Our activity in the market this week involved 13 new trades, specifically 7 buy(s) and 6 sell(s).

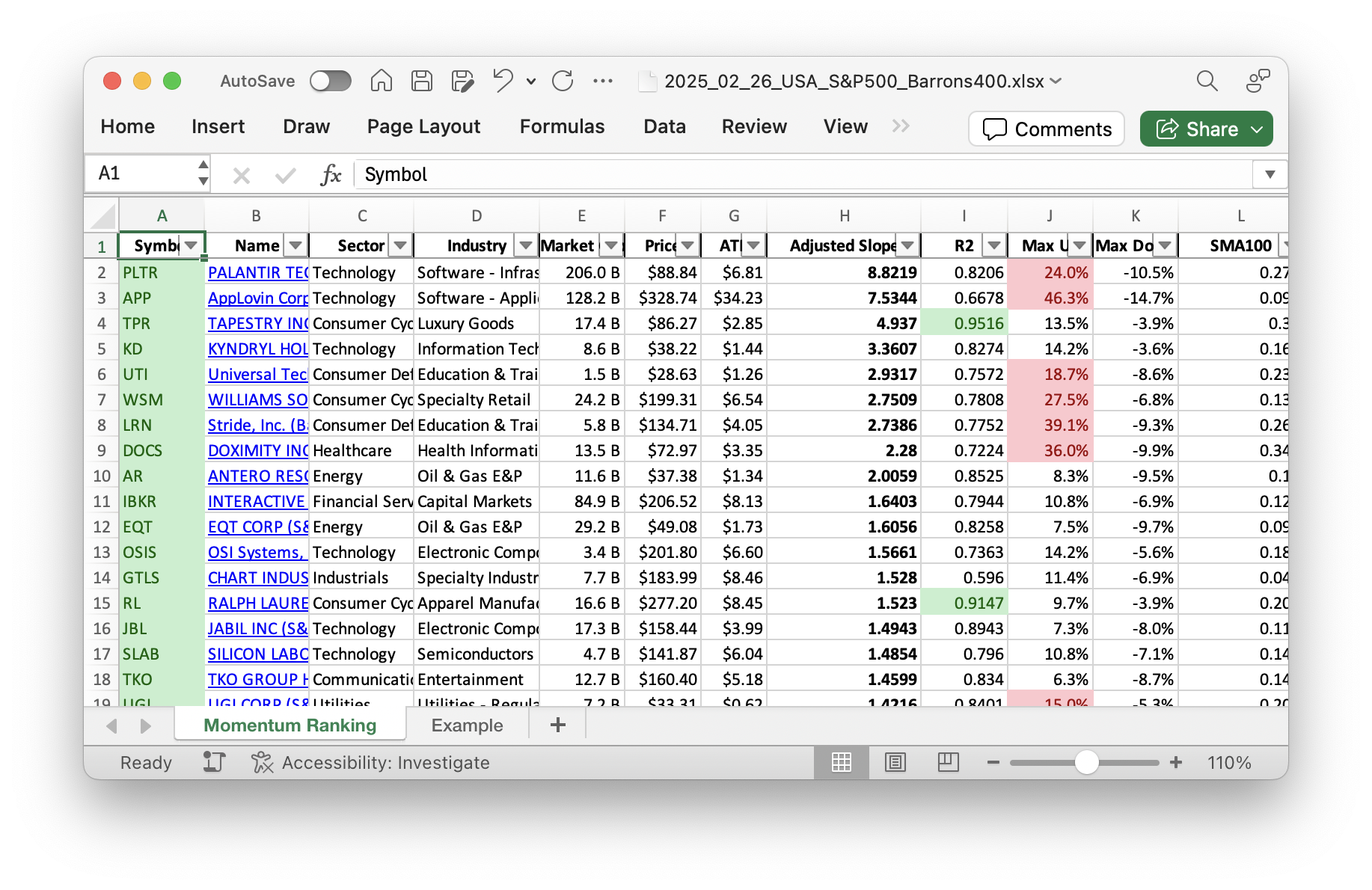

Discover the top-performing stocks of the week with our Momentum Ranking! Click here to access the latest data for week 09.

Weekly Trading Update: Navigating the Markets with Strategic Moves

This week, the portfolio saw some notable activity as we navigated the ups and downs of the market. We’ve had the S&P 500 trading above its 200-day moving average for 50 days now, allowing us to make some calculated decisions. However, it wasn’t all smooth sailing. Technical glitches slowed down the updates, pushing us to address them today. On the brighter side, our strategy, inspired by Andreas Clenow’s ‘Stocks On The Move’, has kept us on track, although the Trade Tuesday wasn’t so kind to us.

