Our market activity this week included 6 new trades: 0 buy(s) and 6 sell(s).

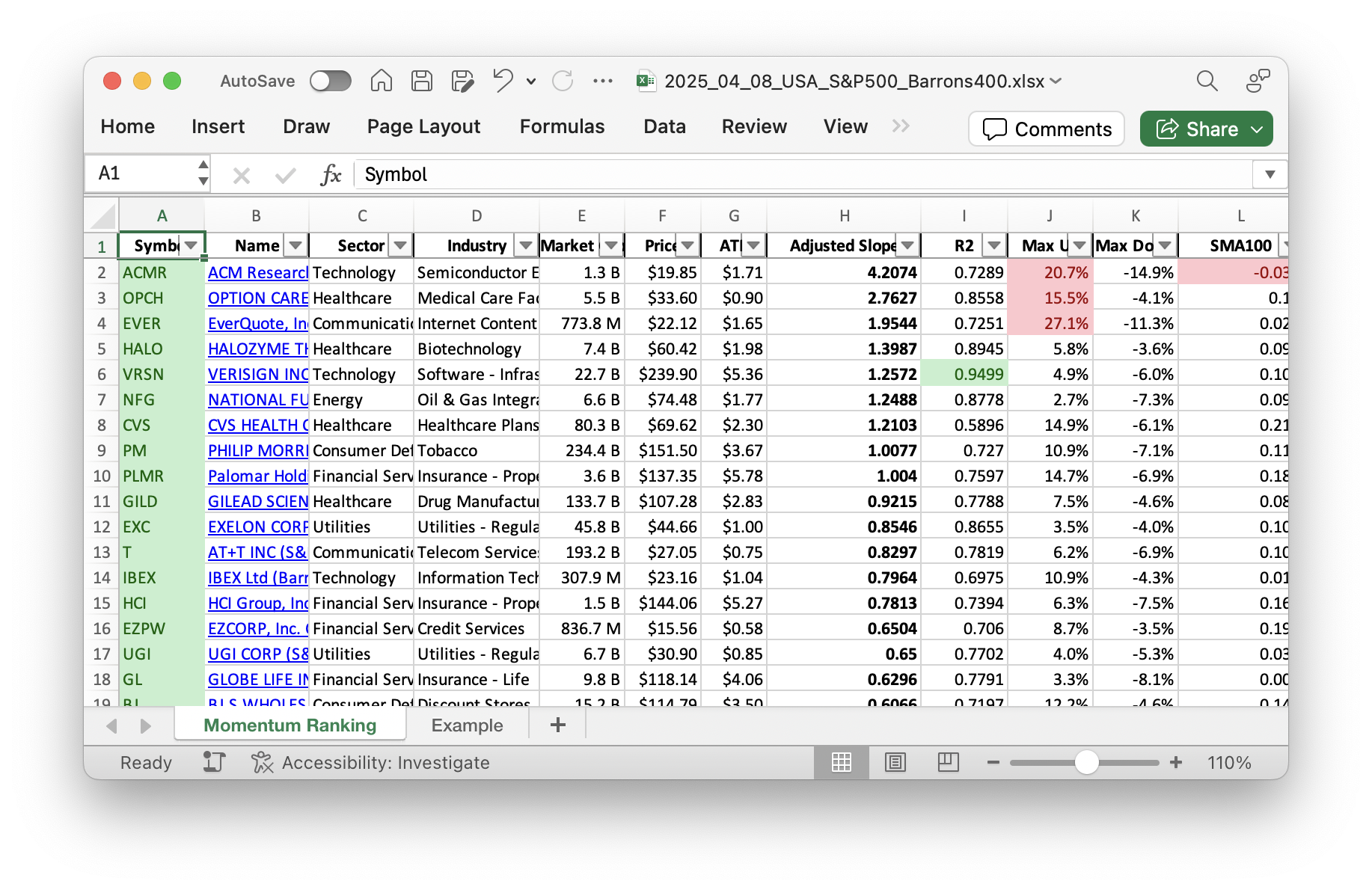

Looking for reliable stock performance data? Check out our weekly Momentum Ranking (based on Andreas Clenow’s book Stocks on the Move), updated every week with the latest figures! Click here to see the report for week 15.

Investing Update: Navigating the Market’s Momentum

Hello, savvy investors! This week, we’re diving into our recent trading activity. It’s vital to keep things straightforward yet exciting. Today, we’ve been watching the S&P 500 as it sits below its 200-day moving average for 10 days. This situation guides our strategy, especially in light of Andreas Clenow’s momentum ranking method from ‘Stocks On The Move’. While the market trends remain cautious, we’ve seen a few shifts in our portfolio.

Buys/Sells in the Portfolio

This week, we made no new purchases as the S&P 500 being below its moving average restricts any new buys. Instead, we focused on managing what we already own. We made the decision to part ways with a few stocks. These stocks, AR, FOX, SLM, TKO, TPR, and UTI, didn’t meet our current criteria. They either dipped below their 100-day moving average or lost their ranking.

The biggest mover is Urban Outfitters, Inc. (UTI), no longer in the top 10% of our ranking. Arguably, it was time to say goodbye.

In our current holdings, LRN stands out with a gain of roughly 16% over the last seven trading days. This educational services sector stock has shown solid resilience and momentum. On the flip side, EQT hasn’t fared as well, experiencing a dip of approximately 10.75%.

Summary

This week underscores the importance of staying flexible in our strategies. It’s fascinating how our largest share remains in cash at the moment, indicating a strategy of keeping cash reserves ready. While we consolidate and streamline our portfolio, we’re closely eyeing any potential economic shifts. Remember, the key to successful investing often lies in adaptability and informed decisions.

We’d love to hear your thoughts or questions about our approach and the market’s current state. Please feel free to leave a comment below!

This week’s transactions:

-

Sold:

-

Bought:

- No buys in this week!

-

Rebalanced / added:

- No positions were added to in this week!

-

Rebalanced / reduced:

- No positions were reduced in this week!

Index Distribution:

At the moment, we are holding mostly cash:

Current portfolio allocation:

Things are a bit quiet in the portfolio, mostly just cash and waiting for the right moment:

Weekly sector distribution:

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| cash | Cash | Cash | Cash | – | 28216 | 0.617 |

| UGI | UGI Corp | S&P 400 | Utilities | 6.65B | -10.20% | 0.107 |

| LRN | Stride Inc | Barrons 400 | Consumer Defensive | 5.65B | -10.50% | 0.075 |

| OSIS | OSI Systems, Inc | Barrons 400 | Technology | 3.13B | -15.34% | 0.059 |

| VRSN | Verisign Inc | S&P 500 | Technology | 22.77B | -6.96% | 0.056 |

| EQT | EQT Corp | S&P 500 | Energy | 29.16B | -13.87% | 0.031 |

| PEN | Penumbra Inc | S&P 400 | Healthcare | 10.33B | -13.48% | 0.029 |

| PLTR | Palantir Technologies Inc | S&P 500 | Technology | 198.85B | -32.39% | 0.026 |

As always, more trades next week!