This week, we executed 9 new trades, including 2 buy(s) and 7 sell(s).

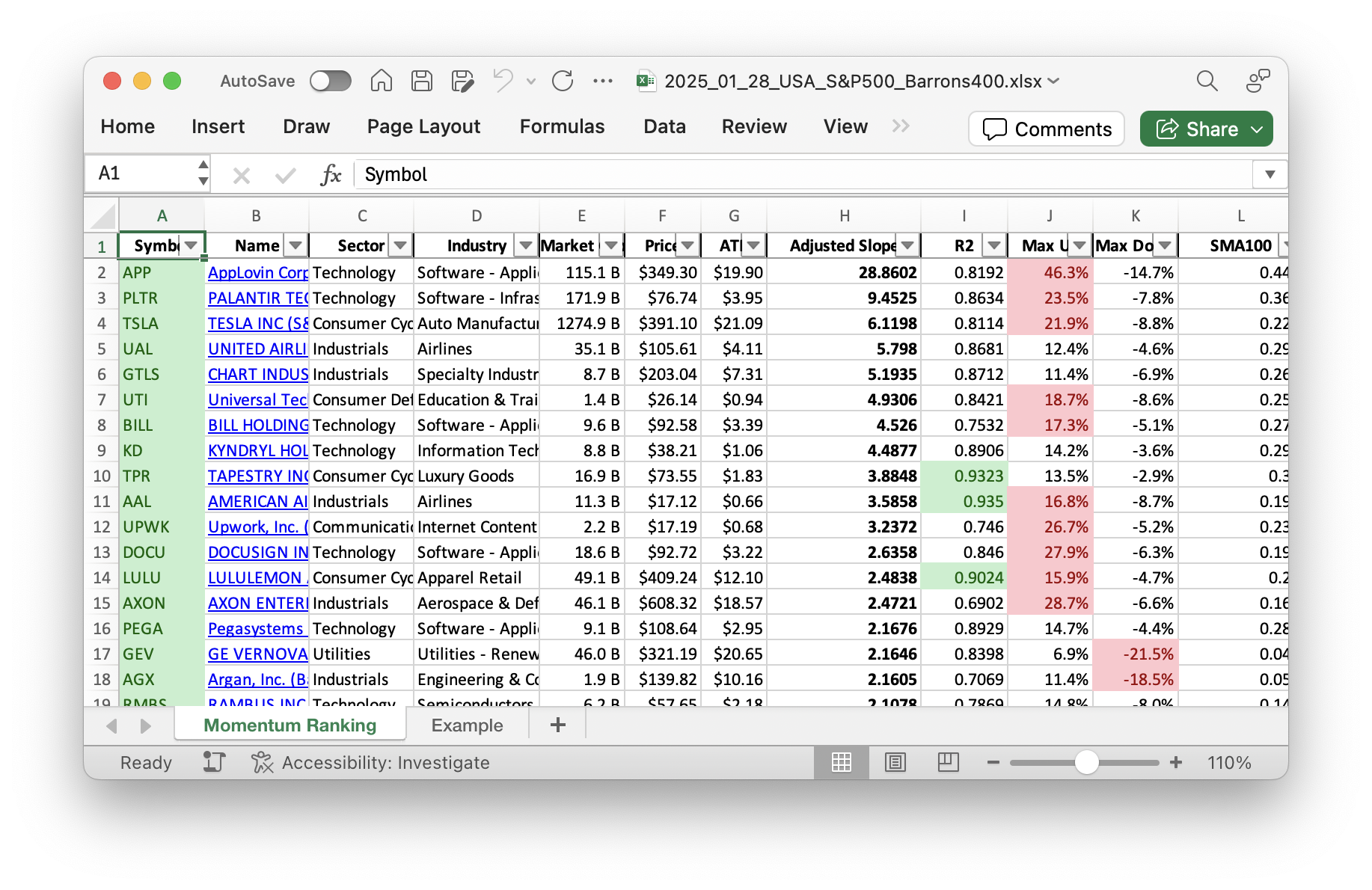

Looking for reliable stock performance data? Check out our weekly Momentum Ranking (based on Andreas Clenow’s book Stocks on the Move), updated every week with the latest figures! Click here to see the report for week 05.

Introduction

Hello fellow investors! This week’s trading activity was quite significant due to some unexpected news. The S&P 500 continues its positive streak, staying above its 200-day moving average for 309 days. However, recent market events have led to some changes in our portfolio. Let’s dive into the details.

