This week, we carried out 11 new trades - 5 buy(s) and 6 sell(s).

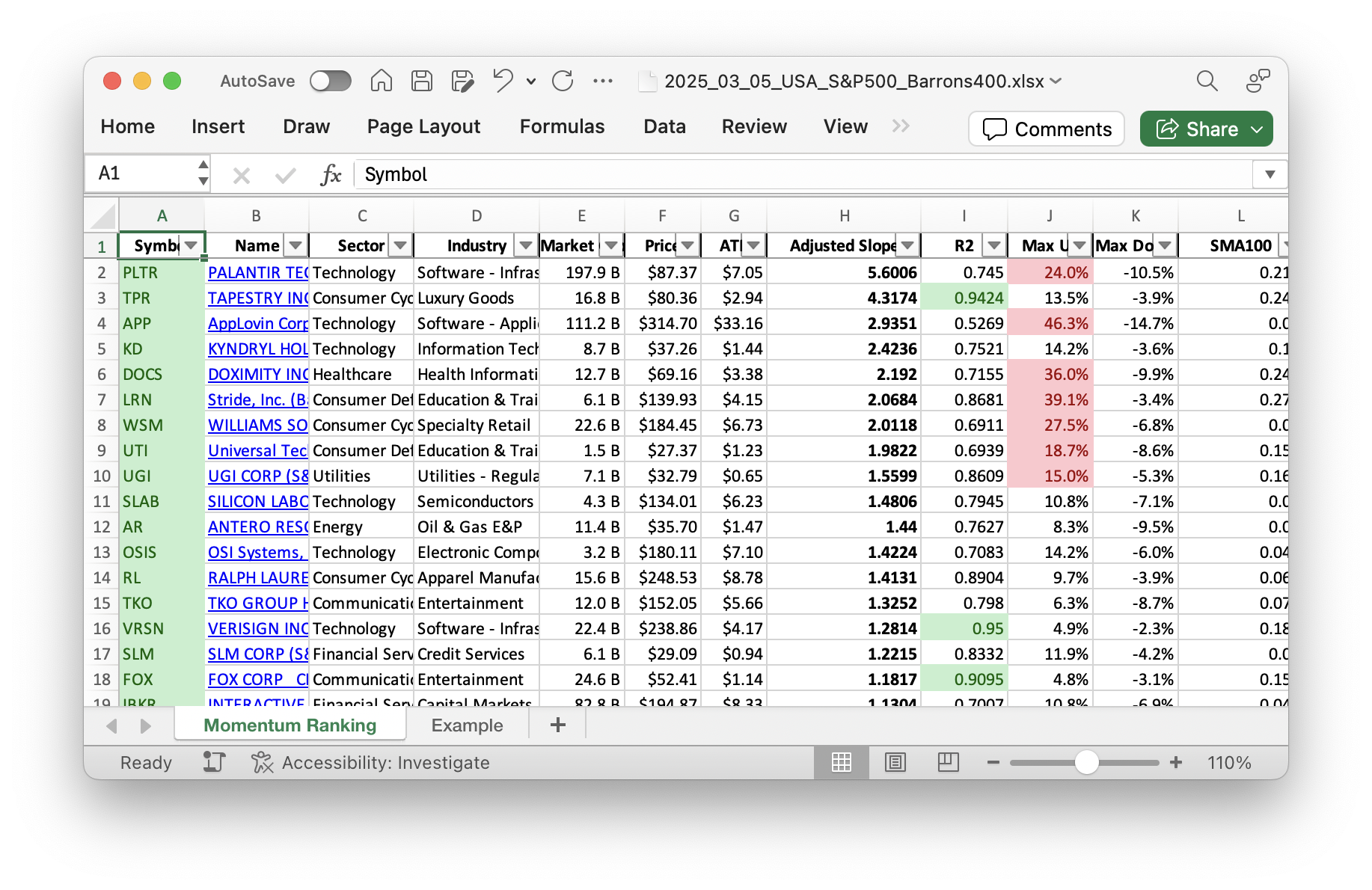

Click here for the Momentum Ranking of week 10.

Introduction

This week in trading has been quite eventful. Our momentum strategy, inspired by Andreas Clenow’s ‘Stocks On The Move’, continues to guide us. The S&P 500 has been floating just above its 200-day moving average for 334 days, allowing us to maintain our strategic momentum ranking approach. February came with a slight blow to the Trade Tuesday Portfolio, showing a decline of -5.75% compared to the S&P 500’s loss of -1.42%. Yet, we remain optimistic with a well thought out strategy.

