Our activity in the market this week involved 6 new trades, specifically 3 buy(s) and 3 sell(s).

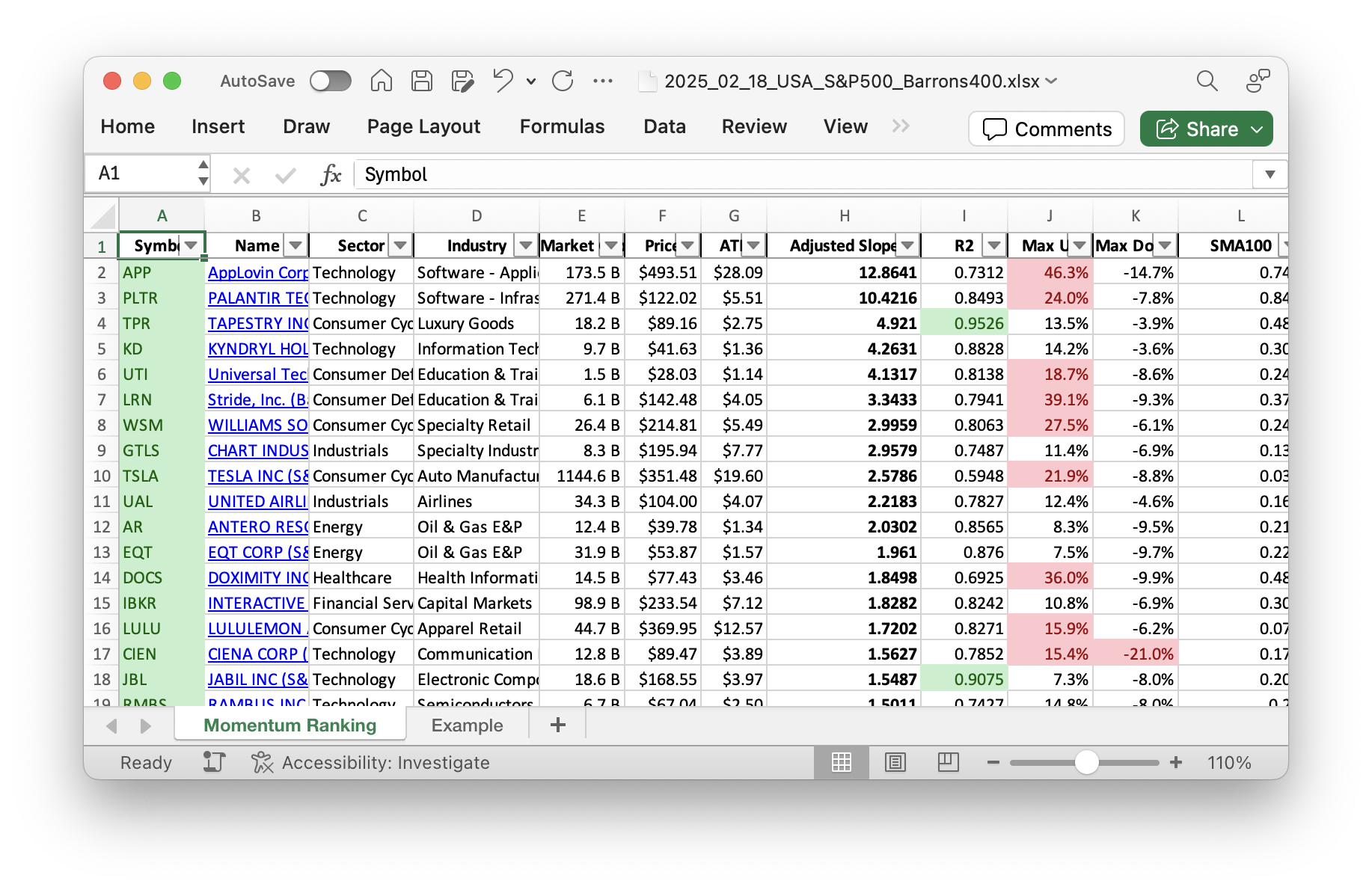

Click here for the Momentum Ranking of week 08.

This Week in Trading: Momentum and Market Shifts

This week, the S&P 500 continues to trade above its 200-day moving average, marking an impressive 323 consecutive days. In our momentum-based trading strategy, as outlined by Andreas Clenow in ‘Stocks On The Move’, this allows us to consider new buying opportunities. With technology as the leading sector in our portfolio—featuring top stocks like Williams-Sonoma (WSM), Stride Inc. (LRN), and EQT Corporation—all indicators point towards an active trading environment.

