This week, we did 6 new trades: 3 buy(s) and 3 sell(s).

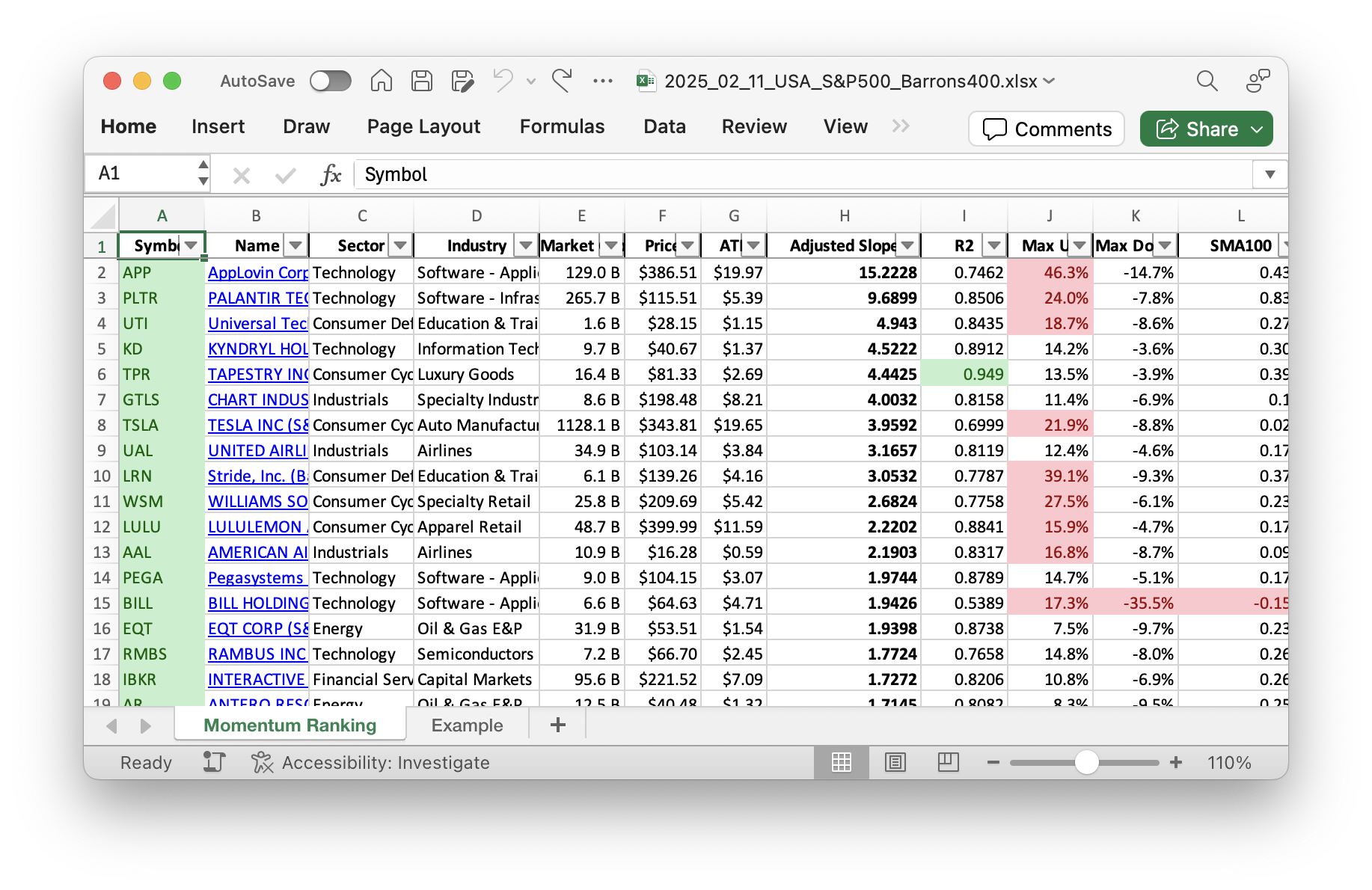

Click here for the Momentum Ranking of week 07.

This Week in Trading: Balancing Momentum and Strategy

This week brought some excitement to our momentum-based portfolio. We’re staying on top of the i ebb and flow of the stock market to ensure long-term growth and stability. Our strategy, inspired by Andreas Clenow’s ‘Stocks On The Move’, saw us rebalancing our holdings while being cautious with new buys. The S&P 500 remains above its 200-day moving average for the 319th day in a row, greenlighting new transactions according to our rules.