Buys/Sells

In line with our strategy, several new stocks made it to our portfolio, while others were shown the door. FOX was added for its strong performance in the media sector, showing promising momentum. OPCH, the best performer this week with a gain of 6.36%, caught our attention in the healthcare field for its robust growth potential. Meanwhile, PEN, a player in medical devices, was bought due to its innovative solutions and steady climb in rankings. In finance, SLM came onboard thanks to its solid fundamentals and sector growth. Lastly, VRSN from technology was picked for its consistent track record and resilience.

On the flip side, we bid farewell to several positions that didn’t meet our criteria. DUOL, despite its uniqueness in education tech, slipped below our momentum requirements. GTLS, JBL, and LULU also faced the same fate due to declining trends not aligning with our strategy. UAL and UPWK rounded off our sales for the week as they dipped below their 100-day moving averages – a sell mandate according to Clenow’s methodology.

Summary

The technology sector retains a significant portion of our portfolio, highlighted by key leaders like UGI, LRN, and TPR. We are cautious yet optimistic, keeping substantial cash reserves to leverage future opportunities. This week, OPCH was a standout performer, while SLAB faced challenges with a -11.54% drop.

In wrapping up, this trading week underscored the importance of flexibility and adherence to our strategy. We continue to refine our portfolio, ensuring it aligns with momentum-based decisions. Share your thoughts in the comments below: did any stock catches your eye?

This week’s transactions:

-

Rebalanced / added:

- No positions were added to in this week!

-

Rebalanced / reduced:

- No positions were reduced in this week!

Index Distribution:

The majority of our portfolio is currently made up of stocks from the S&P 400 sector.

Current portfolio allocation:

The Technology sector now has the largest share in the portfolio:

Weekly sector distribution:

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| UGI | UGI Corp | S&P 400 | Utilities | 7.08B | -4.49% | 0.113 |

| LRN | Stride Inc | Barrons 400 | Consumer Defensive | 6.09B | -3.54% | 0.081 |

| TPR | Tapestry Inc | S&P 500 | Consumer Cyclical | 16.74B | -11.00% | 0.069 |

| OSIS | OSI Systems, Inc | Barrons 400 | Technology | 3.04B | -17.85% | 0.061 |

| TKO | TKO Group Holdings Inc | S&P 400 | Communication Services | 26.01B | -15.14% | 0.059 |

| RL | Ralph Lauren Corp | S&P 500 | Consumer Cyclical | 15.51B | -13.25% | 0.059 |

| VRSN | Verisign Inc | S&P 500 | Technology | 22.70B | -0.92% | 0.055 |

| UTI | Universal Technical Institute Inc | Barrons 400 | Consumer Defensive | 1.50B | -9.83% | 0.047 |

| FOX | Fox Corporation | S&P 500 | Communication Services | 24.56B | -4.67% | 0.046 |

| SLAB | Silicon Laboratories Inc | S&P 400 | Technology | 4.39B | -15.56% | 0.046 |

| CORT | Corcept Therapeutics Inc | Barrons 400 | Healthcare | 5.92B | -25.23% | 0.045 |

| OPCH | Option Care Health Inc | S&P 400 | Healthcare | 5.73B | 0.35% | 0.039 |

| DOCS | Doximity Inc | S&P 400 | Healthcare | 12.98B | -18.79% | 0.033 |

| EQT | EQT Corp | S&P 500 | Energy | 29.82B | -11.92% | 0.032 |

| WSM | Williams-Sonoma, Inc | S&P 400 | Consumer Cyclical | 22.90B | -15.45% | 0.031 |

| SLM | SLM Corp | S&P 400 | Financial Services | 6.15B | -10.51% | 0.031 |

| PEN | Penumbra Inc | S&P 400 | Healthcare | 10.94B | -8.39% | 0.03 |

| KD | Kyndryl Holdings Inc | S&P 400 | Technology | 8.72B | -14.11% | 0.028 |

| PLTR | Palantir Technologies Inc | S&P 500 | Technology | 207.35B | -29.50% | 0.027 |

| IBKR | Interactive Brokers Group Inc | S&P 400 | Financial Services | 82.84B | -17.12% | 0.025 |

| AR | Antero Resources Corp | S&P 400 | Energy | 11.30B | -12.57% | 0.022 |

| cash | Cash | Cash | Cash | – | 989 | 0.021 |

As always, more trades next week!