Our activity in the market this week involved 1 new trades, specifically 0 buy(s) and 1 sell(s).

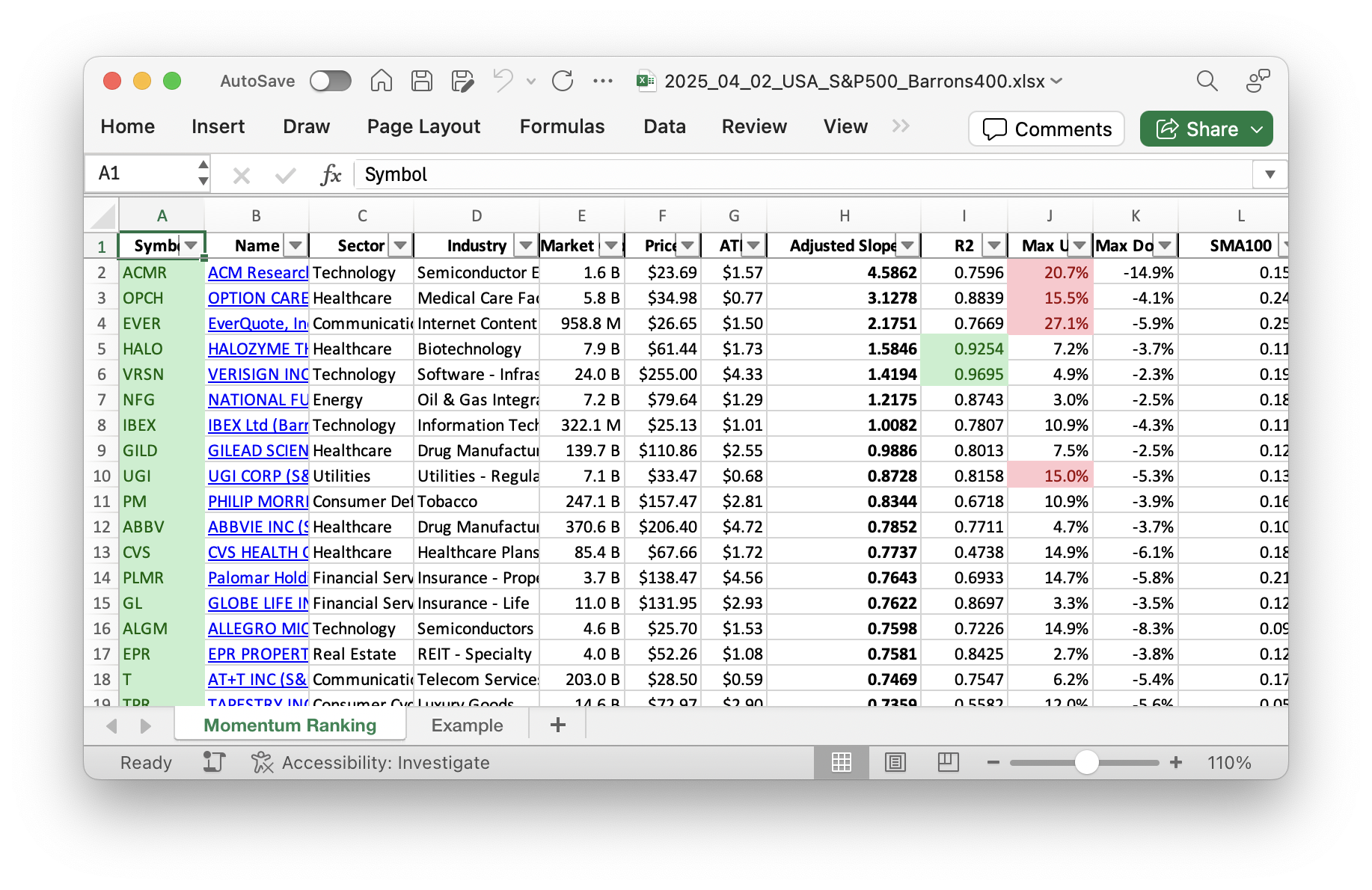

Whether you’re an investor or just interested in the stock market, our weekly Momentum Ranking report based on Andreas Clenow’s book Stocks on the Move is a must-read! Click here to access the latest data for week 14 and stay up-to-date on the top performers.

This Week in Trading: Insights and Updates

Hello, fellow traders! It’s been a busy week in the markets, and we’re here to share the latest developments with you. Despite the S&P 500 staying below the 200-day moving average for 6 days now, we’ve had a few changes in our portfolio. Let’s dive into what happened.

First off, let’s talk about our sales activity. We said goodbye to DOCS this week. It dipped below its 100-day moving average, prompting a sale as per our strategy outlined in Andreas Clenow’s ‘Stocks On The Move.’ This is part of our methodical approach to maintaining a healthy portfolio, ensuring we stick with top-performing stocks.

Our portfolio continues to hold strong, with a notable presence in cash reserves. This reflects a cautious approach, ensuring we’re ready to act when market conditions become more favorable. While we couldn’t make any new purchases because we’re still standing by with no new buys allowed, it’s important to highlight our best and worst performers of the week. FOX was the star, gaining 4.14%, while PLTR slipped, with a loss of 12.48%. The contrast is quite stark!

In summary, this week’s activities underline the importance of sticking to our strategy. No new buys are allowed while the S&P 500 finds itself below the key technical threshold. However, we remain vigilant, ready to seize new opportunities as conditions improve. Our focus on a structured, disciplined approach helps navigate these uncertain times.

We’d love to hear your thoughts on these moves or get any questions you may have. Feel free to drop your insights or inquiries in the comments below. Here’s to staying informed and ready for whatever the markets throw our way!

This week’s transactions:

-

Sold:

-

Bought:

- No buys in this week!

-

Rebalanced / added:

- No positions were added to in this week!

-

Rebalanced / reduced:

- No positions were reduced in this week!

Index Distribution:

At the moment, we are holding mostly cash:

Current portfolio allocation:

We’re playing it safe with a lot of cash in the portfolio at the moment:

Weekly sector distribution:

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| cash | Cash | Cash | Cash | – | 14448 | 0.314 |

| UGI | UGI Corp | S&P 400 | Utilities | 7.21B | -2.62% | 0.117 |

| LRN | Stride Inc | Barrons 400 | Consumer Defensive | 5.61B | -11.11% | 0.076 |

| OSIS | OSI Systems, Inc | Barrons 400 | Technology | 3.27B | -11.45% | 0.063 |

| TPR | Tapestry Inc | S&P 500 | Consumer Cyclical | 15.35B | -18.39% | 0.063 |

| TKO | TKO Group Holdings Inc | S&P 500 | Communication Services | 26.50B | -13.54% | 0.063 |

| VRSN | Verisign Inc | S&P 500 | Technology | 23.95B | -1.75% | 0.061 |

| UTI | Universal Technical Institute Inc | Barrons 400 | Consumer Defensive | 1.43B | -13.87% | 0.046 |

| FOX | Fox Corporation | S&P 500 | Communication Services | 24.67B | -4.64% | 0.046 |

| EQT | EQT Corp | S&P 500 | Energy | 32.68B | -3.46% | 0.035 |

| SLM | SLM Corp | S&P 400 | Financial Services | 6.30B | -8.33% | 0.032 |

| PEN | Penumbra Inc | S&P 400 | Healthcare | 10.44B | -12.56% | 0.029 |

| PLTR | Palantir Technologies Inc | S&P 500 | Technology | 200.93B | -31.69% | 0.028 |

| AR | Antero Resources Corp | S&P 400 | Energy | 12.89B | -2.84% | 0.025 |

As always, more trades next week!