Over the course of the week, we made 1 new trades - 0 buy(s) and 1 sell(s).

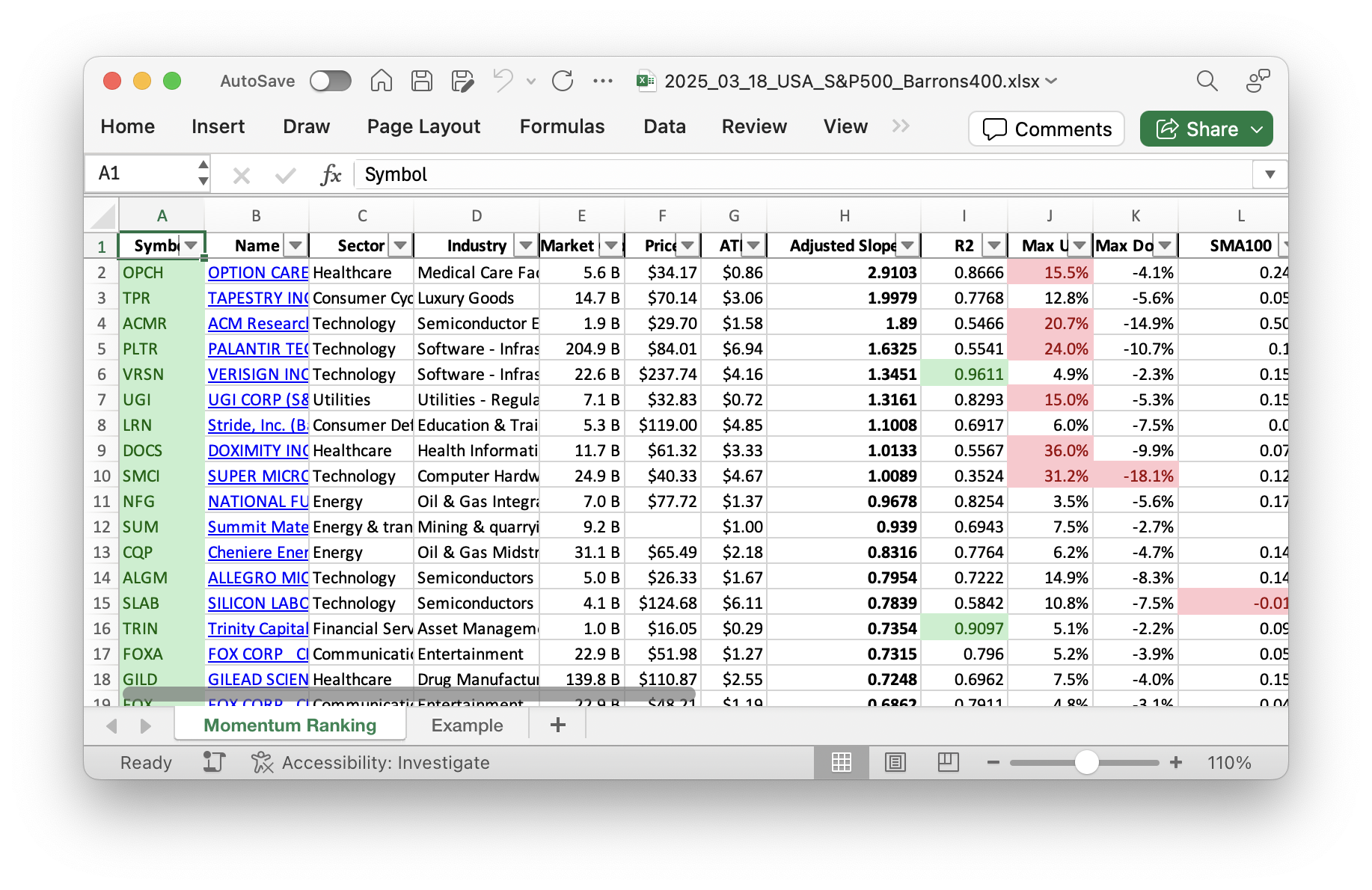

Looking for reliable stock performance data? Check out our weekly Momentum Ranking (based on Andreas Clenow’s book Stocks on the Move), updated every week with the latest figures! Click here to see the report for week 12.