Buys and Sells: A Week of Strategic Moves

In keeping with our strategy, we added a few fresh faces to the portfolio and said goodbye to some others. New Buys: Williams-Sonoma (WSM), a home furnishing giant, joined our portfolio for its robust performance in the consumer discretionary sector. Stride Inc. (LRN), an innovative player in the education technology sector, offers online learning solutions, making it a perfect addition. Last but not least, Antero Resources (AR), excelling in the energy sector, was added due to rising momentum.

Sells: We parted ways with Apollo Global Management (APO), Norwegian Cruise Line Holdings (NCLH), and Pegasystems (PEGA). These stocks no longer met our top-ranking momentum criteria.

The portfolio also witnessed a reshuffle with Rebalances: We increased our holdings in Upwork Inc. (UPWK) to capitalize on its growth, while reducing stakes in Carnival Corp (CCL), Corcept Therapeutics (CORT), Kyndryl Holdings (KD), and Lululemon Athletica (LULU). Speaking of Lululemon, it had a tough week, being our worst performer with a loss of -0.1096%. On the flip side, AppLovin Corp (APP) impressed with a gain of 0.34%, highlighting the dynamic nature of our portfolio.

Wrap-Up and Reflections

This week was marked by strategic adjustments to our momentum-driven portfolio, ensuring we stay on track with our methodical approach. The consistent performance of the technology sector continues to be a focal point, with a balanced view on emerging opportunities. As always, we invite you to share your thoughts or questions in the comments below. Let’s keep the conversation going!

This week’s transactions:

Index Distribution:

Right now, most of the stocks in our portfolio are from the Barrons 400 category.

Current portfolio allocation:

The Technology sector is currently our top dog in terms of portfolio allocation.

Weekly sector distribution:

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| WSM | Williams-Sonoma, Inc | S&P 400 | Consumer Cyclical | 26.38B | -2.57% | 0.078 |

| LRN | Stride Inc | Barrons 400 | Consumer Defensive | 6.21B | -1.64% | 0.069 |

| EQT | EQT Corp | S&P 500 | Energy | 32.38B | -1.05% | 0.068 |

| TPR | Tapestry Inc | S&P 500 | Consumer Cyclical | 18.45B | 1.18% | 0.064 |

| PAYO | Payoneer Global Inc | Barrons 400 | Technology | 3.78B | -6.10% | 0.063 |

| AXON | Axon Enterprise Inc | S&P 500 | Industrials | 53.58B | 0.58% | 0.062 |

| KD | Kyndryl Holdings Inc | S&P 400 | Technology | 9.69B | -4.49% | 0.062 |

| DUOL | Duolingo Inc | S&P 400 | Technology | 19.09B | -0.67% | 0.055 |

| UAL | United Airlines Holdings Inc | S&P 500 | Industrials | 34.06B | -10.73% | 0.051 |

| CORT | Corcept Therapeutics Inc | Barrons 400 | Healthcare | 7.58B | -2.99% | 0.051 |

| PAY | Paymentus Holdings Inc | Barrons 400 | Technology | 3.99B | -17.89% | 0.048 |

| UPWK | Upwork Inc | Barrons 400 | Communication Services | 2.22B | -9.59% | 0.045 |

| AR | Antero Resources Corp | S&P 400 | Energy | 12.51B | -3.19% | 0.044 |

| UTI | Universal Technical Institute Inc | Barrons 400 | Consumer Defensive | 1.53B | -8.18% | 0.043 |

| PLTR | Palantir Technologies Inc | S&P 500 | Technology | 278.83B | 1.43% | 0.033 |

| DOCS | Doximity Inc | S&P 400 | Healthcare | 14.52B | -9.17% | 0.032 |

| APP | Applovin Corp | Barrons 400 | Technology | 161.81B | -6.45% | 0.028 |

| LULU | Lululemon Athletica inc | S&P 500 | Consumer Cyclical | 47.00B | -22.98% | 0.027 |

| AAL | American Airlines Group Inc | S&P 400 | Industrials | 10.52B | -16.15% | 0.026 |

| GTLS | Chart Industries Inc | S&P 400 | Industrials | 8.39B | -10.97% | 0.025 |

| CCL | Carnival Corp | S&P 500 | Consumer Cyclical | 33.11B | -11.00% | 0.023 |

| cash | Cash | Cash | Cash | – | 126 | 0.002 |

As always, more trades next week!