barrons 400 | Communication Services | 2.11B | -13.04% | 0.027 |

| BILL | BILL Holdings Inc | S&P 400 | Technology | 8.68B | -14.30% | 0.025 |

| TPL | Texas Pacific Land Corporation | S&P 500 | Energy | 29.36B | -27.76% | 0.024 |

| AXON | Axon Enterprise Inc | S&P 500 | Industrials | 42.82B | -19.63% | 0.022 |

| CCL | Carnival Corp | S&P 500 | Consumer Cyclical | 29.92B | -12.33% | 0.021 |

| CORT | Corcept Therapeutics Inc | Barrons 400 | Healthcare | 5.31B | -18.50% | 0.021 |

| APP | Applovin Corp | Barrons 400 | Technology | 110.26B | -21.33% | 0.021 |

| DUOL | Duolingo Inc | S&P 400 | Technology | 14.24B | -14.49% | 0.02 |

| cash | Cash | Cash | Cash | – | 165 | 0.003 |

As always, more trades next week!