Buys/Sells

This week, the news about DeepSeek impacted our holdings, prompting us to make several adjustments. Stocks such as $VRT and $VST, which fell over 15%, were sold at a loss. Additionally, several other stocks slipped below their 100-day moving averages, leading to further sells: AGX, GEV, GTLS, STRL, and USLM. On a brighter note, we added new positions in TPR and KD to our portfolio. TPR, short for Tapestry, Inc., is a leading global house of brands specializing in luxury fashion and accessories, while KD, Kyndryl Holdings, operates in the IT infrastructure services market. We also rebalanced and increased our holdings in AXON and UPWK. Our portfolio remains tech-heavy, with companies like Tapestry, Kyndryl Holdings, and Payoneer Global ($PAYO) at the forefront.

Summary

This week saw a very busy period of trading with significant shifts within our portfolio. Our best-performing stock for the week was CORT, which gained 10.76%, while our worst performer was LITE, experiencing a 16.99% loss. Despite the large sell-off, we’re maintaining strategic cash reserves, reflecting our adaptive and cautious approach. Our momentum-driven strategy, as detailed in Andreas Clenow’s “Stocks On The Move,” continues to guide our decisions, emphasizing the importance of staying among the top-ranked stocks.

Overall, it was a challenging week with several portfolio changes. However, we’re optimistic about the new additions and the continued strength of our top holdings. We would love to hear your thoughts or questions about this week’s activities. Feel free to share in the comments below!

This week’s transactions:

Index Distribution:

Our portfolio is currently dominated by stocks from the S&P 500 index.

Current portfolio allocation:

Right now, we’ve got a big chunk of our portfolio in the Technology sector.

Weekly sector distribution:

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| TPR | Tapestry Inc | S&P 500 | Consumer Cyclical | 17.14B | -2.96% | 0.079 |

| KD | Kyndryl Holdings Inc | S&P 400 | Technology | 8.94B | -2.71% | 0.071 |

| PAYO | Payoneer Global Inc | Barrons 400 | Technology | 3.69B | -8.36% | 0.065 |

| AXON | Axon Enterprise Inc | S&P 500 | Industrials | 47.43B | -10.97% | 0.06 |

| ALTM | Arcadium Lithium PLC | S&P 400 | Basic Materials | 6.16B | -0.61% | 0.059 |

| cash | Cash | Cash | Cash | – | 2946 | 0.058 |

| UAL | United Airlines Holdings Inc | S&P 500 | Industrials | 34.57B | -9.38% | 0.057 |

| BILL | BILL Holdings Inc | S&P 400 | Technology | 9.81B | -3.16% | 0.057 |

| AAL | American Airlines Group Inc | S&P 400 | Industrials | 11.35B | -9.61% | 0.056 |

| CORT | Corcept Therapeutics Inc | Barrons 400 | Healthcare | 6.29B | -4.69% | 0.054 |

| UPWK | Upwork Inc | Barrons 400 | Communication Services | 2.30B | -5.07% | 0.049 |

| NCLH | Norwegian Cruise Line Holdings Ltd | S&P 500 | Consumer Cyclical | 12.09B | -3.96% | 0.042 |

| UTI | Universal Technical Institute Inc | Barrons 400 | Consumer Defensive | 1.42B | -4.25% | 0.042 |

| LITE | Lumentum Holdings Inc | S&P 400 | Technology | 5.29B | -25.99% | 0.038 |

| PAY | Paymentus Holdings Inc | Barrons 400 | Technology | 3.71B | -23.60% | 0.035 |

| APO | Apollo Global Management Inc | S&P 500 | Financial Services | 95.05B | -11.35% | 0.033 |

| PLTR | Palantir Technologies Inc | S&P 500 | Technology | 176.43B | -8.66% | 0.033 |

| DOCS | Doximity Inc | S&P 400 | Healthcare | 10.56B | -8.37% | 0.025 |

| TPL | Texas Pacific Land Corporation | S&P 500 | Energy | 28.74B | -29.29% | 0.025 |

| CCL | Carnival Corp | S&P 500 | Consumer Cyclical | 33.90B | -0.35% | 0.023 |

| APP | Applovin Corp | Barrons 400 | Technology | 120.66B | -13.91% | 0.02 |

| DUOL | Duolingo Inc | S&P 400 | Technology | 15.00B | -9.92% | 0.019 |

As always, more trades next week!