The portfolio remained unchanged this week, with no new trades.

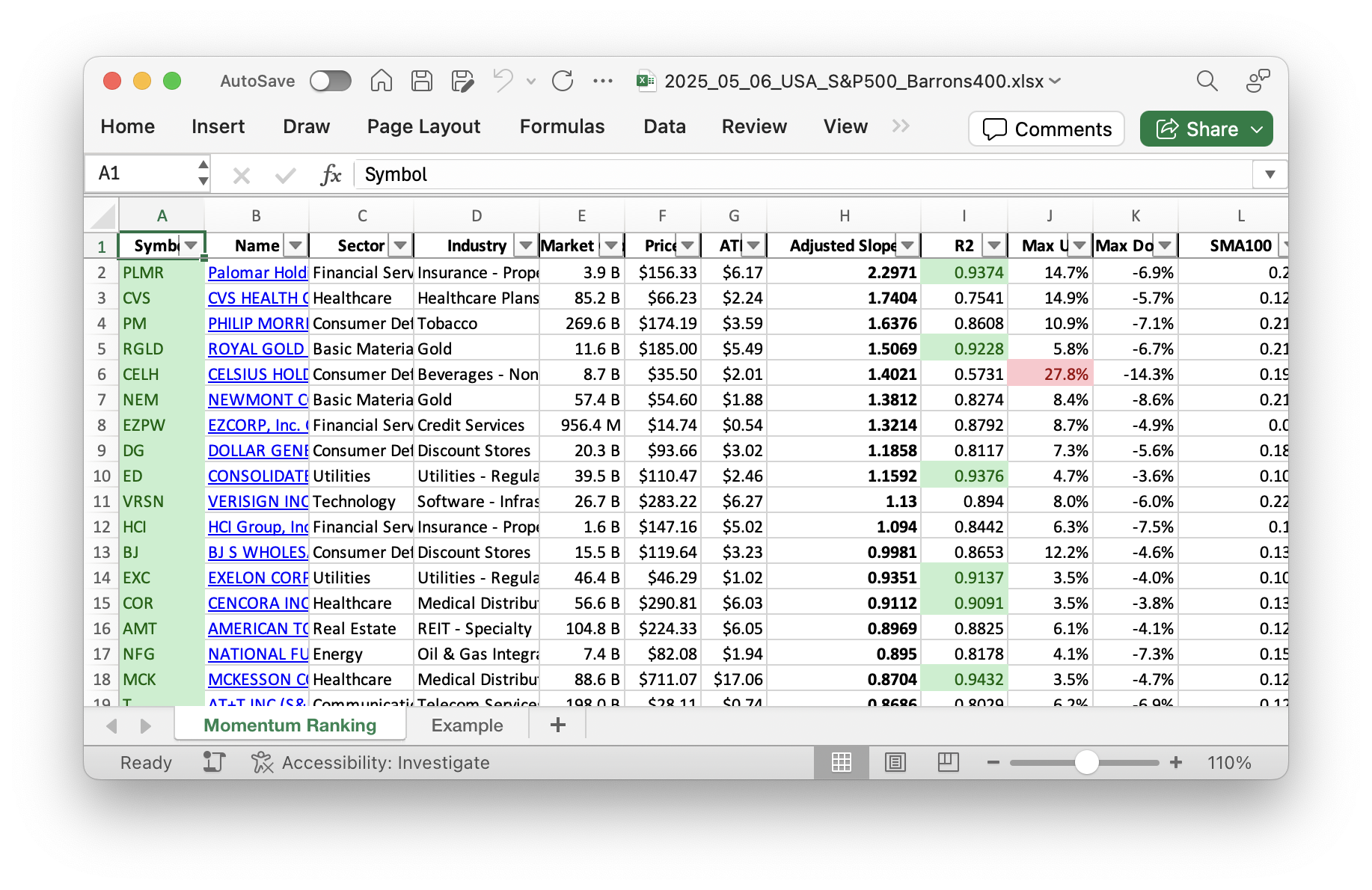

Click here for the Momentum Ranking of week 19.

This Week’s Trading Activity: A Slow and Steady Approach

As we delve into this week’s trading activity, let’s keep in mind that the S&P 500 has been below its 200-day moving average for 21 days. This means we’re in a holding pattern, diligently managing our existing positions without opening any new ones. We are maintaining caution, as our strategy is guided by momentum ranking and the market’s current trends.

Buys/Sells

There were no new buys or sells this week. Instead, we are focused on keeping things steady while the S&P 500 remains below its milestone 200-day moving average. In times like these, it’s essential to apply our strategy with care. Our top holdings right now include cash reserves, UGI, and LRN. UGI, part of the utilities sector, provides stable performance due to consistent demand for energy. On the other hand, LRN from the education technology sector, has been our best performer this week with a notable gain of 12.25%.

Summary

Cash remains a significant part of our portfolio as a protective measure during this uncertain market phase. It’s part of keeping our strategy forward-thinking without unwarranted risk. Our worst performer was PEN, facing a loss of 2.22% over the past 7 trading days, yet we remain vigilant in our assessments as the broader market conditions affect each position differently.

In conclusion, this week was about careful adjustments and monitoring our portfolio, while keeping an eye on key indicators. We believe sticking to our momentum-based strategy will serve us well once the market conditions align favorably. We’d love to hear your thoughts or questions about our strategy or your own experiences. Feel free to share in the comments below!

This week’s transactions:

-

Sold:

- No sells in this week!

-

Bought:

- No buys in this week!

-

Rebalanced / added:

- No positions were added to in this week!

-

Rebalanced / reduced:

- No positions were reduced in this week!

Index Distribution:

At the moment, we are holding mostly cash:

Current portfolio allocation:

We’re kind of just hoarding cash in the portfolio at the moment:

Weekly sector distribution:

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| cash | Cash | Cash | Cash | – | 34292 | 0.639 |

| UGI | UGI Corp | S&P 400 | Utilities | 7.20B | -2.75% | 0.1 |

| LRN | Stride Inc | Barrons 400 | Consumer Defensive | 6.88B | -2.54% | 0.079 |

| OSIS | OSI Systems, Inc | Barrons 400 | Technology | 3.70B | -2.96% | 0.062 |

| VRSN | Verisign Inc | S&P 500 | Technology | 26.57B | -0.97% | 0.058 |

| PLTR | Palantir Technologies Inc | S&P 500 | Technology | 256.76B | -13.21% | 0.035 |

| PEN | Penumbra Inc | S&P 400 | Healthcare | 11.31B | -5.82% | 0.027 |

As always, more trades next week!