No new activity in the portfolio this week.

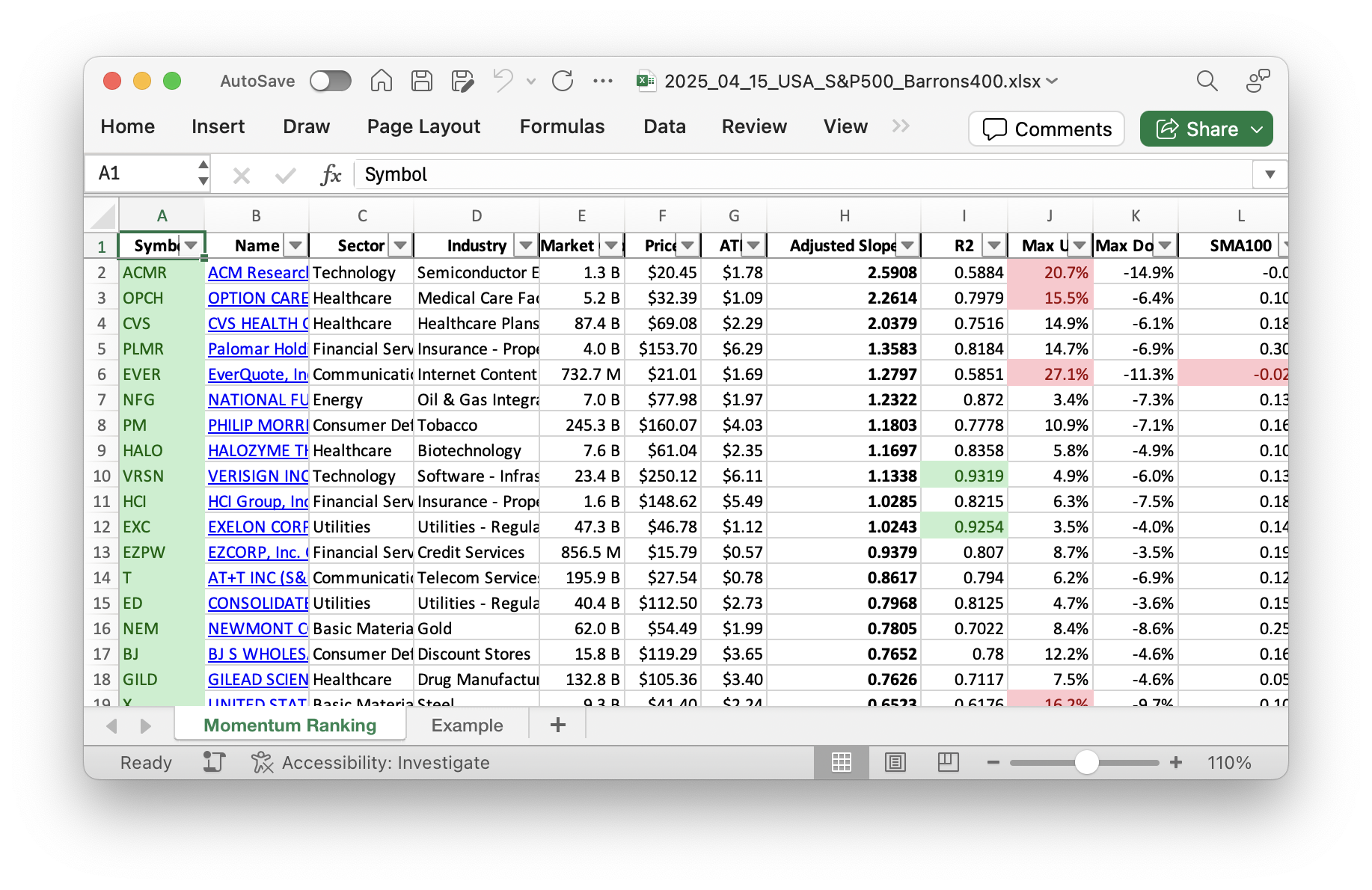

Discover the top-performing stocks of the week with our Momentum Ranking! Click here to access the latest data for week 16.

This Week’s Trading Update: A Cash-Heavy Portfolio

Hey there, fellow traders! Welcome back to another weekly update on our trading activities. As always, we’re keeping it real and straightforward without any unnecessary embellishments. This week, the market’s mood hasn’t shifted much, with the S&P 500 still holding below its 200-day moving average for -15 days now. So, let’s dive into what that means for our strategy and portfolio performance.

Buys and Sells: Holding Steady

There have been no new buys this week. Our strategy remains vigilant, guided by the momentum ranking and signaling no new opportunities since the regime filter doesn’t allow new purchases under the current market conditions. No sells occurred as well, so we’re sticking with our existing holdings. It’s one of those quiet weeks where observation takes center stage over action.

Our portfolio has a significant focus on cash reserves. This not only provides a cushion during uncertain times but also positions us to act quickly when the market turns promising. Over the last 7 trading days, Palantir Technologies (PLTR) was a shining star, delivering a robust gain of 25.15%. Meanwhile, holding cash, as expected, returned a steady and uneventful 0.0%–a comforting stability in turbulent times.

Summing It All Up

This week’s activity is a testament to patience being a virtue in investing. It might seem like we’re just sitting on our hands with our cash-heavy stance, but this conservative approach is a calculated strategy for navigating periods of market volatility. We believe in holding strong within our current framework while remaining agile to capitalize on future opportunities.

It’s important to stay informed and prepared, even when the trading volume is low. Whether you’re new to this approach or a seasoned trader, we encourage you to share your thoughts or questions about your experiences and strategies in the comments. Let’s keep the conversation going, and together, we’ll continue navigating the market tides with clarity and insight.

This week’s transactions:

-

Sold:

- No sells in this week!

-

Bought:

- No buys in this week!

-

Rebalanced / added:

- No positions were added to in this week!

-

Rebalanced / reduced:

- No positions were reduced in this week!

Index Distribution:

At the moment, we are holding mostly cash:

Current portfolio allocation:

There’s not a lot going on in the portfolio right now, just a lot of cash sitting around:

Weekly sector distribution:

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| cash | Cash | Cash | Cash | – | 30886 | 0.624 |

| UGI | UGI Corp | S&P 400 | Utilities | 6.90B | -6.84% | 0.104 |

| LRN | Stride Inc | Barrons 400 | Consumer Defensive | 6.00B | -4.98% | 0.073 |

| OSIS | OSI Systems, Inc | Barrons 400 | Technology | 3.24B | -12.35% | 0.058 |

| VRSN | Verisign Inc | S&P 500 | Technology | 23.56B | -3.24% | 0.055 |

| EQT | EQT Corp | S&P 500 | Energy | 30.18B | -10.85% | 0.03 |

| PLTR | Palantir Technologies Inc | S&P 500 | Technology | 228.86B | -22.19% | 0.028 |

| PEN | Penumbra Inc | S&P 400 | Healthcare | 10.60B | -11.65% | 0.027 |

As always, more trades next week!