We kept things status quo this week with no new trades.

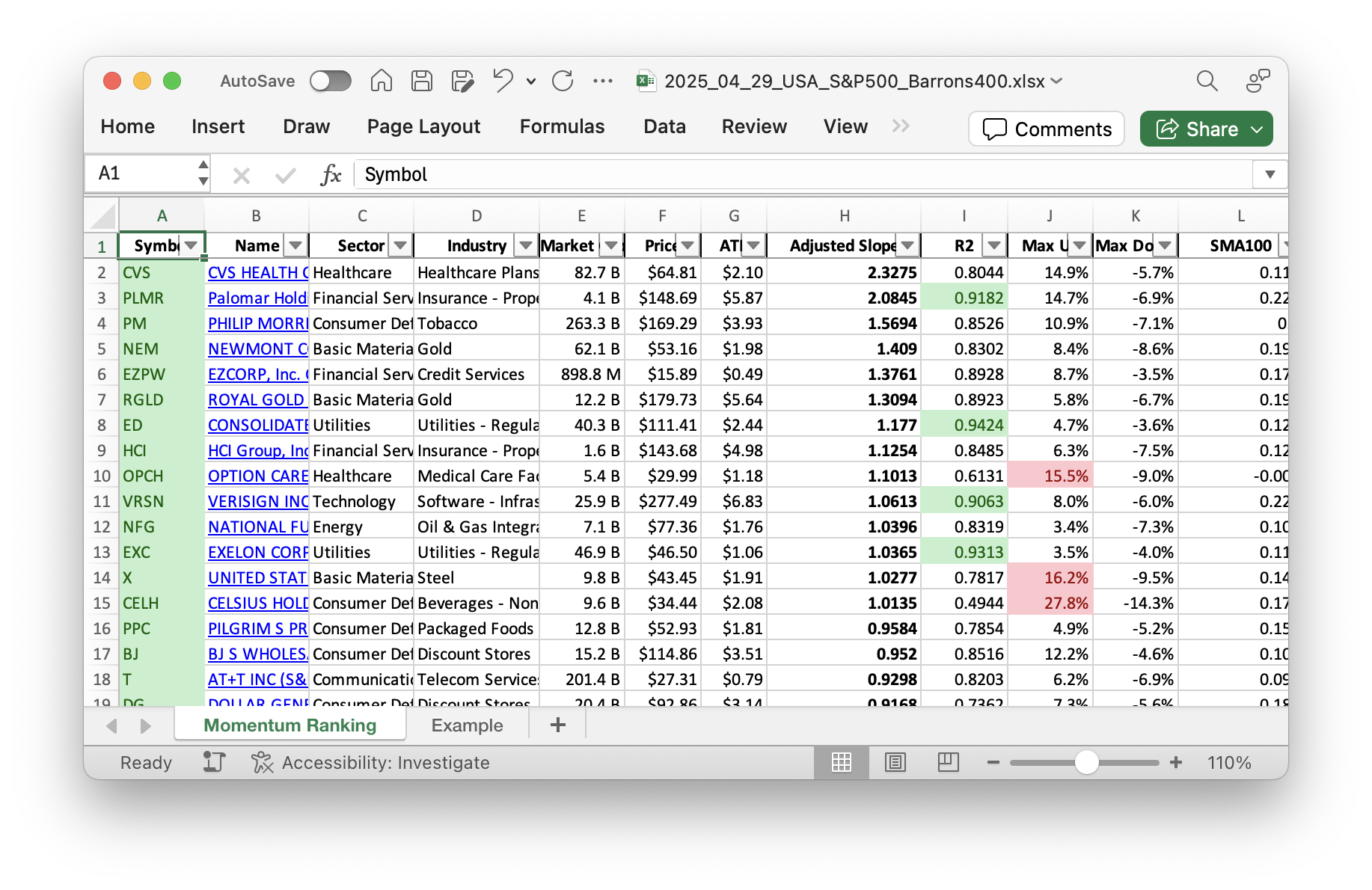

Whether you’re an investor or just interested in the stock market, our weekly Momentum Ranking report based on Andreas Clenow’s book Stocks on the Move is a must-read! Click here to access the latest data for week 18 and stay up-to-date on the top performers.

This Week’s Trading Activity: A Steady Week on the Market

Hello, fellow traders and investors! It’s time for our weekly trading activity recap. This week, the S&P 500 has continued to trade below its 200-day moving average, marking -24 days in total. This price action means our strategy couldn’t initiate any new positions. Our approach, as detailed in Andreas Clenow’s Stocks On The Move, relies heavily on these technical signals. When the market is not ticking those boxes, we stay vigilant and patient.

Buys/Sells

Although we haven’t made any new buys or sells this week, it’s still worth checking in with our portfolio. Our largest position at the moment is cash. This cautious approach is key, especially when the market doesn’t favor new entries. With our cash reserves ready, we are in a great position to identify and seize opportunities as soon as they arise.

Within our existing holdings, PLTR has been a standout performer this week, gaining over 22%! On the other hand, UGI wasn’t quite as strong, with a slight loss of 1.42%. Still, it’s all part of the long game in stock trading.

Summary

Overall, it’s been a steady week with no major shifts. We’re keeping an eye on our core holdings and are poised for action when the market provides the right conditions. Sometimes no moves are the best moves!

As always, your thoughts are invaluable to us. Feel free to share your comments or ask any questions you might have below. Happy investing!

This week’s transactions:

-

Sold:

- No sells in this week!

-

Bought:

- No buys in this week!

-

Rebalanced / added:

- No positions were added to in this week!

-

Rebalanced / reduced:

- No positions were reduced in this week!

Index Distribution:

At the moment, we are holding mostly cash:

Current portfolio allocation:

The portfolio is mostly just cash right now, waiting for some good opportunities:

Weekly sector distribution:

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| cash | Cash | Cash | Cash | – | 32353 | 0.638 |

| UGI | UGI Corp | S&P 400 | Utilities | 7.00B | -5.48% | 0.104 |

| LRN | Stride Inc | Barrons 400 | Consumer Defensive | 6.10B | -4.40% | 0.075 |

| VRSN | Verisign Inc | S&P 500 | Technology | 26.05B | -0.89% | 0.06 |

| OSIS | OSI Systems, Inc | Barrons 400 | Technology | 3.38B | -8.68% | 0.06 |

| PLTR | Palantir Technologies Inc | S&P 500 | Technology | 267.08B | -9.20% | 0.034 |

| PEN | Penumbra Inc | S&P 400 | Healthcare | 11.43B | -4.79% | 0.029 |

As always, more trades next week!