New Buys and Strategic Sells

This week, we made several key movements. We welcomed three new stocks into our portfolio: EQT Corporation, Lululemon Athletica, and Pegasystems. EQT Corporation, a natural gas company, gained traction thanks to strong sector momentum. Lululemon, a leader in the athletic apparel industry, continues to impress with brand loyalty and innovation. Pegasystems, known for its software solutions, rounds out our buys due to its potential for growth in the tech sector.

On the selling side, we parted ways with ALTM, BILL, and TPL. Each of these stocks no longer held top positions in our adjusted slope ranking or fell below critical moving averages. As part of the strategy, these stocks were released from our portfolio to maintain a focus on promising avenues.

Additionally, rebalancing saw us increasing our stakes in CCL and PAY, while reducing our positions in APO, DOCS, GTLS, PLTR, and TPR. Notably, DOCS experienced a significant 20% boost, showing strong upward momentum. Unfortunately, BILL faced a 20% decline, contributing to its departure.

Weekly Wrap-Up and Insights

The technology sector continues to dominate our portfolio, with top holdings such as KD, EQT, and PEGA. PLTR emerged as our best-performing stock with an impressive gain, while NCLH took the hit as the worst performer. Our cash reserves offer flexibility to tap into new opportunities when aligned with our strategy filter.

Overall, this week was marked by careful adjustments and strategic decisions to align with our momentum approach. Let us know your thoughts or questions in the comments; we’re eager to engage with fellow investors.

This week’s transactions:

Index Distribution:

We’re mainly invested in stocks from the S&P 500 group at the moment.

Current portfolio allocation:

The Technology sector is currently our top dog in terms of portfolio allocation.

Weekly sector distribution:

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| KD | Kyndryl Holdings Inc | S&P 400 | Technology | 9.43B | -7.09% | 0.071 |

| EQT | EQT Corp | S&P 500 | Energy | 31.89B | -2.55% | 0.068 |

| PEGA | Pegasystems Inc | Barrons 400 | Technology | 8.93B | -8.37% | 0.067 |

| LULU | Lululemon Athletica inc | S&P 500 | Consumer Cyclical | 50.69B | -16.94% | 0.066 |

| PAYO | Payoneer Global Inc | Barrons 400 | Technology | 3.60B | -10.54% | 0.062 |

| AXON | Axon Enterprise Inc | S&P 500 | Industrials | 50.62B | -4.98% | 0.062 |

| TPR | Tapestry Inc | S&P 500 | Consumer Cyclical | 16.77B | -7.81% | 0.058 |

| CORT | Corcept Therapeutics Inc | Barrons 400 | Healthcare | 7.24B | -3.13% | 0.055 |

| UAL | United Airlines Holdings Inc | S&P 500 | Industrials | 33.92B | -11.09% | 0.052 |

| DUOL | Duolingo Inc | S&P 400 | Technology | 17.30B | -4.47% | 0.051 |

| PAY | Paymentus Holdings Inc | Barrons 400 | Technology | 3.93B | -19.11% | 0.049 |

| UTI | Universal Technical Institute Inc | Barrons 400 | Consumer Defensive | 1.53B | -7.76% | 0.043 |

| CCL | Carnival Corp | S&P 500 | Consumer Cyclical | 33.03B | -11.30% | 0.043 |

| NCLH | Norwegian Cruise Line Holdings Ltd | S&P 500 | Consumer Cyclical | 11.41B | -11.39% | 0.039 |

| DOCS | Doximity Inc | S&P 400 | Healthcare | 14.21B | -11.12% | 0.035 |

| APO | Apollo Global Management Inc | S&P 500 | Financial Services | 89.03B | -16.96% | 0.033 |

| PLTR | Palantir Technologies Inc | S&P 500 | Technology | 261.93B | -1.52% | 0.032 |

| AAL | American Airlines Group Inc | S&P 400 | Industrials | 10.68B | -14.87% | 0.027 |

| GTLS | Chart Industries Inc | S&P 400 | Industrials | 8.55B | -9.19% | 0.026 |

| UPWK | Upwork Inc | Barrons 400 | Communication Services | 2.10B | -13.56% | 0.022 |

| APP | Applovin Corp | Barrons 400 | Technology | 126.34B | -9.86% | 0.021 |

| cash | Cash | Cash | Cash | – | 1021 | 0.019 |

As always, more trades next week!