Buys and Sells Overview

We’ve made significant changes this week to align with our momentum-based strategy. New additions to the portfolio are Interactive Brokers Group (IBKR), Jabil Inc. (JBL), OSI Systems Inc. (OSIS), Ralph Lauren Corporation (RL), Silicon Laboratories Inc. (SLAB), TKO Group Holdings (TKO), and UGI Corporation (UGI). Each of these companies operates in a unique and promising sector. For instance, IBKR is a leader in the financial services sector, recognized for its advanced technology and competitive pricing. Similarly, JBL, operating in the electronic manufacturing services sector, continues to show promising growth potential. Our biggest share of the portfolio rests in technology stocks, with notable positions in UGI, LRN, and TPR.

Meanwhile, we parted ways with several stocks. Sells included American Airlines Group Inc (AAL), AppLovin Corporation (APP), Axon Enterprise Inc. (AXON), Carnival Corporation (CCL), Paycor HCM Inc. (PAY), and Payoneer Global Inc. (PAYO), aligning with our rule of selling when stocks don’t remain in the top rankings or drop below their moving averages. Despite the tech sector presenting challenges, armed with the resilient UGI, which grew by 3.35%, our approach remains future-focused. Sadly, PLTR faced a tough time with a drop of about 26.28%.

In Summary

The portfolio’s performance this week reflects the dynamic nature of the market. Strategic buys, informed by our momentum strategy, were balanced against careful sales, keeping us adaptable and prepared for the next market shift. As always, we’re committed to navigating the ebb and flow of the market with precision and expertise. Feel free to share your views or ask questions in the comments below. Your insights add valued perspectives to our ongoing trading journey.

This week’s transactions:

-

Rebalanced / added:

- No positions were added to in this week!

-

Rebalanced / reduced:

Index Distribution:

The majority of our portfolio is currently made up of stocks from the S&P 400 sector.

Current portfolio allocation:

Our portfolio is currently dominated by the Technology sector.

Weekly sector distribution:

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| UGI | UGI Corp | S&P 400 | Utilities | 7.12B | -1.28% | 0.109 |

| LRN | Stride Inc | Barrons 400 | Consumer Defensive | 5.86B | -7.14% | 0.073 |

| TPR | Tapestry Inc | S&P 500 | Consumer Cyclical | 17.88B | -4.91% | 0.068 |

| OSIS | OSI Systems, Inc | Barrons 400 | Technology | 3.41B | -7.85% | 0.061 |

| TKO | TKO Group Holdings Inc | S&P 400 | Communication Services | 27.27B | -10.85% | 0.06 |

| RL | Ralph Lauren Corp | S&P 500 | Consumer Cyclical | 17.11B | -4.28% | 0.06 |

| DUOL | Duolingo Inc | S&P 400 | Technology | 16.90B | -13.01% | 0.055 |

| CORT | Corcept Therapeutics Inc | Barrons 400 | Healthcare | 6.61B | -15.85% | 0.047 |

| cash | Cash | Cash | Cash | – | 2325 | 0.047 |

| SLAB | Silicon Laboratories Inc | S&P 400 | Technology | 4.61B | -11.14% | 0.047 |

| UTI | Universal Technical Institute Inc | Barrons 400 | Consumer Defensive | 1.56B | -6.28% | 0.045 |

| JBL | Jabil Inc | S&P 500 | Technology | 17.41B | -9.05% | 0.038 |

| DOCS | Doximity Inc | S&P 400 | Healthcare | 13.72B | -14.18% | 0.033 |

| WSM | Williams-Sonoma, Inc | S&P 400 | Consumer Cyclical | 24.52B | -9.45% | 0.032 |

| LULU | Lululemon Athletica inc | S&P 500 | Consumer Cyclical | 46.12B | -24.43% | 0.03 |

| EQT | EQT Corp | S&P 500 | Energy | 29.08B | -14.10% | 0.03 |

| KD | Kyndryl Holdings Inc | S&P 400 | Technology | 8.91B | -12.17% | 0.027 |

| PLTR | Palantir Technologies Inc | S&P 500 | Technology | 208.16B | -29.23% | 0.027 |

| GTLS | Chart Industries Inc | S&P 400 | Industrials | 7.89B | -16.21% | 0.025 |

| IBKR | Interactive Brokers Group Inc | S&P 400 | Financial Services | 86.87B | -13.08% | 0.024 |

| UAL | United Airlines Holdings Inc | S&P 500 | Industrials | 32.07B | -15.94% | 0.022 |

| AR | Antero Resources Corp | S&P 400 | Energy | 11.53B | -10.79% | 0.021 |

| UPWK | Upwork Inc | Barrons 400 | Communication Services | 2.13B | -13.40% | 0.02 |

As always, more trades next week!