Our market activity this week included 1 new trades: 0 buy(s) and 1 sell(s).

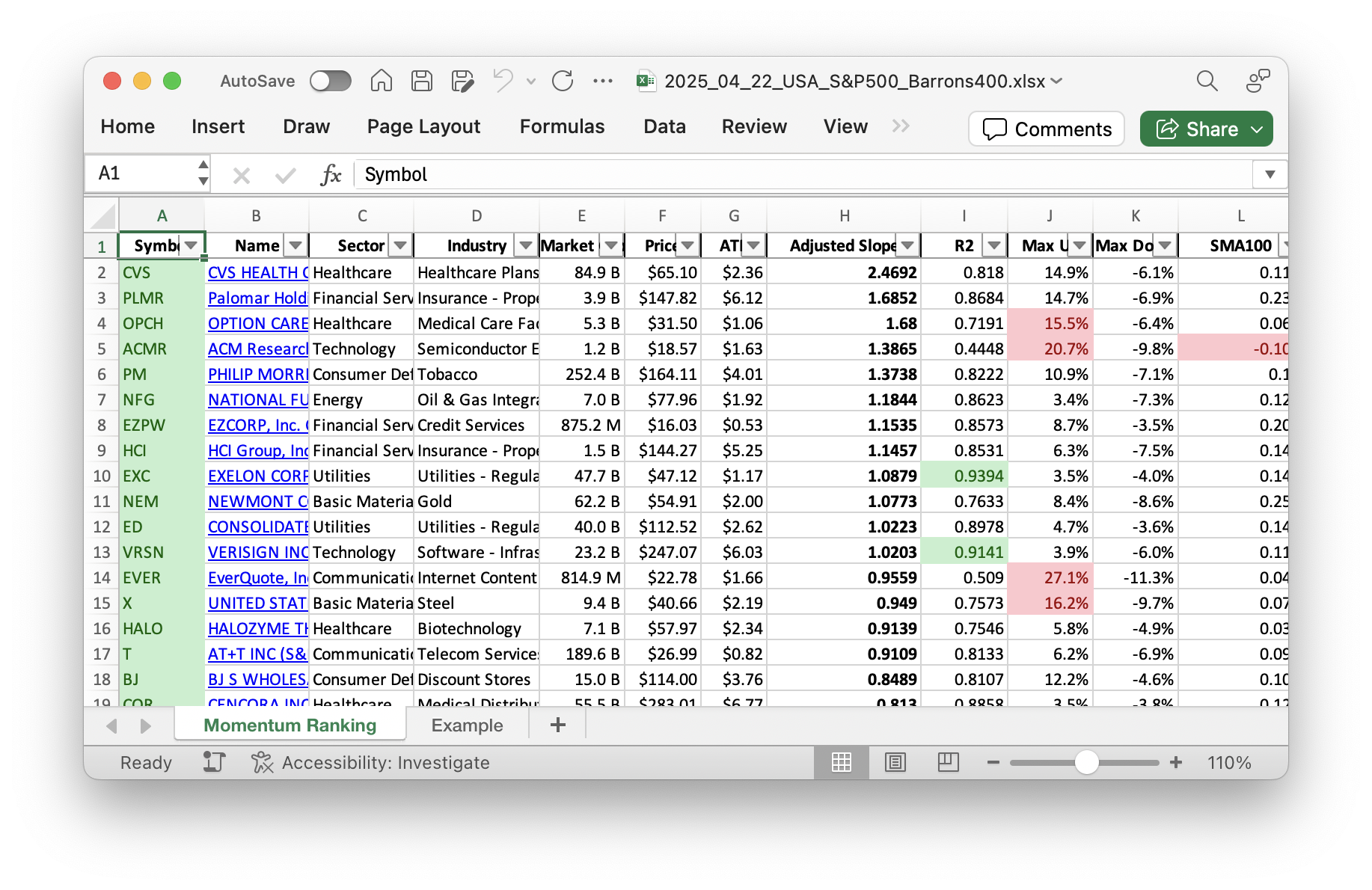

Discover the top-performing stocks of the week with our Momentum Ranking! Click here to access the latest data for week 17.

Weekly Trading Activity Review

Hello there! Let’s dive into this week’s trading activity for our momentum-based strategy, inspired by Andreas Clenow’s book ‘Stocks On The Move’. The S&P 500 remains below its 200-day moving average for the 19th consecutive day. With this trend, our focus leans towards rebalancing and safeguarding existing positions rather than initiating new ones. Our strategy mandates that new positions are put on hold during such periods, ensuring prudent risk management.

This Week’s Buys and Sells

Sell Alert: We parted ways with EQT this week. The energy company slipped below its 100-day moving average, signaling it’s time to move on. It’s a tough decision but a necessary one in line with our strategy’s rules. This exit is dictated by our momentum ranking which ensures that only top performers remain in the portfolio. EQT’s departure allows us to maintain a disciplined approach to investing.

Sector Insight: The most significant portion of the portfolio is currently in cash. We are keeping cash reserves, awaiting the right moment to deploy resources when the market conditions become favorable. It’s like holding our breath before taking the plunge.

Portfolio Insights

Top Performers: UGI Corporation, from the utility sector, has been a star lately, showing a gain of 4.68% over the last seven days. Its consistent performance underlines the stability the utility sector can offer in times of market uncertainty.

Least Performing: Meanwhile, our holding in VeriSign (VRSN) didn’t fare as well, posting a slight loss of 0.63%. No need for panic; market fluctuations are normal. Keeping an eye on our strategy will guide us through.

In Summary

In conclusion, this week’s trading activity has been all about playing it safe and making necessary adjustments. With most of the portfolio dedicated to cash, we are well-positioned to seize opportunities when the market environment improves. Remember, investing is as much about patience as it is about action.

We’re eager to hear your thoughts or questions! Feel free to share them in the comments below. Happy trading!

This week’s transactions:

-

Sold:

-

Bought:

- No buys in this week!

-

Rebalanced / added:

- No positions were added to in this week!

-

Rebalanced / reduced:

- No positions were reduced in this week!

Index Distribution:

At the moment, we are holding mostly cash:

Current portfolio allocation:

There’s not a lot going on in the portfolio right now, just a lot of cash sitting around:

Weekly sector distribution:

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| cash | Cash | Cash | Cash | – | 31813 | 0.652 |

| UGI | UGI Corp | S&P 400 | Utilities | 7.06B | -4.65% | 0.107 |

| LRN | Stride Inc | Barrons 400 | Consumer Defensive | 6.01B | -4.84% | 0.074 |

| OSIS | OSI Systems, Inc | Barrons 400 | Technology | 3.19B | -13.57% | 0.058 |

| VRSN | Verisign Inc | S&P 500 | Technology | 23.23B | -4.59% | 0.054 |

| PLTR | Palantir Technologies Inc | S&P 500 | Technology | 221.57B | -24.67% | 0.028 |

| PEN | Penumbra Inc | S&P 400 | Healthcare | 10.60B | -11.57% | 0.028 |

As always, more trades next week!