This Week’s Trading Activity: A Quick Look

This week was quiet for our trading strategy as the S&P500 remained below its 200-day moving average for the 7th consecutive day. Our main goal is to stick to a disciplined approach, focusing only on opportunities that meet our criteria. With the markets like this, we’re keeping a healthy reserve of cash. Cash is always king when it comes to waiting for the right moment!

Portfolio Movements: Sells and No New Buys

We had an exit from Silicon Laboratories Inc. (SLAB) this week. As per our strategy outlined in Andreas Clenow’s “Stocks On The Move”, a stock needs to be in the top 10% based on the annualized adjusted slope, and SLAB unfortunately fell out of favor. It’s part of the semiconductor sector, which is quite competitive and volatile recently.

Our approach involves not opening new positions when the S&P500 is trending below its 200-day moving average. This rule helps us avoid unnecessary risks in uncertain market environments.

Portfolio Summary and Highlights

The current market did not provide opportunities for new purchases, so cash remains our largest holding. It’s a safe place to wait while the market presents a clearer direction. Among our top holdings, UGI Corp., from the utility sector, and Stride, Inc. (LRN), an education tech company, are standing strong.

Over the last week, the best performing stock in our portfolio was Antero Resources Corp. (AR) with a substantial gain of 15.64%. Meanwhile, Fox Corporation (FOX) was the weakest, with a loss of -5.68%. These performance metrics remind us why diversification and a systematic approach to trading are key.

In conclusion, the past week reinforced the importance of patience and strategy in trading. We remain vigilant, ready to act when the market aligns with our criteria. Feel free to share your thoughts or questions in the comments below. We’re always eager to hear from fellow trading enthusiasts!

This week’s transactions:

-

Sold:

-

Bought:

- No buys in this week!

-

Rebalanced / added:

- No positions were added to in this week!

-

Rebalanced / reduced:

- No positions were reduced in this week!

Index Distribution:

The S&P 400 index is currently contributing the most to our portfolio.

Current portfolio allocation:

We’re keeping most of our money in cash for the time being in the portfolio:

Weekly sector distribution:

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| cash | Cash | Cash | Cash | – | 13090 | 0.289 |

| UGI | UGI Corp | S&P 400 | Utilities | 7.03B | -5.16% | 0.118 |

| LRN | Stride Inc | Barrons 400 | Consumer Defensive | 5.20B | -17.69% | 0.073 |

| TPR | Tapestry Inc | S&P 500 | Consumer Cyclical | 14.58B | -22.50% | 0.063 |

| OSIS | OSI Systems, Inc | Barrons 400 | Technology | 3.18B | -14.08% | 0.063 |

| TKO | TKO Group Holdings Inc | S&P 400 | Communication Services | 24.96B | -18.58% | 0.061 |

| VRSN | Verisign Inc | S&P 500 | Technology | 22.49B | -1.87% | 0.058 |

| UTI | Universal Technical Institute Inc | Barrons 400 | Consumer Defensive | 1.46B | -12.34% | 0.049 |

| FOX | Fox Corporation | S&P 500 | Communication Services | 22.79B | -11.91% | 0.044 |

| EQT | EQT Corp | S&P 500 | Energy | 31.39B | -7.28% | 0.034 |

| SLM | SLM Corp | S&P 400 | Financial Services | 6.16B | -10.26% | 0.032 |

| DOCS | Doximity Inc | S&P 400 | Healthcare | 11.41B | -28.62% | 0.032 |

| PEN | Penumbra Inc | S&P 400 | Healthcare | 10.56B | -11.53% | 0.031 |

| PLTR | Palantir Technologies Inc | S&P 500 | Technology | 197.02B | -32.99% | 0.029 |

| AR | Antero Resources Corp | S&P 400 | Energy | 12.33B | -4.62% | 0.024 |

As always, more trades next week!